Meet the Aggregators Supercharging FDIC Insurance

TFL #18: Plus, Robinhood Launches 24 hr Trading

Happy Sunday! 🙋♂️

Welcome back to The Fintech Ledger, #18! 🔥

This week Robinhood announced it would launch a 24 hr trading platform in the coming weeks, Goldman paid $215 million to settle discrimination claims from female employees, PayPal’s stock hit a low not seen since 2017, and Twitter gets a new CEO (ostensibly to free up Elon’s calendar for shitposting and market moving memes).

And to all the mothers out there, Happy Mother’s Day! 💐 You are all incredible!

I’m looking forward to spoiling my wife today, who is an incredible mother to our little girl. 👨👩👧

I am truly blessed.

Without further ado, let’s get to it.

Psst : Was this newsletter forwarded to you? Sign up here to get the latest weekly fintech and crypto insight right to your inbox ~ free!

Robinhood set to Launch 24hr.Trading

Robinhood (NASDAQ: HOOD) announced it would be launching 24-hour trading, five days a week for stocks and ETFs in the coming weeks. Known for disrupting the industry with no fee trading, this would be another big change for the industry from the traditional Wall Street operating hours (i.e. 9:30 a.m. to 4:00 p.m. ET in the United States). The company said it plans to roll out the feature for some users by early next week, and will initially allow them to buy whole shares of 43 of the most traded ETFs and individual stocks, such as Tesla, Amazon, and Apple.

The move is not entirely unprecedented. Today, some brokers offer “extended hours” trading sessions starting as early as 4 a.m. ET, ending at 8 p.m. ET. Rivals E*Trade and TD Ameritrade, for example, allow overnight trading between 8 p.m. and 4 a.m. ET, but only offer about two dozen ETFs. This will mark the first U.S. brokerage to provide overnight trading in individual stocks.

FDIC Yesterday, Today, and Tomorrow

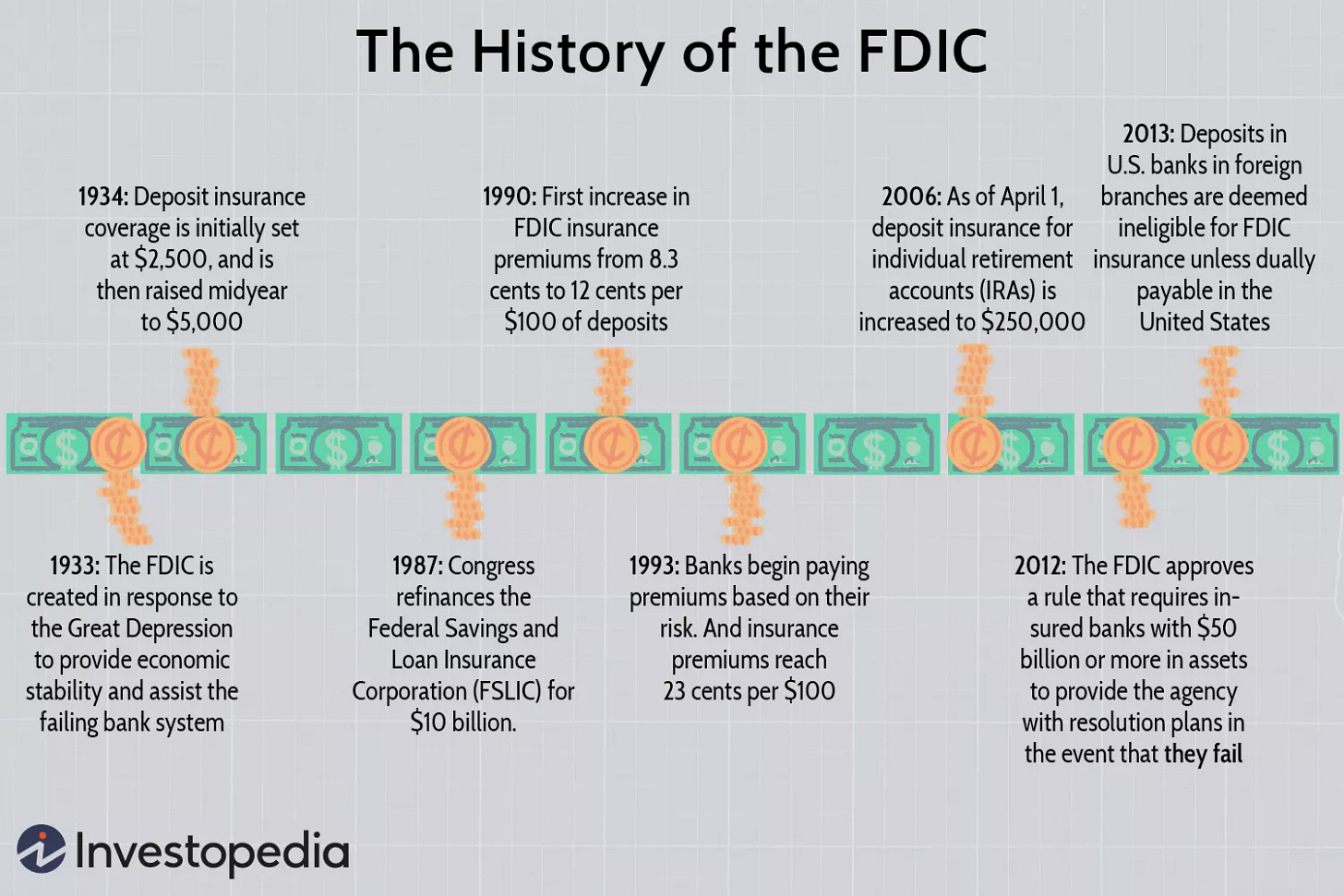

The Federal Deposit Insurance Corporation is an independent agency that provides deposit insurance for bank accounts in the U.S. and was created to help boost confidence among consumers about the health and well-being of the nation's financial system. In October of 1929, the U.S. stock market crashed, leaving financial markets devastated. By March of 1933, more than 9,000 banks had failed. Commonly referred to as The Great Depression, it was a time of great financial instability that would ultimately become the worst economic depression in modern history.

As a result of the bank failures of the time, Congress passed the Emergency Banking Act of 1933, which formed (among other things) the FDIC. Since the FDIC began operations in 1934, no depositor has ever lost a penny of FDIC-insured deposits, and the amounts insured have risen over time.

Arguably not enough. From the FDICs own website, they only maintain a balance just above 1.00% of the exposure in the U.S. banking system. This was a chief reason

The DIF balance hasen every quarter since the end of 2009, and stood at a record $119.4 billion on March 31, 2021, up from $110.3 billion at the end of 2019. The reserve ratio stood at 1.25 percent at March 31, 2021, down from 1.41 percent at the end of 2019.

Source: FDICs website

The Fed and Treasury felt the need to step in with added assurances after the SVB collapse to stave off a contagion.

Moral hazard anyone?

Thanks for reading The Fintech Ledger! 📚 Subscribe for free to get weekly insight into what’s going on in fintech, crypto, the economy and more, including:

2 to 3 deep dives on the biggest stories of the week 📝

Fintech & Crypto News: Insight, partnerships, fundings 🚨

Beyond the Ledge: Long Reads & Recs 📚

Podcast I’m digging 🎧

Tweet of the Week 🐤

Chart of the Week 📈

Optimism Wins 🥇

...and more…free!

Fintechs Race to Grab Deposits with Increased Coverage

With a relatively low amount of coverage - FDIC insurance caps out at $250,000 - it should be no surprise that many banks have a significant percentage of deposits above that amount. This fact greatly accelerated the panic that ensued over the last few months, as people and businesses rushed to move funds above the cap to new institutions. The below chart details the most exposed banks. As might be expected, Silicon Valley Bank and Signature Bank were right at the top.

Source: S&P Global Market Intelligence

Fintech is changing that, however.

Business-focused neobanks like Brex and Mercury have developed programs that let business customers invest idle cash in Treasuries or money market funds.

Mercury recently launched a new account that provides customers with $3 million of FDIC insurance, more than twelve times the typical limit of $250,000. In the current environment, it’s no wonder they attracted over $2 billion in deposits after the SVB Collapse.

Brex offers Brex Cash accounts, which are not bank accounts but rather cash management accounts offered by Brex Treasury (a FINRA-registered broker-dealer), that function very similarly to a traditional business bank account. With a number of partner banks behind the service, business customers can become eligible for up to $6 million in total.

Both fintechs managed to secure the additional coverage within weeks of SVB collapsing.

"The fintechs are moving faster than banks. They are piecing things together to come up with solutions that they expect will appeal to customers, and they are not wed to a single set of tools."

Brian Graham, partner at Klaros Group, to American Banker

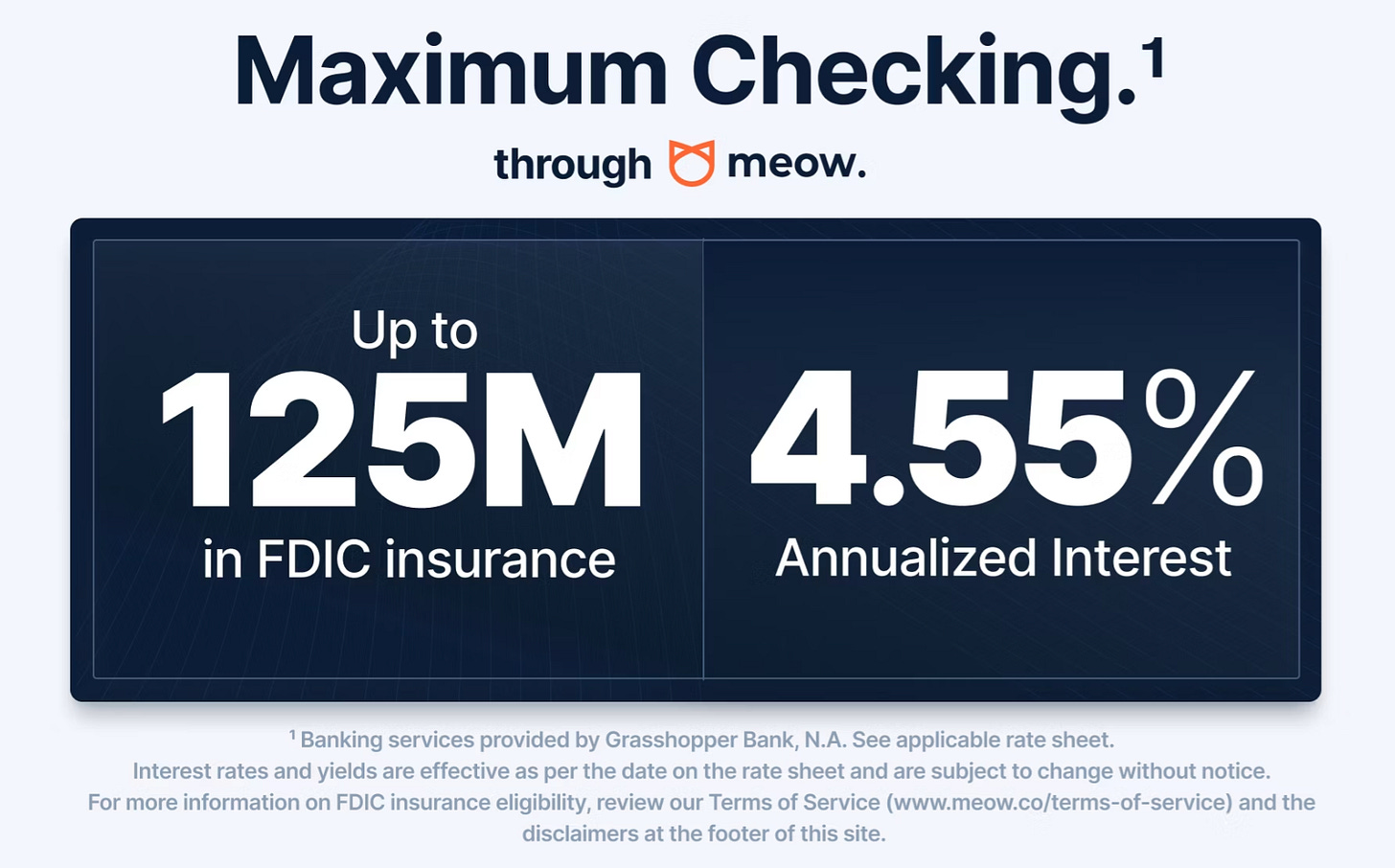

Not to be outdone, Meow 😸, a fintech also positioned towards serving startups, is advertising a business checking account with -wait for it - up to $125 Million in coverage💸!

Mrrrrrrrrrrawr…….hiiiiiiiiiss….Behave!

Balance Sheet Management - Extended FDIC Coverage

All this is done through an intermediary who takes any excess deposits and divides them into $250,000 chunks among other banks in their network - thus extending the amounts that are covered. There are a few players in this space - IntraFi, R&T Deposit Solutions, StoneCastle Cash Management, and newcomer ModernFi. These companies have a number of banks in their respective networks’, and allocate deposits typically as a one-way buy or sell or reciprocal agreement.

The public attention that has been generated on whether or not your deposits are insured, and whether the $250,000 deposit cap is a hard cap…Now the relevant market for these deposit networks is bigger than the banks themselves.

Leo D'Acierno, senior advisor at Simon-Kucher & Partners, speaking to American Banker

As is usually the case, the private sector seems to have figured out a better way to protect depositors, albeit with help from the existing coverage. Nonetheless, it has largely been fintechs leading the charge.

And in a post-SVB world, business is booming. 🚀

Better Tomorrow Ventures (BTV), a pre-seed and seed-stage Fintech VC firm, is starting a new accelerator, The Mint. Founding Partners Sheel Mohnot and Jake Gibson previously ran the 500 Startups accelerator, after founding fintech companies themselves, so they have a bit of experience here.

Time to build!

Original tweet.

Check out my FintechTweeps for a curated list of Fintwit’s best & follow me @rsconway for more (Twitter).

PayPal’s stock price fell to $63.38 a share after disappointing earnings on Monday. For context, this is the lowest price for the company since September 2017!

Miguel Armaza hosts the Fintech Leaders Podcast and Newsletter and is Co-Founder & Managing General Partner of Gilgamesh Ventures, a seed-stage investment fund focused on fintech in the Americas.

In this episode, he interviews David Haber, Fintech VC at a16z, and previous founder of Bond Street (acquired by Goldman Sachs), a NY fintech that aimed to transform small business lending in the US. David shares lessons for aspiring entrepreneurs, key qualities of a great venture capital investor, the a16z investing vision - and more.

Happy listening 🎧

Slash raises $19M to be the bank for your side hustle, and “most importantly, I truly f*ck with our customers.” (Suggested next hire would be PR).

Goldman Sachs to pay $215 million to settle discrimination claims from female employees.

Revolut's CFO leaves the digital bank after two years, citing personal reasons.

WhatsApp now allows Singapore-based users to pay businesses within the app.

Lev, a digital transaction platform for commercial real estate, announced Lev Match, a new marketplace for debt financing.

Zimbabwe's central bank launches digital currency backed by physical gold.

Petal Raises $35 Million in New Funding, Spins Off B2B Data Analytics Unit Prism Data.

Goldman, Deutsche Börse, 30 firms join Canton Network for institutional blockchain interoperability.

FDIC Plans to Hit Big Banks With Fees to Refill Deposit Insurance Fund.

Melio Launches B2B Payments Mobile App for Small Businesses.

Charlie, a new banking app, wants to help with the financial woes of retirement.

Robinhood looks to Make Stock Markets Tradealbe 24 Hours a Day.

Analysis: Crypto firms scramble for banking partners as willing lenders dwindle.

‘Attack on Bitcoin’ Claims Circulate as Transaction Fees Climb Higher.

PayPal Discloses Nearly $1B of Crypto Assets on Balance Sheet.

Bitcoin Transaction Fees Surpass Block Rewards for the First Time Since 2017.

Crypto Exchange Poloniex to Pay $7.6 Million to Settle Probe Into Sanctions Violations.

Binance Announces Exit from Canada, Citing Regulatory Tensions.

White House proposes a 30 percent tax on electricity used for crypto mining.

Decentralized Artificial Intelligence: (Francisco Javier Arceo, Chaos Engineering)

This article discusses the potential of using blockchain and cryptography to create a secure, decentralized ledger for Artificial General Intelligence (AGI). It is, according to Arceo, to ensure generative AI remains safe.

It is not decentralised OR centralised … it is decentralised AND centralised. (Chris Skinner, TheFinanser.com).

Thanks for reading. If you enjoyed this content, make sure to hit the subscribe button, like this post and leave a comment.

If you have any feedback or thoughts, I’d love to hear from you. The best place to find me is on Twitter or LinkedIn!

Until next week, fare thee well friends

Don’t forget - if you enjoyed this newsletter please share it with a friend (or two!)- remember, sharing is caring!

Disclaimers: All content and views expressed here are the authors’ personal opinions and do not reflect the views of any of their employers or employees. The author does not guarantee the accuracy or completeness of the information provided on this page. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this Site constitutes a solicitation, recommendation, endorsement, or offer by TFL or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.