Fiction or Reality? The Rise of AI in Fintech

TFL # 19: Revolut’s UK banking license denied; former SVB & Signature Bank execs brought before Congress for show

Happy Sunday! 🙋♂️

Welcome back to The Fintech Ledger #19!🔥

I’m coming to you from Mexico City this week. This city has a special place in my heart; for one I met my wife here. We also spent our “luna de cuarentena,” what we jokingly refer to as our extended honeymoon (we were married on March 7, 2020). It’s definitely on “the it list”- having experienced a spike in temporary residence permits from U.S Citizens since the start of the pandemic which….I have mixed feelings about. I guess we all just want secrets to stay our own.

It’s also a phenomenal fintech city with a lot of interesting companies, builders and opportunity. If there’s any fintech people around that want to meet up hit me up on Twitter.

Now for the latest. This week, former SVB and Signature Bank execs were brought before congress in a meaningless political display (is there any other kind?), Revolut’s banking license was denied in the UK, and we caught a glimpse of the future of AI in fintech.

Let’s jump in.

Palacio de Bellas Artes, Mexico City

Psst : Was this newsletter forwarded to you? Sign up here to get the latest insight right to your inbox ~ free!

There’s been a lot written about how Generative AI will fundamentally change the future of fintech, if not the world at large. A few of my favorite pieces delving into the fintech side of things are from Simon Taylor of Fintech Brain Food, Sarah Hinkfuss of Bain Capital Ventures, and Francisco Javier Arceo from Chaos Engineering. All three takes are mind bending in their own way.

This week we were introduced to a few real life examples of fintechs bringing the future to us. The creativity and innovation will make you believe that the AI application in fintech is prime for a paradigm shifting leap forward.

I can’t wait.

The future belongs to those who believe in the beauty of their dreams.

~ Eleanor Roosevelt

Ramp introduces Ramp Intelligence, AI tools for reducing business costs

Ramp, a corporate credit card and expense management startup, this week announced Ramp Intelligence, an AI based technology to enhance savings for its small business customers. The service uses OpenAI's GPT-4 technology to analyze software prices, scan email receipts, audit expense reports, and compare vendor contracts to market averages, helping small business customers determine if they are getting a good deal.

Why it matters:

The AI-powered tools are trained to understand and interpret large amounts of text, enabling them to scan through reams of contracts and fine print, extracting the most relevant information and provide recommendations. This previously would have taken innumerable hours of work, and can ensure businesses have the best information to optimize their cost structure.

Notable investors

Ramp counts notable investors including Founders Fund’s Keith Rabois, Microsoft CEO Satya Nadella, and….Jeb Bush. No low energy here.

Thanks for reading The Fintech Ledger! 📚 Subscribe for free to get weekly insight into what’s going on in fintech, crypto, the economy and more, including:

2 to 3 deep dives on the biggest stories of the week 📝

Fintech & Crypto News: Insight, fundings 🚨

Beyond the Ledge: Long Reads & Recs 📚

Podcast I’m digging 🎧

Tweet of the Week 🐤

Chart of the Week 📈

Optimism Wins 🥇

...and more…free!

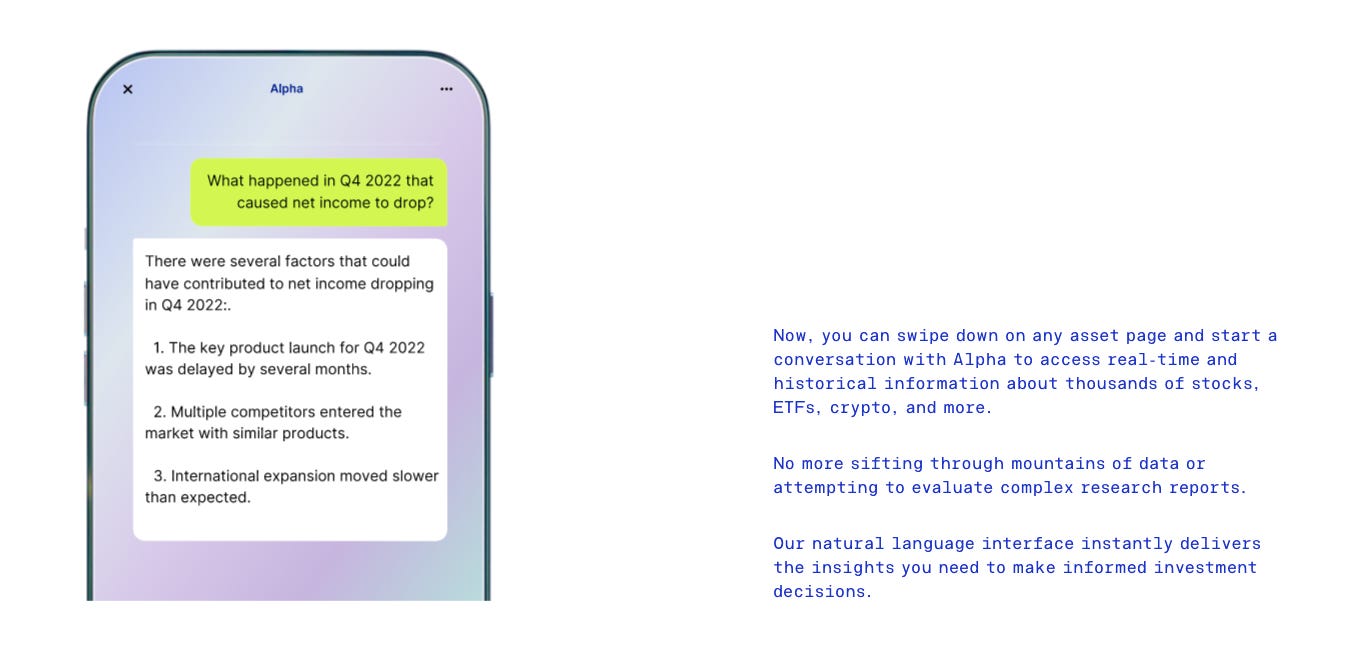

Public announces Alpha to Enhance Investing Experience with AI

Public, an investment platform that allows retail investors to invest in stocks, treasuries, crypto, ETFs, and alternative assets, this week introduced Alpha, an AI-powered tool to enhance the investing experience. Built with OpenAI's GPT-4 technology, Alpha promises the ability to sift through thousands of analyst reports, market data, news articles, and earnings call transcripts - providing real-time and historical data for tens of thousands of assets.

Why it matters:

Alpha will potentially save investors dozens of hours of time by delivering contextualized information and insights instead of having them manually search through various sources. The efficient market hypothesis just got more…efficient.

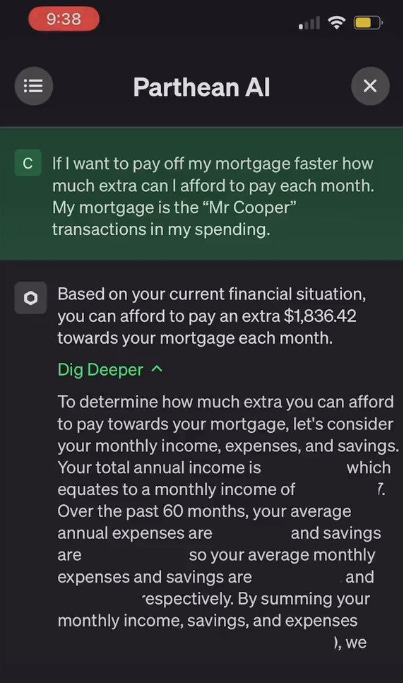

Parthenon’s AI tools for personal finance

There is a ton written about financial inclusion, and it usually starts with education. What has always frustrated me about this topic is the overwhelming amount of free information already available. That said, I’m all for making it easier to digest financial concepts and create user-friendly interfaces for people to ask very specific questions. This is what Parthenon promises. Imagine the ability to ask any question about your finances and get answers that are personalized and immediate. Questions as basic as:

How much can I afford to spend on this trip to Aspen?

What do I need to do to retire at 60 if my income stays the same?

What have you noticed about my finances that needs improving?

How is my portfolio currently diversified?

What would be an appropriate emergency fund number for me?

Why it matters:

If Parthenon can live up to even a portion of the claims, this could be a game changer. It’s like a personal financial advisor in your pocket, answering the questions that could create a real impact on individuals’ financial lives.

Thoughts on AI in Fintech.

While it is still a relatively new development, we are reminded (daily on twitter) how “this week was pivotal” for Generative AI. Moving at light speed, the complexity of AI models has been doubling every few months, which is mind boggling. This is truly a new era. Previously, knowledge was achieved linearly, step by step (The Enlightenment). AI enabled systems expand exponentially. Simply, the pace of innovation is moving so fast we cannot fully contemplate what the future holds. It’s part mystery, existential risk and optimistic surprise rolled into one.

I’m optimistic for sure but have some thoughts as to bottle the existential risk piece that goes beyond “just unplug the thing.”

More to come in a future post.

Alex Johnson of Fintech Takes is such a clear thinker, a really solid person (and new #girldad!) and one of the best synthesizers of what matters in fintech. He recently put together a really, really good list of fintech resources including the best newsletters (TFL is highlighted!), reporting, podcasts, events and more.

You’re going to want to bookmark this one.

Original tweet here.

Check out my FintechTweeps for a curated list of Fintwit’s best & follow me @rsconway for more (Twitter).

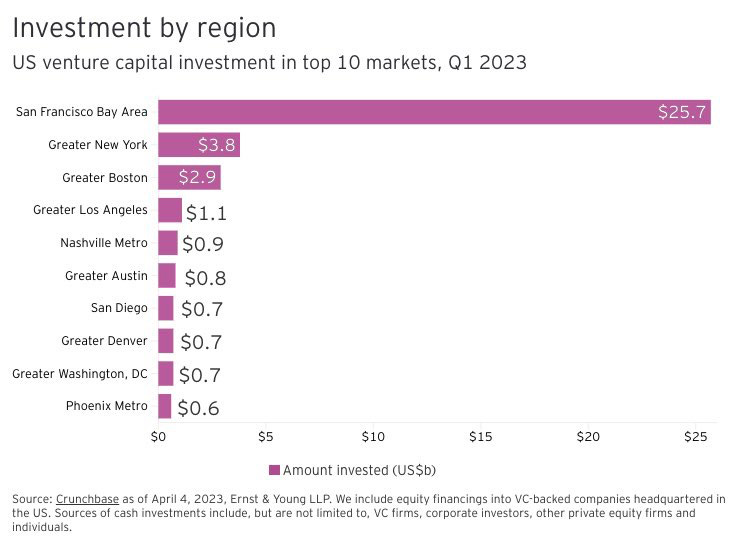

Narrative violation! Apparently SF is not dead.

Lex Sokolin of The Fintech Blueprint is an immensely insightful individual who will make you rethink your assumptions on fintech, crypto and…pretty much everything. When I talk to Lex I always think of the old maxim “If you’re the smartest person in the room, you’re in the wrong.” He always stretches your intellect in some way.

In this podcast, he speaks with Anish Acharya -a general partner at Andreessen Horowitz (a16z), a VC firm in Silicon Valley, California. They analyze the impact and adoption of disruptive platform shifts, shed some light on Credit Karma's growth strategies from Anish’s time as a GM at the company, and envision a landscape transformed by AI integration and Web 3.0 convergence.

Happy listening 🎧

Bank of England plans to reject Revolut’s bid for banking license.

Former CEOs of Silvergate and Silicon Valley Bank were grilled by Congress over risk management practices and bank failures in the last few months.

Nubank Reports First Quarter 2023 Financial Results, remains bullish on opportunities in Mexico and Colombia.

Visa and Mastercard agree to lower interchange fee in Canada below 1%.

Mastercard Launches Solution for Secure Digital Account Opening.

Smart Raises $95 Million to Expand Retirement Savings Technology Platform.

Revolut CFO will depart the company after two years, citing “personal reasons.”

CFPB’s Small Business Lending Rules Headed for More Scrutiny on Capitol Hill.

Watch out, TurboTax: upstart tax-filing service Column Tax is helping claim refunds.

Percent, a Private credit marketplace, lands $29.7m Series B funding.

ZestMoney founders resign as Goldman backed fintech struggles to raise funds.

Tipalti raises $150 million in credit from JPMorgan and Hercules Capital.

Zepz, parent to WorldRemit and Sendwave, lays off 26% of employees.

Uber advances super-app ambitions, partners with Hopper to add flights to its “one-stop travel solution”.

Apple and Google Pose Threats to Crypto Industry, Ex-Coinbase CTO Says.

Worldcoin, co-founded by Sam Altman, is betting the next big thing in AI is proving you are human.

Stablecoin Tether's reserves hit $81.8 billion in Q1 - reserves report.

US Chamber of Commerce Slams SEC, Backs Coinbase in Legal Fight.

SEC calls Coinbase's suit over digital asset rules petition 'baseless'.

AI Chatbot Has Learned the Difference Between Good and Evil.

Web3 is Going Just Great: a16z-backed Mecha Fight Club NFT robot cockfighting game put on ice as maker pivots to AI.

Rise, a Payroll Startup, Wins CoinDesk's 2023 Pitchfest Contest.

Bitcoin-Ether Correlation Weakest Since 2021, Hints at Regime Change.

Your Old Game Boy Can Now Be Turned Into a BTC and ETC Hardware Wallet.

This week’s long read comes from Kristen Anderson, former CEO of recently shuttered Catch, in Fintech Takes. Catch was a fintech company focused on providing benefits to independent workers. In this raw essay, Kristen discusses the often overlooked yet real part of Silicon Valley; failure. A real take on the trite “fail fast” motto, in her own words she states:

At least once a day for the last 6 months I've felt one of the following: shame, fear, disappointment, anger, embarrassment, or sadness. Sometimes all of them. If you're a founder and you're struggling, ask for help.

This is an important piece. Don’t miss it.

Alas all good things must come to an end. If you enjoyed this content, please hit “like” button. Ideas for an area you’d like to learn more on, leave a comment!

Psst: I’d love to hear from you. The best place to find me is on Twitter or !

Until next week, fare thee well friends.

Don’t forget - if you enjoyed this newsletter please share it with a friend (or two!)- remember, sharing is caring!

Disclaimers: All content and views expressed here are the authors’ personal opinions and do not reflect the views of any of their employers or employees. The author does not guarantee the accuracy or completeness of the information provided on this page. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this Site constitutes a solicitation, recommendation, endorsement, or offer by TFL or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.