Underdogs: Regional Banks in Trouble; Buffet warns of "Big Dumb Things."

TFL #17 Calling out The Fed. Again.

Happy Sunday! 🙋♂️

Welcome back to The Fintech Ledger, #17! 🔥

This week JPM successfully won the bid to acquire First Republic Bank after the FDIC put it into receivership, which led to a tough week for a number of regional banks. Inflation is still too high, leading the Fed to another rate rise - the tenth straight meeting it has done so - making a downturn all the more likely. Meanwhile, the Oracle of Omaha held his annual Berkshire Hathaway’s shareholder meeting, attracting devotees of all kinds who make the pilgrimage annually to soak up his unique wit and wisdom.

We’ve got a bit of a doozy this week. It’s getting weird out there.

Psst : Was this newsletter forwarded to you? Sign up here to get the latest weekly fintech and crypto insight right to your inbox ~ free!

I like underdog stories. Who doesn’t. So if you’ve been paying attention to what’s been going on in the banking sector (who hasn’t), you’re most likely a little depressed (and worried). Regional banks are in trouble. Big trouble. Last week, we covered the imminent takeover of First Republic Bank by at the time an unknown suitor. On Monday, it was announced that the winning bidder at $16 billion was JP Morgan Chase. The House of Morgan, Goliath for those following along, needed a regulatory waiver from the FDIC because it already had more than 10% of U.S. deposits before the acquisition.

This is now the third US bank to fail in the last 60 odd days. And while not probably household names, these were not small institutions. Below you can see that the three failed banks were relatively massive compared to most of the failures in 2008, save Washington Mutual. What does this mean for other, smaller regional banks who similarly exhibit unrealized losses as a result of poor interest rate hedging (in response to rapid fire Fed hikes)?

The answer: it’s looking increasingly worse.

JPMs Really, Really, Really Good Deal

First Republic's 84 branches reopened Monday as JPMorgan, and former First Republic customers received the following communication on Friday May 5th from their new banker. Estimates put the cost to the FDIC at around $13 billion, with the

final cost to be determined once the FDIC terminates receivership. JPMorgan, for their part, acquired $93 billion in deposits and expects to recognize an upfront, one-time, post-tax gain of $2.6 billion (not including an estimated $2 billion in restructuring costs over the next 18 months). All this amounts to an expected $500 million of incremental net income per year for the megabank.

For those keeping score.

Goliath 1

David -3

More to Come?

Last week, we covered The Feds sham “Mea Culpa” in their Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank - a self published post mortem of sorts. For those who didn’t read through 118 pages, I’ll spare you.

TL;DR

The Fed: We screwed up, but not really. I mean, the last guys tied our hands, and and and….if we only had more oversight - this wouldn’t have happened. If you just give us more power for next time, we’ll make sure this doesn’t happen again. Pinky promise.

It’s like students grading their own papers. So no one should be surprised to learn that wasn’t the full story. In Q3 2022, 722 banks reported unrealized losses exceeding 50% of capital. The Fed knew it. And did….nothing.

Source

I guess it could have been a little inconvenient when they were trying to snuff out the inflation that managed a backdoor slant while they were busy doing who knows what.

Meanwhile, regional bank stocks got pumelled last week. On Friday, over 130 regional bank stocks were down more than 5%. None were in the green.

Source

I think it’s fair to assume we’re not done yet.

Buckle up.

Thanks for reading The Fintech Ledger! 📚 Subscribe for free to get weekly insight into what’s going on in fintech, crypto, the economy and more, including:

2 to 3 deep dives on the biggest stories of the week 📝

Fintech & Crypto News: Insight, partnerships, fundings 🚨

Beyond the Ledge: Long Reads & Recs 📚

Podcast I’m digging 🎧

Tweet of the Week 🐤

Chart of the Week 📈

Optimism Wins 🥇

...and more…free!

Elsewhere in Omaha 🔥

Meanwhile, the annual pilgrimage to Omaha to hear the Oracle himself speak took place this last week at the annual Berkshire Hathaway annual shareholders meeting. A main reason please flock to event is to hear Buffett offer up wisdom. On markets, and life. This year’s version didn’t disappoint.

Buffet sounded optimistic about value investing (surprise), although he anticipates that businesses will see a decline in their year-over-year earnings as economic activity slows down. He noted that commercial real estate could face difficulty due to higher borrowing rates and banks could come under pressure (I assume he must read The Fintech Ledger as part of his daily routine).

From a geopolitical point of view, he stated he doesn't expect the US dollar to lose its status as the world's reserve currency anytime soon.

“We are the reserve currency, I see no option for any other currency to be the reserve currency.”

Warren Buffett

Meanwhile, Buffett's right-hand man, Charlie Munger, said while he acknowledged “we are going to see a lot more robotics in the world,” he remains “skeptical of some of the hype in AI.”

“Old-fashioned intelligence works pretty well” over AI.

Charlie Munger

And for good measure, there’s always something one of the two men say that makes it all worth it.

“In the 58 years we’ve been running Berkshire, I would say there’s been a great increase in the number of people doing dumb things, and they do big dumb things.”

Warren Buffett

Big. Dumb. Things.

H/T to Todd Baker for calling out what the CRB consent order means for the partner bank model.

Original tweet (thanks Elon).

Check out my FintechTweeps for a curated list of Fintwit’s best & follow me @rsconway for more (Twitter).

In uncertain times people’s ability to save for emergencies is hindered. That much is intuitive. Bankrate’s 2023 Annual Emergency Savings Report shows that debt is steadily increasing are really inhibiting peoples ability to save.

Key takeaways:

Nearly half of US adults have less savings or no savings compared to a year ago.

36% of people have more credit card debt than emergency savings, the highest on record since 2011.

43% of US adults would pay for an unexpected emergency expense from their savings.

Source

Optimism is the madness of insisting that all is well when we are miserable.

~ Voltaire

In times like this it’s always good to remember that optimism is a choice. A16z reminds us that great companies are born in good times and bad. Time to build.

Source

I’ve been a big fan of the Wharton Fintech Podcast ever since (shameless plug alert!) I was on it. Seriously though, it’s amazing what this group of MBA students from Wharton are able to produce week after week, year after year.

In this episode, host Nihar Bobba speaks with Angela Strange, General Partner at a16z. Famous for coining the phrase "Every Company Will Be a Fintech Company," in this episode they delve into the state of fintech, why she believes every company will be a fintech company, the operating principles she brings to her investing role, and much more.

Happy listening 🎧

Apple’s New Savings Account Draws Nearly $1bn In Deposits In First Four Days.

JPMorgan acquires First Republic in a deal that included $173 billion of loans, $30 billion of securities, and $92 billion in deposits (insured and uninsured).

First Republic’s failure, expected rate increases plunge regional bank stocks.

Finix becomes a Payments Processor, integrates directly to American Express, Discover, Mastercard, and Visa.

Former Bolt CEO and Founder Ryan Breslow Debuts New Health Startup “Love”.

Greenwood Acquires Kinly, Bringing Together Two of The Largest Black-Owned Fintechs.

African PSP Nomba raises $30M, backed by Base10 Partners and Shopify.

1-800-FLOWERS.COM, Inc. Acquires an intelligent gifting platform, SmartGift.

Belvo acquires Brazilian company Skilopay to grow its payments offering.

Tellus, a fintech backed by Andreessen Horowitz, catches Senate Banking chair’s eye; calls on FDIC to look into for high yield claims.

Ant’s Financial License Is in Limbo as China Shakes Up Regulatory System.

Microsoft and Stripe partner to launch Teams Payments for businesses.

UK Neobank Monzo announced it hit the 250K business customer milestone.

Brazilian Fintech CloudWalk Surpasses US$ 100 million ARR and Reaches Centaur Status (yeah I had to google that too).

Coinbase sues SEC after months of silence from federal regulator.

Bitcoin Set New Record of Daily Transactions the Same Day the U.S. Government Quietly Engineered a Bank Buyout.

Standard Chartered's head of digital assets research Geoff Kendrick “bitcoin could hit $100,000 by the end of 2024”.

Coinbase Sued in Class Action Lawsuit for Alleged Privacy Violations Over Customer Biometrics.

Mastercard Launches Crypto Credential Service for Cross-Border Transfers.

Mastercard is expanding its partnership with Paxos Trust Company, to bring crypto trading capabilities to banks.

PayPal extends crypto transfers to more than 60M Venmo customers.

NFTs and The Metaverse. How non-fungible tokens enable the growth of societies within immersive virtual worlds.

Bitcoin gets a vote of confidence as MicroStrategy increases holdings.

FTX-ed: Crypto Investors Are Moving Back to Hardware Wallets, self custody.

NFT Marketplace Blur Now Enables You to Use JPEGs to Borrow ETH.

Portal and ZeroDev announce the development of the first MPC + Account Abstraction (AA) wallet-as-a-service.

Every week I come upon some good longer reads and research pieces. Below is the best of what I found last week.

Global Fintech 2023: Reimagining the Future of Finance: (Boston Consulting Group & QED Investors)

This one is full of insight and worth taking some time to dig into. The report portrays a different world, one that operators and investors alike are already all too familiar with.

Fintechs are employing different playbooks to survive the funding winter, with many focusing on unit economics as opposed to unbridled revenue growth at any cost.

Some of the key points that I took away include:

a. Valuations

2020-2022 saw peak valuations (20x revenue), where the last 12 months have seen a short term-correction.

b. Opportunity

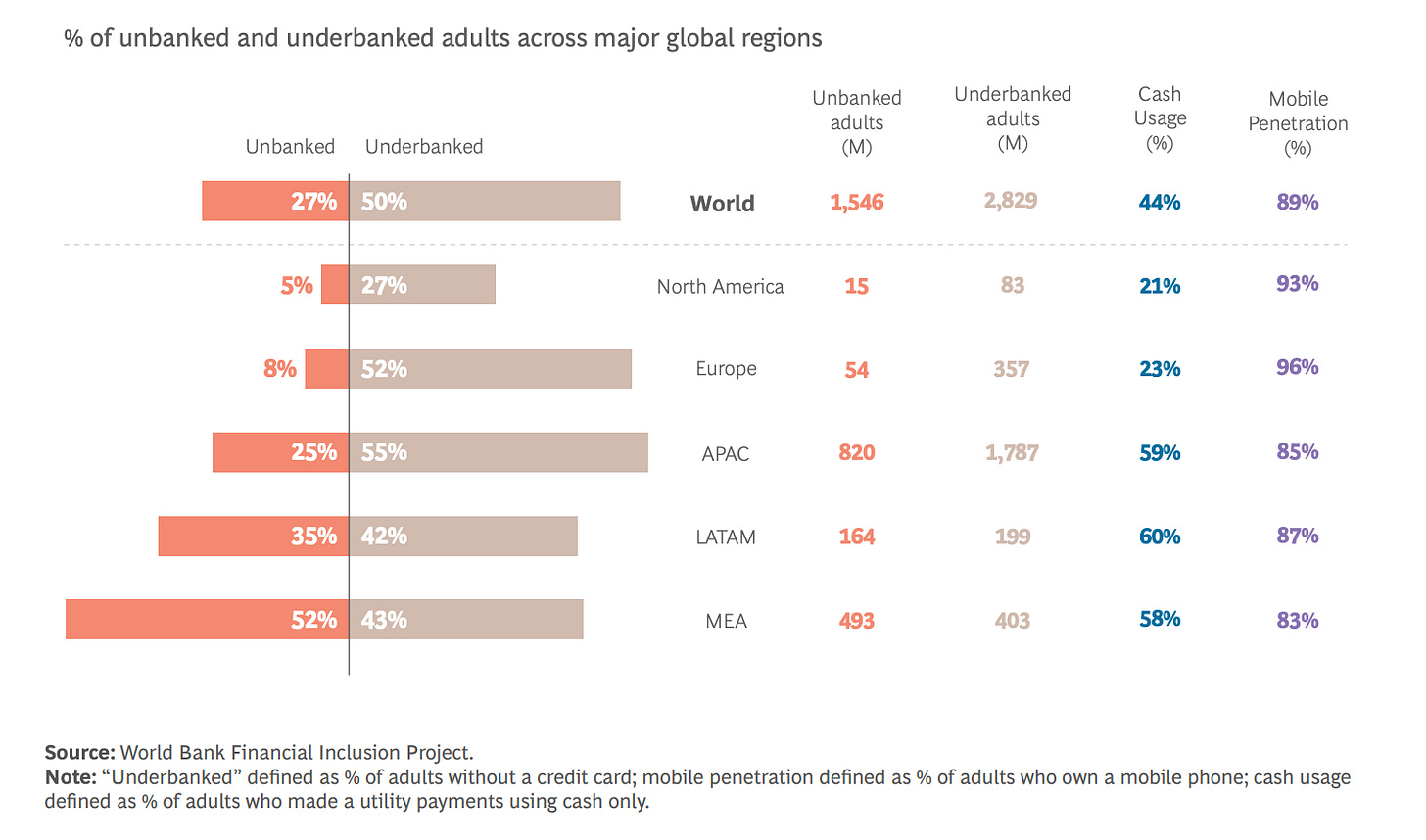

Circa 80% of adults worldwide are either underbanked or unbanked.

c. Growth

Global revenues are expected to reach $1.5 trillion by 2030, with banking-related fintechs representing a quarter of all banking valuations.

d. Asia Emerging

APAC is expected to become the top market by 2030, outpacing the US.

e. Payments —> B2B and B2B2X

While Payments Led the Last Era of Fintech, B2B2X and B2b Are Expected to Lead the next era of fintech growth.

f. Developing Markets Key to Growth

Neobanks and lending platforms will face challenges in developed markets but play a critical role in emerging markets.

If The U.S. Bans TikTok, Where Will Gen Z Go For Financial Advice? (Ron Shevlin, Forbes)

Ron’s always great column Observations from the Fintech Snark Tank looks at TikTok influencers providing financial advice (“Finfluencers”) for Gen Z and Millennials. A recent survey reveals 34% of Gen Z gets financial advice from TikTok, vs. 24% from traditional advisors. As you might imagine, the advice is questionable, but how should it (or should it) be regulated?

Traditionally high-risk industries and merchants in gaming, sports betting, telehealth, travel, and cannabis have struggled with few options for payments and fraud solutions, leading to clunky experiences and limited capabilities. This is a good look at these risk verticals, representing billions of dollars in annual payment volume, and the opportunities to serve them.

Thanks for reading. If you enjoyed this content, make sure to hit the subscribe button, like this post and leave a comment.

If you have any feedback or thoughts, I’d love to hear from you. The best place to find me is on Twitter or LinkedIn!

Until next week, fare thee well friends.

Don’t forget - if you enjoyed this newsletter please share it with a friend (or two!)- remember, sharing is caring!

Disclaimers: All content and views expressed here are the authors’ personal opinions and do not reflect the views of any of their employers or employees. The author does not guarantee the accuracy or completeness of the information provided on this page. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this Site constitutes a solicitation, recommendation, endorsement, or offer by TFL or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.