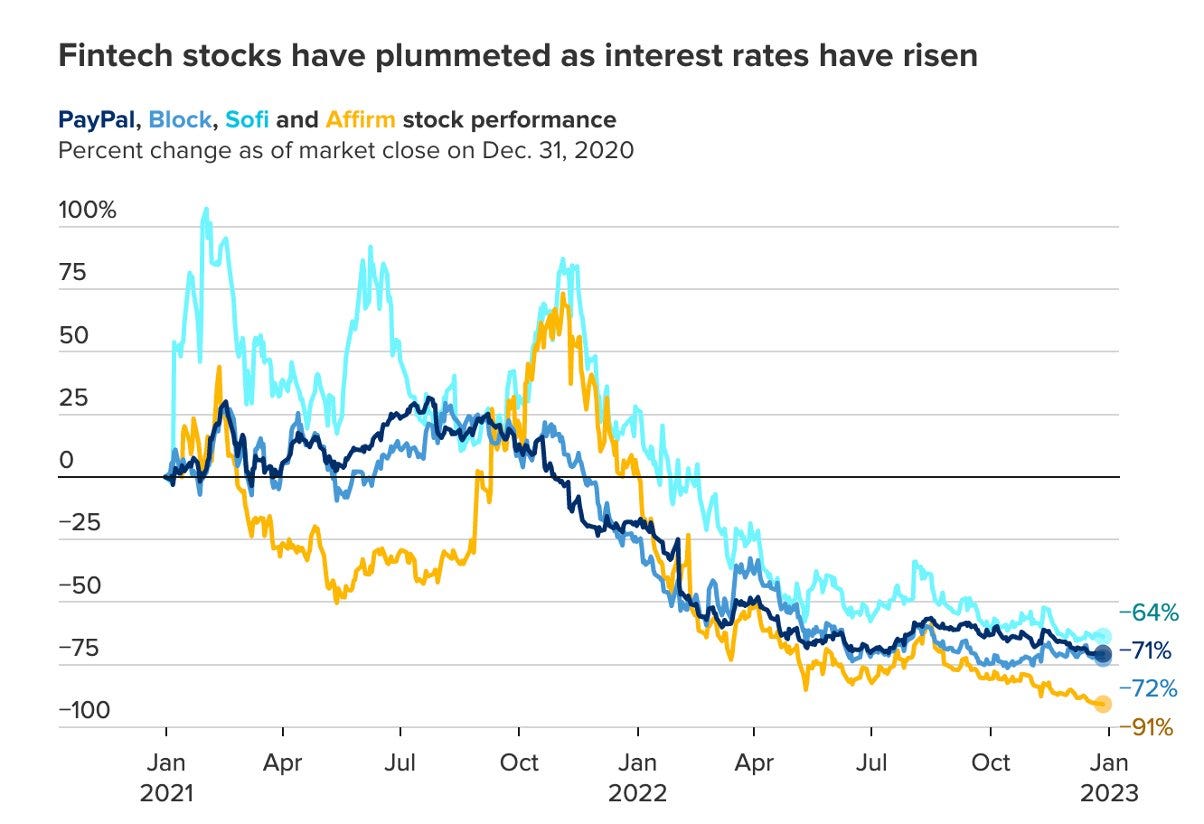

The jobs numbers out this week paint a seemingly paradoxical picture. With almost daily announcements of “More layoffs!” followed by headline 3.4% overall unemployment, the lowerst figure since 1969, what is really going on? The answer is…complicated. On the one hand, the U.S. added 1.1 million jobs over the past three months, over 500 thousand in January alone. That’s great news, in isolation. However, as readers of TFL know well, the fintech and crypto sectors haven’t fared so well. With layoffs at companies big and small, for those affected, the numbers don’t “feel” great. This week alone we saw more layoffs at some big names: PayPal announced circa 7% of employees - about 2,000 full-time employees. Payroll provider Gusto laid off 126 ‘Gusties’, representing 5% of the company. SoFi Technologies announced 65 job cuts, or about 5%. Drivewealth cut 20% of headcount, and Affirm laid off 19% of their workforce, circa 2,500 employees, after a pretty lackluster earnings call. Public fintech stocks are at what we all hope is a nadir.

Source: WallStreet Journal

So what gives? Are we in a “Patagonia Vest” recession?

And…..WTF is that?

Scott Galloway, N.Y.U. marketing professor, podcaster of ‘The Prof G Show,’ bloviating business ‘guru’ with legions of fanboys (yes they’re mostly ‘men’) and haters alike (there was an anti-Galloway Index for his perceived bad stock takes at one point), has recently dubbed the current economic situation as the “Patagonia Vest recession.” So, does the man with aspirations of being “the most influential thought leader in the history of business” - yes, he actually said that - have a point?

Insufferable as he is, he kinda does has a point.

Let’s dive in.

What’s Going On?

We’re definitly in an economic cool down; the economy in Q4’ 2022 was up only 1% year over year. Inflation, which has proven anything but “transitory,” wreaked havoc on the global economy, peaking at over 9% in June 2022. The Fed, the central bank of the United States responsible for monitoring and ultimatly keeping inflation at a 2% target, completely botched the initial response.

“[T]hese one-time increases in prices are likely to have only transient effects on inflation.”

Fed Chair Jerome Powell, in March of 2021

Botched is generous. He doubled down on being wrong. Like wrong stadium, wrong city, wrong sport, wrong… everything. And all we got for it was this meme (and rampant inflation).

What is Inflation? And Why is it Bad?

By now most of us have Googled (or Bing!-ed - if that’s your thing. jk nobody’s doing that)“Inflation” to get a better grip. At it’s core, inflation is a sustained increase in the prices of goods and services. Inflation has many causes, including:

Demand-pull inflation: high demand for goods and services, which in turn leads increases prices. Demand can come from consumer spending, investment spending, or government spending*.

* US increased spending from 20% of GDP in 2015 to 25% today

Cost-push inflation: the cost of production increases, leading to higher prices for goods and services e.g rising labor costs, higher taxes, or an increase in the cost of raw materials.**

**The Pandemic wreaked havoc on global supply chains, Rising Energy Prices

Monetary inflation: an increase in the money supply by printing more money or making it easier for banks to lend.***

*** US increased the money supply by 40%, 40%!!!- during the Pandemic

Structural factors: caused by structural factors such as a mismatch between supply and demand in certain industries, or a lack of market competition.

So we’re batting .750. And at least two of those are self enforced errors.

OK so inflation is here. Why is it so bad anyways? A few reasons. First, it reduces purchasing power, meaning you need more money to purchase the same things you did yesterday. Second, it erodes savings, as you have less to put away. And third, it can lead to a loss of economic activity for non essential products and services (what gets “cut” when times get tight).

It is sometimes referred to as an “inflation tax” or a “back door tax” because, unless your income is rising higher than inflation (doubtful) you are in effect, poorer.

Fed Moves Into Gear (Finally)

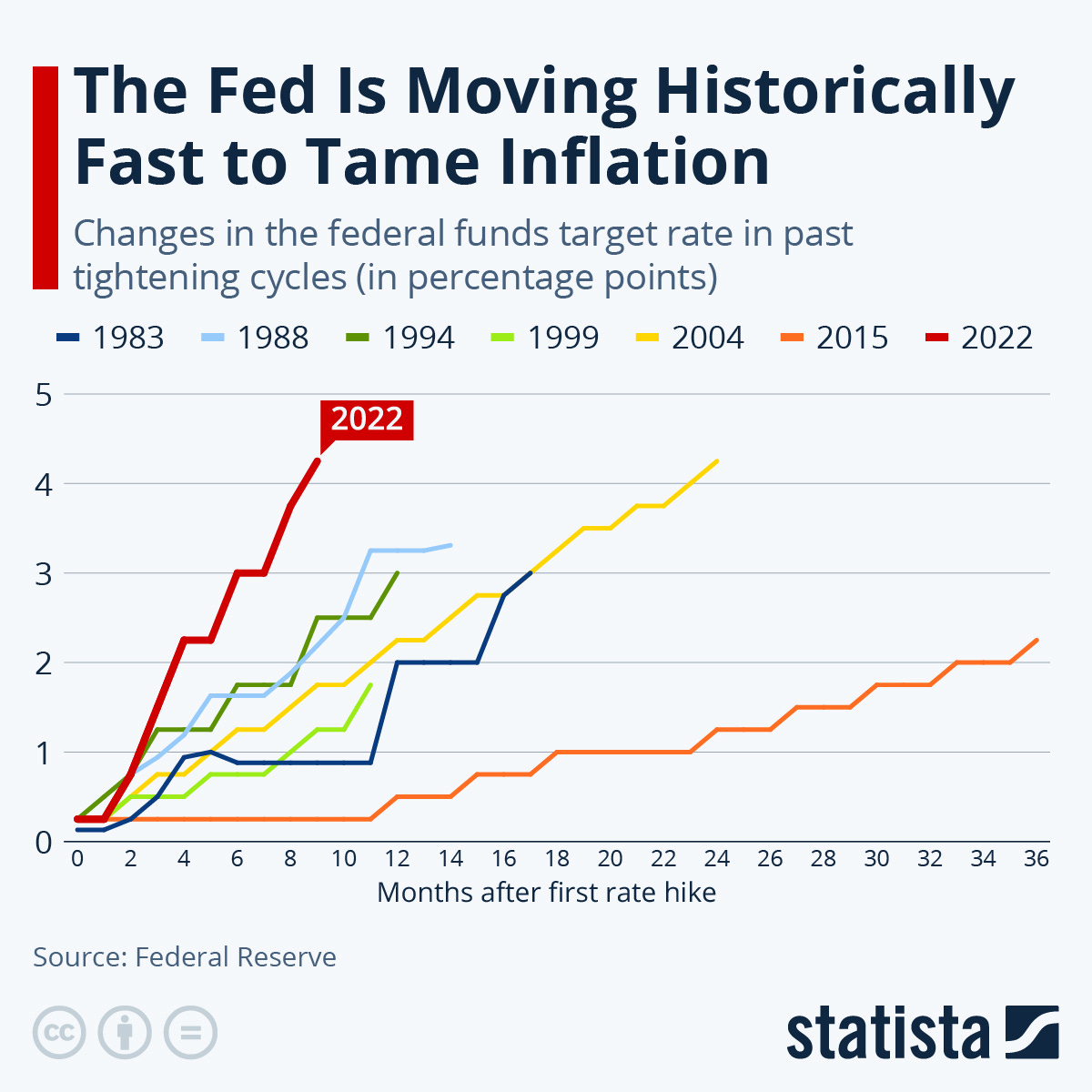

Since The Fed reversed course and accepted reality, they have raised rates faster than at any prior tightening period. Rapid course correction doesn’t happen unless you are way off course.

Two Economies?

This backdrop is important to understand where we are today. In fact, a broad part of the economy (the technology sector) is being disporportionatly affected by this overall economic shift. And there seems to be no shortage of schadenfreude from the usual suspects (typical monday morning quarterbacks). Yet, as the tech sector makes up only 2% of the US private sector jobs, the direct effect on overall payrolls has not affected the overall unemployment rate. So what is driving the jobs boom? Sectors that are just now getting back on their feet from the pandemic. Often overlooked sectors like restaurants, hospitals, nursing homes and child-care centers, which, together with other services like dry cleaning and automotive repair account for about 36% of all private-sector payrolls.

So it appears we have a vastly different reality as it relates to jobs. The Fed, it appears, wants to even that out. And not in the way you may initially think.

Enter the Fed: Job destroyer

The Fed has a dual mandate - pursuing the economic goals of maximum employment (3.4% - yeah record lows!) and price stability (argh- inflation is really sticking around the party late). On the one hand, they’ve failed miserably at price stablility. But can they be lauded for strong jobs numbers? In this case, doubtful. It appears job growth is strong despite the prevailing headwinds. Or as a simple result of the waning of the pandemic. Unfortunatly, those two mandates are opposed to each other right now. When overall unemployment is low (like right now), salaries tend to rise. Rising salaries mixed with existing inflation is a molotov coctail for the economy. So, they’re forced to choose. And guess which is the favorite child? Ding ding. Inflation.

So, prepare for some Fed induced pain in the jobs market.

The Fed will likely continue to increase rates to try and get the economy to shed jobs in the hopes of taming inflation. The CME FedWatch Tool now estimates an 82.7% probability of another 0.25% increase in March. Fed officials have signaled raising rates above 5% this year, which seems contrary to what markets had in mind.

Before (and even after) the recent “good” unemployment numbers most had priced a leveling off or even rate cuts in late 2023. But after the January jobs numbers came in, JPow came out and told investors rates would need to remain higher for longer. They ignored him and markets surged.

He reiterated the same again this week and the markets surged. So now we’re caught in this dance, with the outlook looking more precarious by the day. Financial markets are likely to get spooked - reducing the possiblility of a “soft” economic landing.

And how we have no other choice but to JPow….

After he bungled everything to this point….

I guess… there’s a chance?

Buckle up.

Deep dive: What Happend to Fintech valuations? 📉

Bain Capital Ventures recently released The Fintech Formula: A Data-Driven Blueprint for Creating Enduring Value. While the title is certainly uninspired, the authors did a good job parcing through 121 publicly-traded fintech companies. The result was an index (the “BCVF”) which they used to compare to the broader market.

TL;DR

Public market fintech was hurt much more than non-fintech peers.

TL;DR (in charts)

The bigger they are, the harder they fall.

Next gen punished more than legacy fintech.

For me, one of the ‘aha’ findings was that the loss of market cap value for nex-gen fintech companies vs their legacy peers seemed to not be supported by data. That is, there didn’t appear to be any discernible differences in either financials or business models to warrant the difference. It seemed the market turned sour and…piled on. To me, that signals an alpha opportunity.

It’s worth diving into on your own here.

Let me know what you think.

Kraken Get’s Whacked by the SEC

The SEC came down on Kraken this Thursday. The U.S. agency announced it came to a $30M settlement with the Crypto exchange for offereing unregistered securities. In a Kraken blog post, it said it will immediately end its crypto staking-as-a-service platform for U.S. customers. Staking is when you lock crypto assets for a set period of time to help support the operation of a blockchain. In return for staking your crypto, you earn more cryptocurrency. Investors in Kraken’s staking product were advertised annual investment returns of as much as 21 percent.

For readers of this newsletter, this should not be a surprise. TFL took a deep look into the nascent “wild west” of crypto regulation in the US. It’s ramping up, with the SEC’s Gary Gensler’s putting on his best Doc Holliday impersonation as of late.

“Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries, when offering investment contracts in exchange for investors’ tokens, need to provide the proper disclosures and safeguards required by our securities laws. Today’s action should make clear to the marketplace that staking-as-a-service providers must register and provide full, fair, and truthful disclosure and investor protection.”

SEC Chair Gary Gensler

Kraken is the third largest cryptocurrency exchange according to CoinMarketCap, with daily trading volume of circa $650 million globally. Gensler has been increasingly upping the ante after the FTX debacle. Speaking to Bloomberg in December, he said “the runway is getting shorter” for crypto firms to register with the agency.

Prior to the announcement, Coinbase CEO Brain Armstrong, who has publicly called out the SEC in the past, said “staking restrictions would be terrible path for the U.S.” Coinbase currently has two million ETH currently staked on Coinbase, with close to 20 million ETH under custody, a potentially significant revenue driver.

Is this the fist domino that will ripple across the industry? Time will tell, but it’s clear the SEC is trying to draw a line in the sand.

Didn’t See That Coming 🤯

CoinDesk reports that investment firm Cherokee Acquisition, a distressed asset investment banking firm that also has a marketplace for credit claims against bankrupt firms, is now offering the ability for crypto investors to purchase bankruptcy 'put options' to protect funds on Binance, Coinbase, and Kraken. The options will allow account holders to recover 100% of their assets in the event the major exchanges file for bankruptcy and lock customer assets.

For those already looking at losses in the already bankrupt firms Celsius Network, Voyager Digital and FTX, the firm is currently structuring deals and buying customer claims.

In December, former FTX customers with roughtly $1 billion in credit claims had signaled intered in taking a severe haircut - taking $0.08-$0.12 on every $1 of deposit claims via Cherokee's marketplace.

Ouch!

Tweet of the week 🧵

It’s official: SF is still dead forever ☠️ and tech will never come back.

In other news, welcome On Deck!

Fintech & Crypto Update 📊

In what can only be explained as ‘impeccable timing,’ Apple announces ‘buy now, pay later’ program, called Apple Pay Later. Story here.

Tech layoffs hit H-1B workers hard. Story here.

Coinbase wins dismissal of class action lawsuit alleging they had sold tokens illegally. Story here.

Binance is suspending U.S. dollar bank transfers, affecting a small portion of the user base. Other ‘on ramp’ mechanisms will remail available. Story here.

U.S. lenders saw diminishing deposits for two consecutive quarters for the first in a decade. Now they have to borrow cash to make up the difference. Story here.

CFPB & the Biden Administration, propose a rule to limit excessive credit card late fees, loophole that allows fee hikes with inflation. Story here.

Delinquencies are rising, prompting lenders to dust off their recession plafbooks. Story here.

Affirm’s exclusivity provision with Amazon has lapsed as the buy now, pay later space becomes more competitive. Story here.

Why everyone’s bullish on generative AI. Story here.

In another blow to the BNPL space, Australian Openpay has gone into receivership, laying off 80 employees, just days after announcing record quarterly results. Story here.

Mastercard and Binance announce they would be launching a prepaid card in Brazil. Story here.

Home-Buying Companies Stuck With Hundreds of Houses as Demand Slows, Rates surge. Story here.

Proving consumer fintech is not yet dead, Fierce launches out of stealth with $10M seed funding to “Empower Customers to Take Control of Their Finances”. Story here.

Pipe gets new CEO; Block and Intuit veteran. Story here.

Visa announced a new Atlanta hub, seeking to tap ‘diverse local talent.’ Story here.

Podcasts I’m digging 🎧

Financial crime is the seedy underbelly of the global economy. I enjoyed this podcast from Kate Moody, who was joined by Iain Armstrong, Regulatory Affairs Practice Lead at ComplyAdvantage and Jessica Cath, Head of Financial Crime at Project Delivery, to discuss: "How will financial crime evolve in 2023?"

Deeper Reads: Down the Rabbit Hole 🐰🕳

The Fintech Formula: A Data-Driven Blueprint for Creating Enduring Value

Healthtech x Fintech’s Biggest Prize: The Financial Operating System for Healthcare

Demystifying the Banking Regulators’ Recent Crypto Actions: Key Takeaways for Fintech Companies

Jobs & Co-Founder Matching 💼🤼🛠🔊

Fintech is incredibly competitive. It is also a remarkable community. Let’s help our peers who are looking for the next thing and help connect incredible talent with amazing companys where they can build great things!

Looking for a co-founder? Cambrian's bi-annual fintech co-founder matching tool is now live! (including 75+ technical co-founders).

Looking for a job? For those not ready for the entrepreneur’s journey, here is a link to thousands of VC portfolio company jobs. H/T to Michaela Keady

That’s it for the main edition of TFL this week.

That’s a Wrap 🎬

Thanks for reading. If you enjoyed this content, please tell all your fintech and crypto friends to check it out and make sure to hit the subscribe button.

If you have any feedback or thoughts, I’d love to hear from you. The best place to find me is on Twitter!

Until next week, hasta lluego amigos.