Breakfast Club vs. Gossip Girl: 👦 👧 Teen Banking & the fight for GenZ

TFL #20: US Avoids debt impasse; FIS to buy Bond?; Monzo hits profitability; Stripe launches charge cards and more.

Good morning fintech Illuminati 🧐 and welcome back to The Fintech Ledger - #20!

Last week we say the annual debt ceiling debacle get resolved (though not solved); JP Morgan announced they are working on a LLM for Investment advice; Apple savings faces some withdrawal hiccups, two BaaS acquisitions were announced/ in the works, and Venmo throws its hat into the teen banking space.

This last point caught my eye because it’s been….a minute since I had the proverbial trip in high school down to my dad’s bank to get my first checking account. I thought it would be a good time to go deeper into this space and I was pleasantly surprised (and sometimes horrified). One thing is for certain, this ain’t your fathers bank account.

Let’s get to it.

Psst: Was this newsletter forwarded to you? Sign up today for free to get the latest insight right to your inbox and join the most intelligent (and fun!) community of fintech and web3 operations and investors around.

Venmo looks to bank the Teens

Venmo is introducing Teen Accounts for parents and legal guardians to open an account for their teenagers to send and receive money. The account has a Teen Debit Card connected to the parent's account, and the parent can monitor up to five Teen Accounts. Teens can track their own spending and may be eligible for direct deposits. It’s worth noting that this feature has been prototyped since 2020, which is a long time, even in the notoriously slow product cycle of fintech. It will be available to select customers next month.

Key takeaways:

Parents can monitor transactions, manage privacy settings, and send money to their teen with the Venmo Teen Account.

Teens can track their own spending in the Venmo app and may be eligible to receive direct deposits.

Venmo does not currently plan to add any additional functionality for teen accounts, such as savings accounts, crypto or budgeting tools (why not?)

The parental linking could serve to reverse acquire Venmo adults whose teens want to use the service.

To jump into it, there are a few questions I want to ask:

What is the real value of these teen users?

What are the main acquisition channels?

Why does Venmo throw their hat in the ring now?

Who are the main competitors and how do they stack up?

Thanks for reading The Fintech Ledger! 📚 Subscribe for free to get weekly insight into what’s going on in fintech, crypto & the economy at large, including:

2 to 3 deep takes on the biggest stories 📝

Fintech & Crypto News: Insight, fundings 🚨

Podcast I’m digging 🎧

Beyond the Ledge: Long Reads & Recs 📚

Tweet of the Week 🐤

Chat of the Week 📈

...and more…free!

Why teens? Why now?

According to the press release, Venmo believes that the parent to teen financial relationship is symbiotic: teens can best learn from their parents and parents can better control and monitor teen spending habits with the service.

Research shows that over 45% of Gen Z prefer to have a conversation with an adult to learn about personal finance, and over 50% of parents are interested in using an app to help their children learn about money management.

PayPall Press Release Introducing the Venmo Teen Account

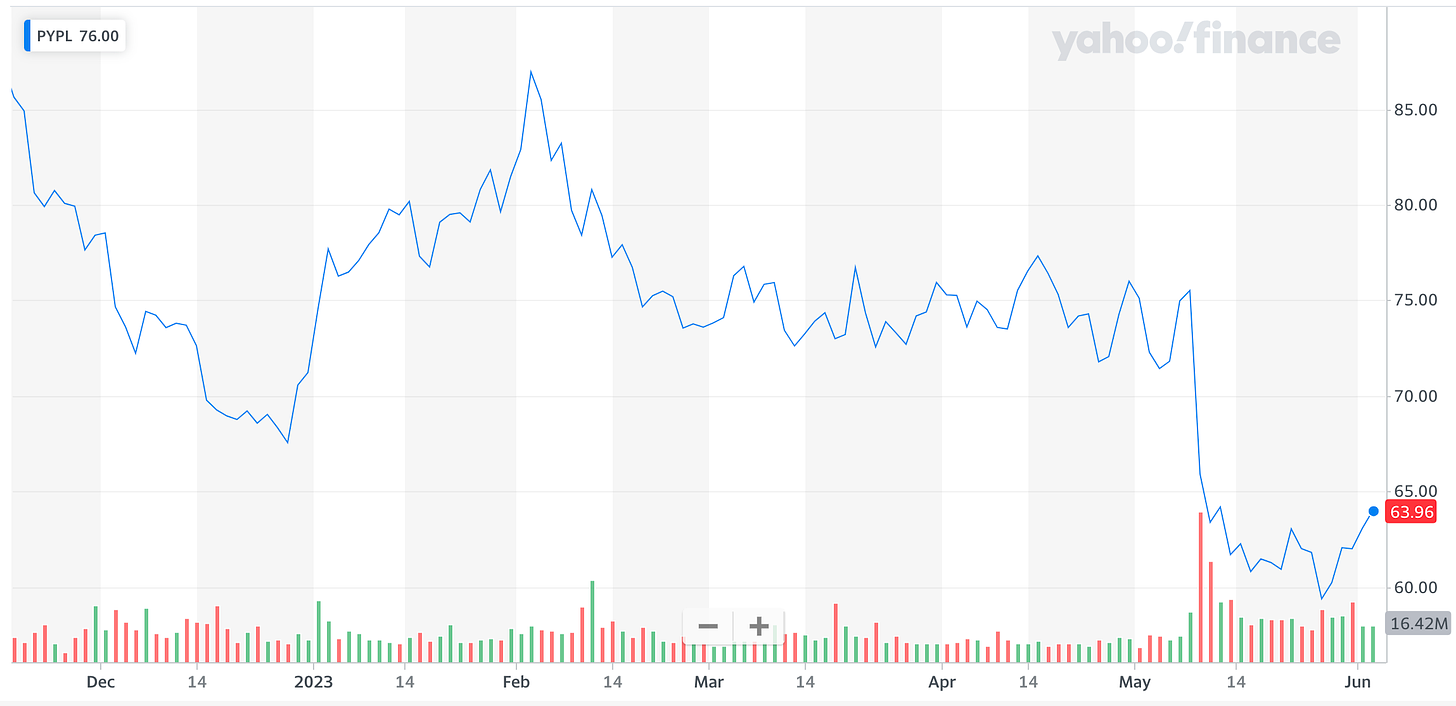

PayPal’s very bad, no good month

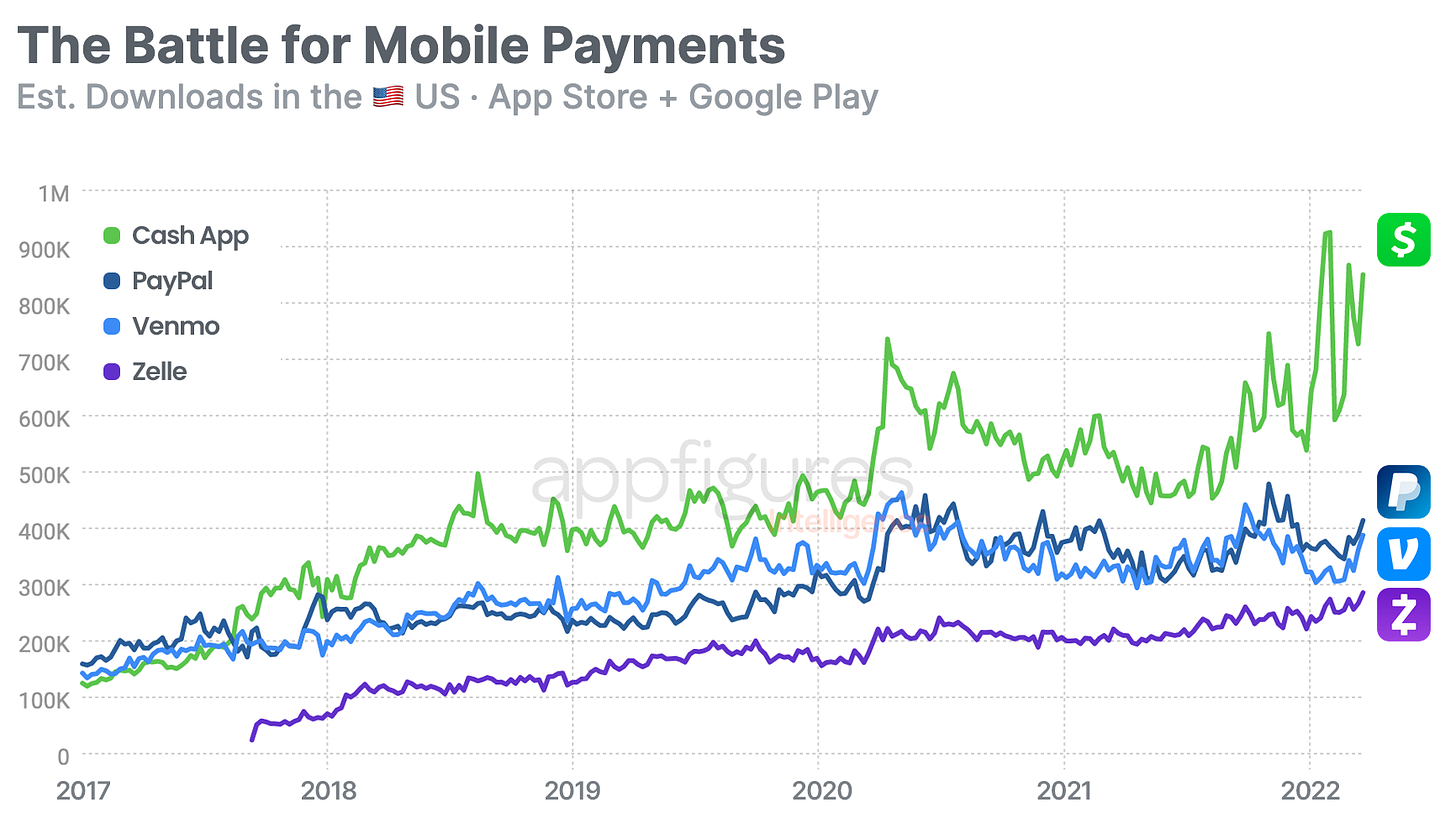

PayPal, the owner of Venmo, had a dismal May. According to S&P Global Market Intelligence, the stock fell 18% for the month. Revenue growth has slowed to single digits (9%), and is expected to further decelerate to 6.5% to 7% in the second quarter. What’s more, Venmo has fallen way behind rival CashApp in the battle for mobile payment app (P2P) downloads.

Further dampening investor sentiment, CEO Dan Shulman is set to leave the company at the end of the year. So, it would seem, now is a good time to shake things up a little and breathe some new life into this brand, especially if they can capture new GenZ users (that historically have been quite sticky, though I’d argue will be less so today), and increase both near term and future revenues.

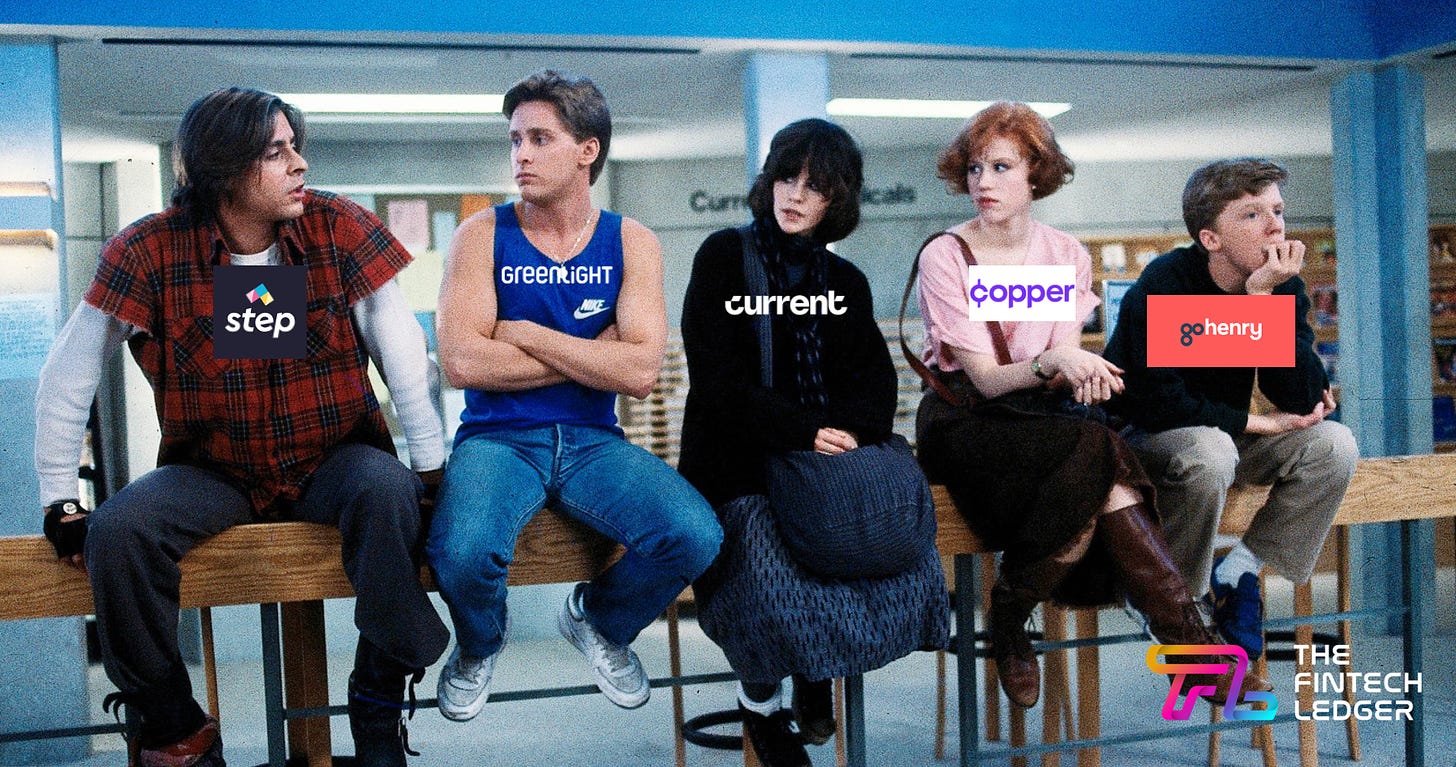

So who are they up against?

Meet the Digital Incumbents

Greenlight

Greenlight was founded in 2014 by veteran entrepreneurs Tim Sheehan and Johnson Cook. Sheehan previously founded Reachable (a social media marketing platform) and Cook founded Atlanta Tech Village (a tech startup hub). Sheehan felt there was a need for financial education for kids, a need that wasn’t being met by high school classes, where almost no financial education exists. Sadly, large banks also offer little by way of products and/ or education geared toward helping the next generation learn financial skills. The co-founders felt that encouraging savings over spending from a weekly allowance was only table stakes and just scratched the surface of what is possible.

Greenlight, the most expensive of the teen digital players, has three different monthly subscription plans with differing features to choose from, including:

Debit card (standard)

Investing (Fractional shares, ETFs)

LevelUp (Financial literacy game for kids and teens)

Chores & Allowance (Turn allowance on autopilot, like a Direct Deposit from mom & dad)

Security & Control (Turn cards on/off, real time spending notifications, parent approved trades, unsafe spending categories blocked).

CashBack (Up to 1% to Savings) & Savings (up to 5% APY, capped at $5,000)

Note: With savings and cashback rates like the above (which vary by tier), most of the revenue would come from subscription fees.

Source

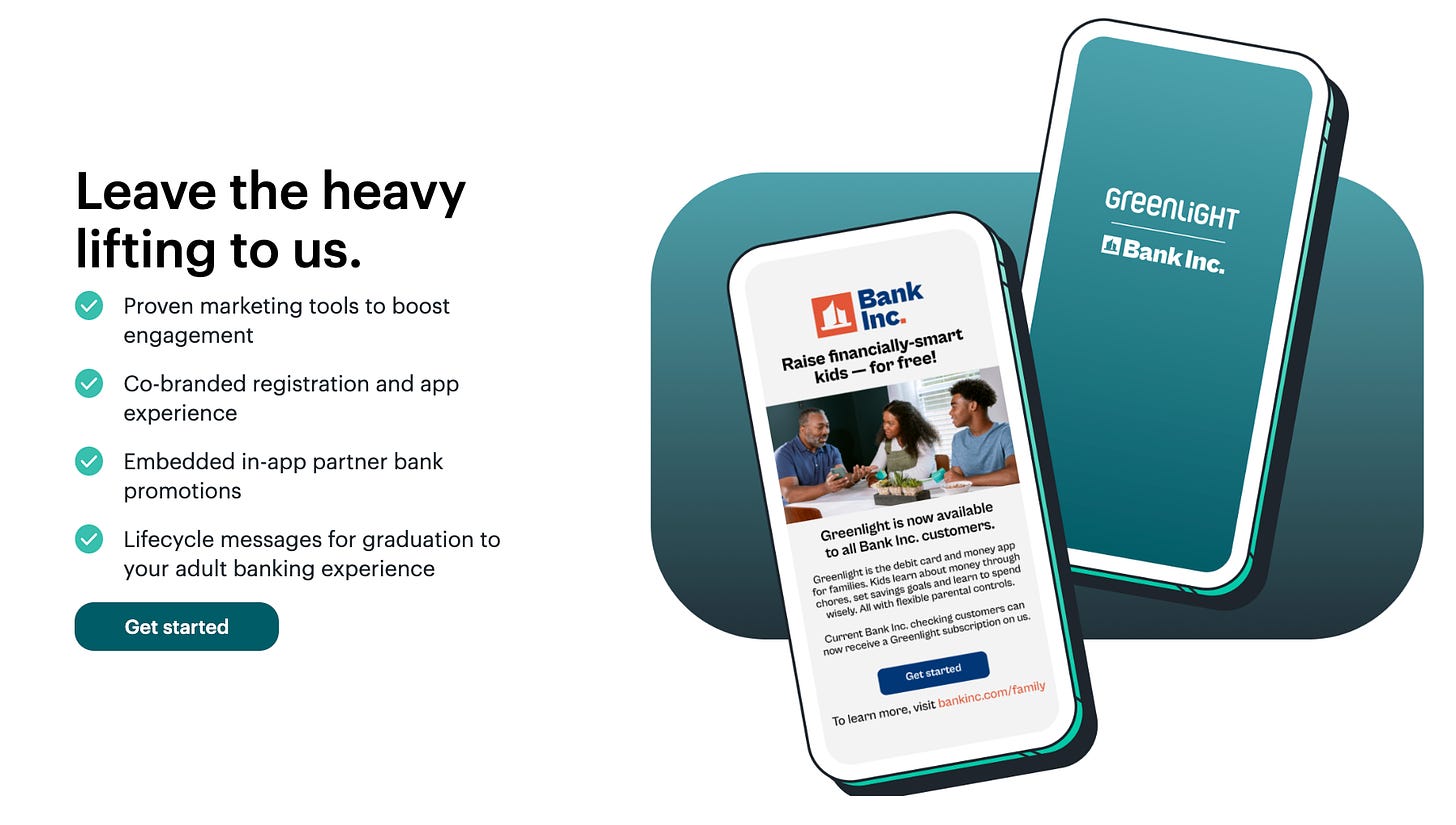

Greenlight really highlights financial literacy - and it appears to be pretty robust. Interestingly, they position their financial literacy tools towards schools and offer a web-based library built for teachers by financial education experts, aligning to K-12 standards. Moreover, they also offer a BaaS type solution for banks, with the promise of a co-branded banking experience for “the next generation” and zero technical lift.

Greenlight has raised a total of $556M to date, with their last round (Series D of $260M in April of 2021), led by Andreessen Horowitz (a16z), and including participation from returning backers TTV Capital, Canapi Ventures, Wells Fargo Strategic Capital, BOND, Fin VC and Goodwater Capital, as well as new investors Wellington Management, Owl Ventures and LionTree Partners.

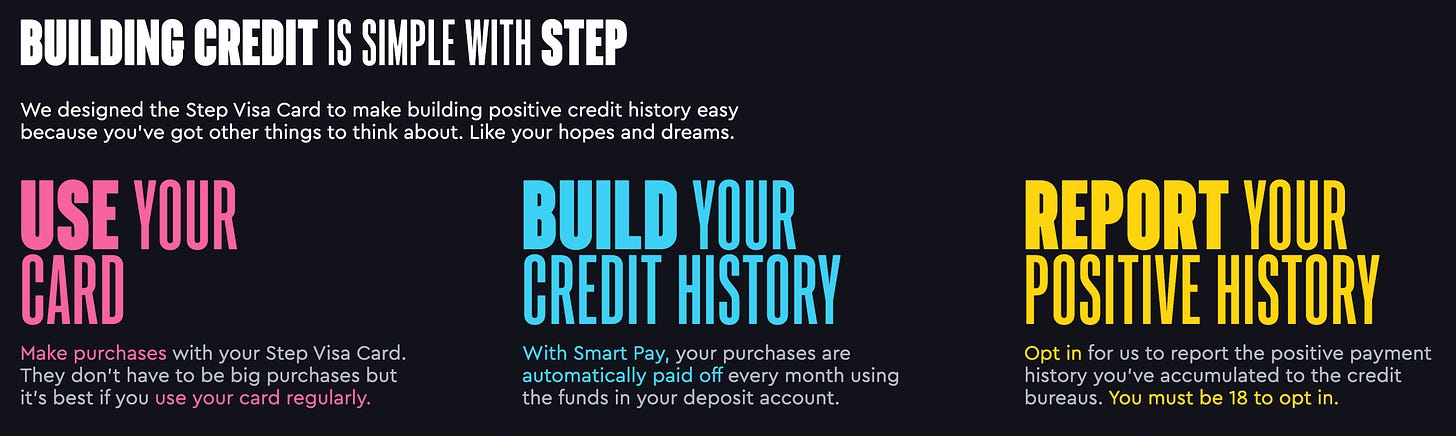

Step

Step is one of the newer entrants into this space, having launched in 2018 by Fintech veterans CJ MacDonald and Alexey Kalinichenko to provide kids with financial tools they need to make smart money decisions earlier, and boasts employees from well known technology companies like Affirm, Google, Gyft, Cash App, Square, and Stripe. Along with Greenlight, Step is a market leader in this quickly evolving space and kinda like the QB dating the head cheerleader/ prom queen. They’re cool.

Like the others on this list, the core spending mechanism is a debit card, via a partnership with Evolve Bank and Trust. From their website:

We (Step) believe everyone deserves access to banking that helps them become financially independent. That’s why we’ve built a financial platform that empowers people under 18 and adults to build credit history¹, invest², save, and spend.

The credit history part is interesting, and Step reports that “the average Step user has an initial credit score of 723 when they turn 18,” putting them in the “good” range - ostensibly setting them up for a strong credit history start.

Steps savings account also boasts 5.00% APY for those who set up a $500 direct deposit or more a month. There are some interesting details on this that are worth calling out. From the Savings disclosure, they go to extreme lengths to make sure the APY is NOT interest nor an APY, stating:

“Your Step deposit account is not an interest bearing product. The savings percentage is not interest, but instead earned as cash rewards directly funded and managed by Step. The rewards, if calculated as an APY, would be 5.00%. This percentage is variable and may change over time. See our Step Premium Rewards terms for more detail. To qualify, a minimum direct deposit of $500 or more from a payroll provider or employer within each 30 day period is required. We may offer promotions for new or existing customers from time to time.The savings percentage is not interest, but instead earned as cash rewards directly funded and managed by Step.”

So, the 5% is NOT interest, it’s a “Reward”, but if it was calculated “as an APY” it would amount to 5.00%.

Got it.

Wait. Huh?

Teens learning early the devil is in the details and lawyers can spin just about anything.

On the investment front, a Step teen can open a stock account (with parental permission of course) to invest in securities (fractional shares) and crypto (bitcoin). Step also offers tools for parents like monitoring, credit history, and fast sending and receipt of money (allowance), and features financial education heavily in the marketing and platform. The cornerstone FinLit program (it’s lit! 🔥 ) features a six lesson Money 101 program available to all users and “currently being taught at Step’s 100+ partner high schools.”

The Step rewards are points based, where teens can earn up to 3x points at new rotating merchants monthly, again if they maintain a monthly qualifying direct deposit.

Step is the only points based rewards program of this group. I’ve always been skeptical of points based rewards, which instantly trigger the below meme in my mind.

Steps meteoric growth can be heavily attributed to their “cool kids” marketing tactics, where TikTok star Charli D’Amelio, one of Step’s investors, has been promoting the fintech service to her 100-million-strong fanbase - and also boasts a number of celebrity investors including Will Smith, Justin Timberlake, Alex Rodriguez, Jared Leto, Stephen Curry, The Chainsmokers (yep, The Chainsmokers) - among others.

To date, they have raised over $500M in debit and equity financing, and have taken a “no fees” approach to the account, in contrast to Greenlight’s subscription plans.

Source:

Current

Current was founded in 2015 to be the “future of banking,” originally started out exclusively in the teen banking space, but has since expanded to adults. This fact for me is a natural progression; how stable is acquiring a fickle audience with a low LTV and natural proclivity to churn in a few years? That said, compared to the others on this list, expanding to adult populations appears to have limited the teen feature set for Current, which includes:

Instant transfers - from parents and other family members to teen accounts (not clear if this is from an external or needs to be a parent owned Current account)

Teen budgeting

Notifications/ control - on teen spending, with the ability to block merchants from the app, and the ability to set spending limits.

Chores and Allowance - automate allowance payments and assign chore lists

Savings - with a rate up to 4%, plus spending roundups and “Pods” (separate savings goals), Current is not unique (and pays less)

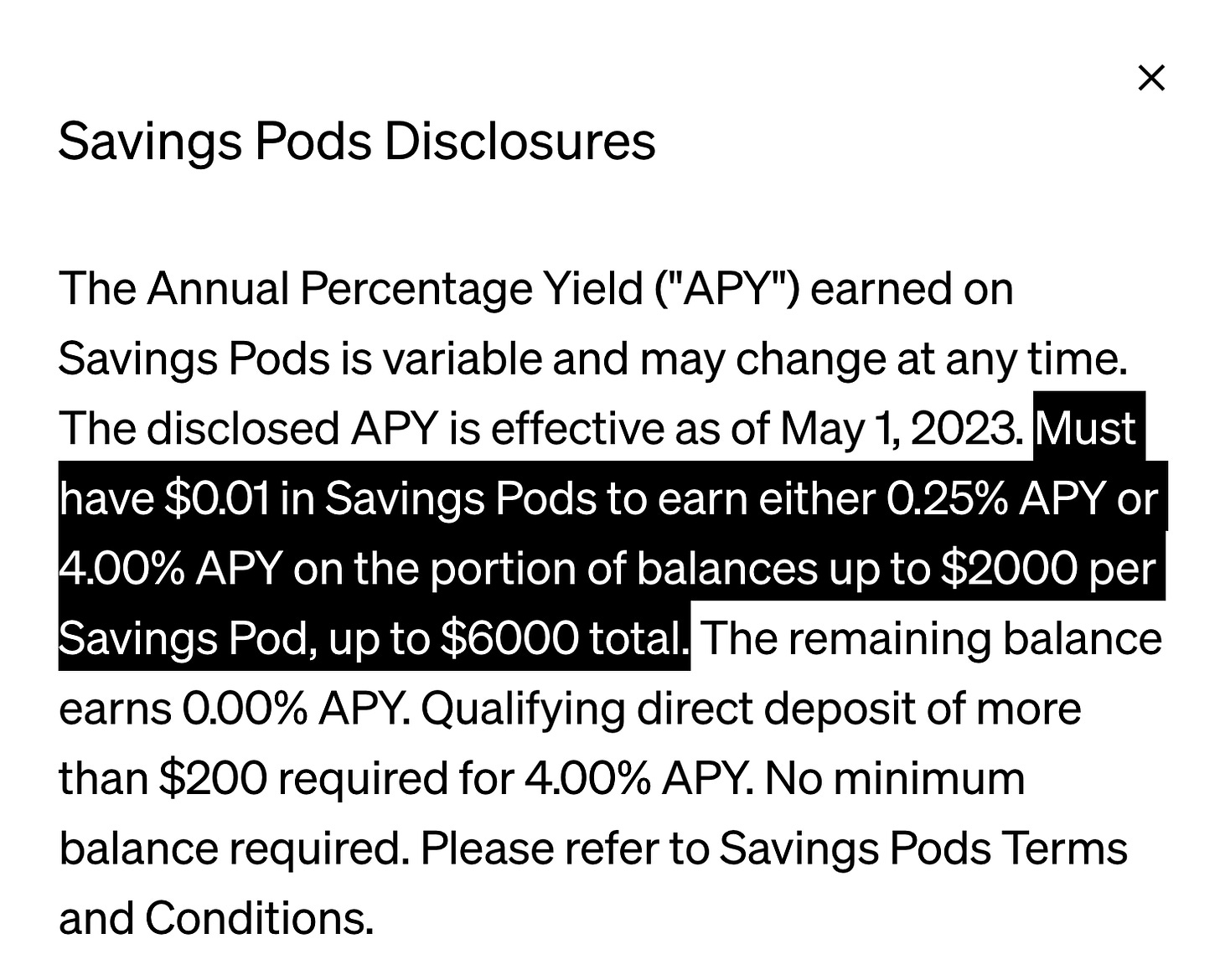

The 4% is also a little disingenuous. While the 4% is pretty prominently displayed, there are some pretty weird hoops to get through. To start, it is capped at $6k - and you can only get the full 4% if you split the $6k into three separate savings Pods of $2k each.

Current has raised over $400 M (Series D) from Andreessen Horowitz, Tiger Global Management, TQ Ventures, Avenir, Sapphire Ventures, Foundation Capital, Wellington Management, QED Investors and EXPA.

Source

GoHenry (Acquired by Acorns April ‘23)

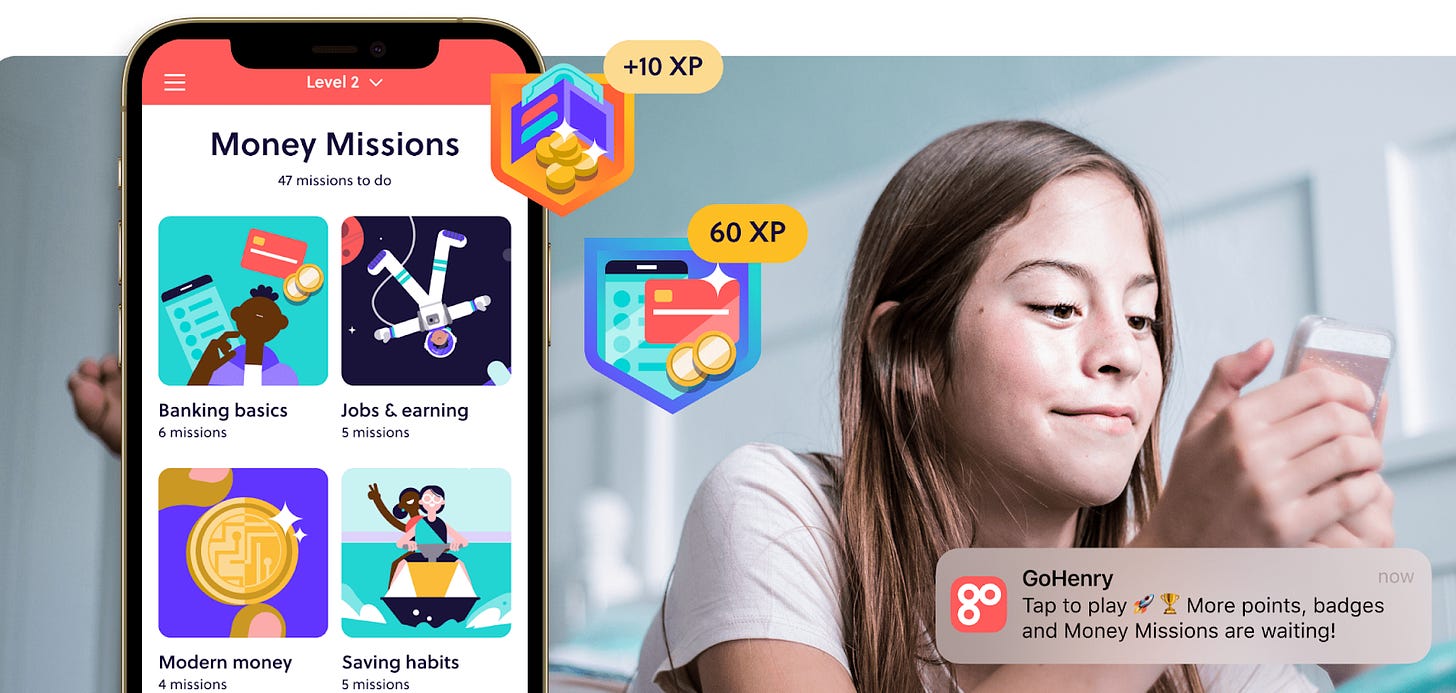

GoHenry started in 2012, operates in the UK and the US (and more recently France, Spain and Italy via its acquisition of French FinTech Pixpay). A pioneer in financial literacy for 6-18-year olds, GoHenry is a financial education app and prepaid debit card with in-app, gamified money lessons designed to teach kids and teens how to be smart with money from a young age.

Launched in 2012, GoHenry helps young people learn about money by empowering them with essential money management skills tailored to their age - with parental oversight. The parents use an online account to link to an account for each of their children. With a mission to “make every kid smart with money,” in a practical, fun way. Like the others on this list, GoHenry enables parents to:

Pay Allowance - Pay allowance by setting up weekly allowance amounts

Add money - from their bank by transfer, standing order or by a debit card.

Create chores - from a pre-set menu or create their own from a list of suggestions.

Educate - GoHenry has a good amount of info here, in the form of blogs as well as in app, interactive teaching content (called Money Missions), where you can walk your child through where money comes from, how to earn it, how taxes work, and more. On the blog content, they separate it into allowance tips, chore tips, money safety, money management tips and financial education. There’s plenty here to help, and it can give parents really practical ideas to make learning more fun.

Savings - The savings feature at GoHenry is pretty similar to the others on this list. Kids can use the app to set savings goals with target dates, with an optional autosave feature. Parents can choose to lock in the child’s savings goals, or unlock them once they reach their milestone.

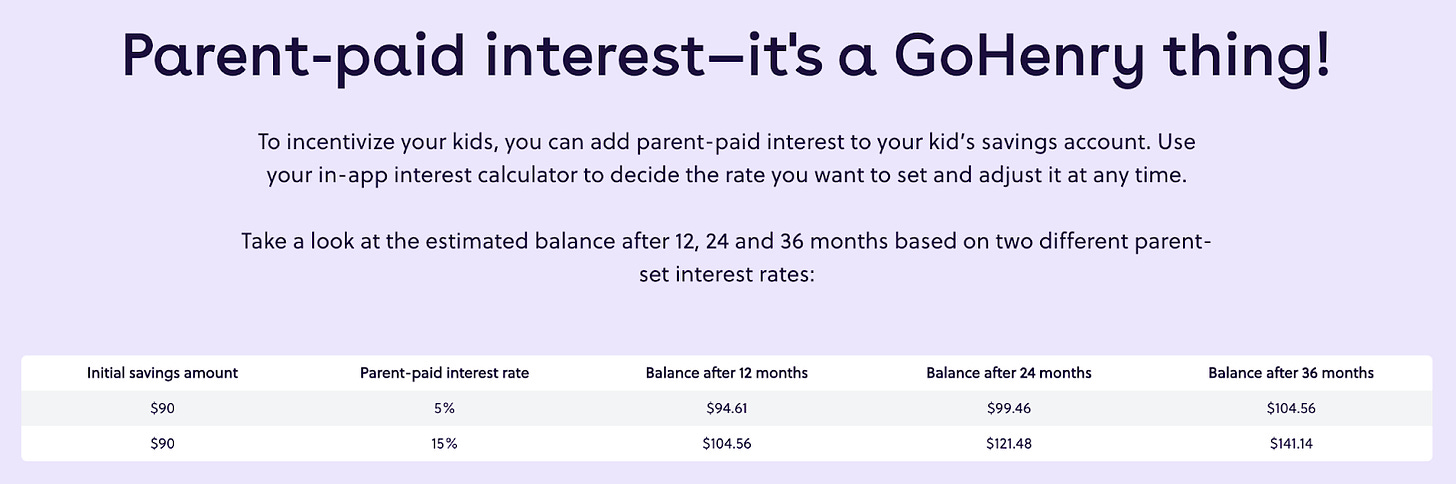

The big difference here is GoHenry offers ….wait for it…parent paid interest.

That’s right. It’s a benefit for the parents to pay the APY!?!?

Don’t get me wrong, this would be cool as an augment but passing this on as a benefit and paying 0%...when rates are this high?

Maybe it’s the parents who need a little more financial education.

Parental controls - Like the others, parents get real-time notifications and in-app parental controls so they can set spending limits by date range or by merchant, and choose where a card is used (or not used).

Customization - This is a pretty cool feature, and differentiates GoHenry a little bit by offering up to 45 different customizable debit card designs.

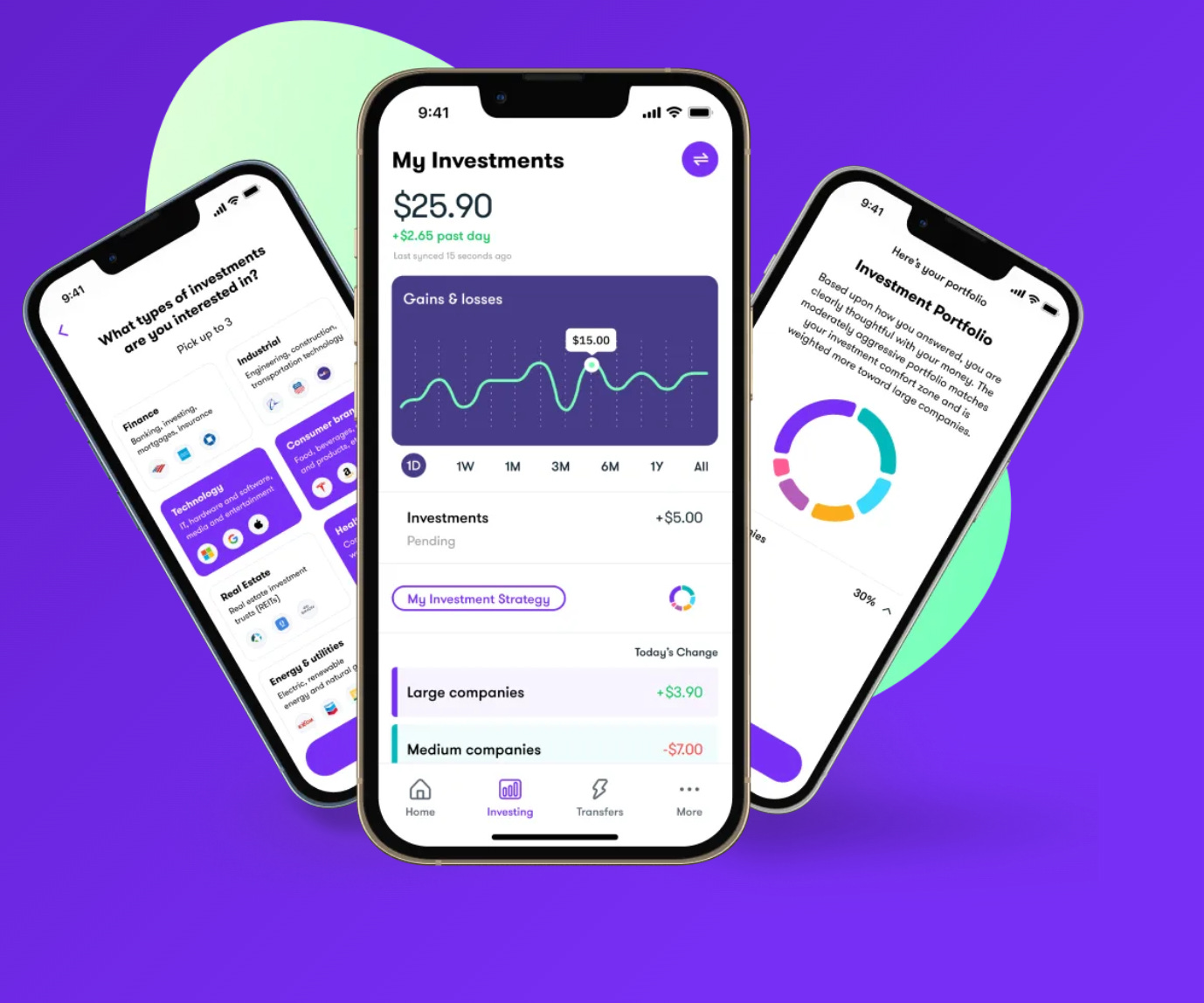

GoHenry had raised about $121M (Series B 2022) prior to the acquisition by Acorns. It will be interesting to see how or if Acorns adds the investing features it is more known for.

Copper

Copper, which started in 2019 in Seattle and styles itself as a “Knowledge Bank” (see what they did there), teaching kids and teens smart money habits while they bank. Their mission is to “create the first financially successful generation, together.”

In a similar vein to the other teen focused fintechs above, Copper believes today’s kids are not being taught enough about money, and offers kids “everything they need to develop smart money habits while they bank–all in a parent-supervised, safe space.”

Similar to the others on this list, they offer:

Debit card

Savings - with a 5% APY, plus the ability to divvy a % of deposits toward savings

P2P/ Allowances - easy payment from within a closed loop network

Auto-reload - from the parents account when the balance dips

Investing: contrary to the others on this list, Copper offers a ETF/ robo-advisor type offering, arguably a smarter move vs. some of the other investing options (have you seen the investing nonsense on TikTok?), and allows the teens to get started for just $1.

Source

Financial literacy- if it is not clear by now, this is the cornerstone of all of the companies on this list. And Copper seems to deliver here, with impressive learning content like guides (e.g. budgeting, investing, credit) quizzes, a ‘MoneyMoves” blog and more.

Parents have a number of options today to help educate, monitor and teach their teens smart money decisions. I was pleasantly surprised that, for the most part, the companies targeting this segment realized that education, combined with gamification of good money habits and parental controls could be used to provide better financial outcomes.

That said, these companies are just providing tools, and the ultimate responsibility lies with the parents to ensure they are actively participating in their children’s financial education. With more options, control and educational opportunities than previous generations, GenZ should be better prepared for financial success.

I am hopeful they and their parents will take advantage.

Bill Ackman, investor, hedge fund manager and the founder and CEO of Pershing Square Capital Management, makes the case on Twitter for JP Morgan CEO Jamie Dimon, who has hinted that he’s thought about politics before, to run for US President.

Original tweet.

A well-curated timeline can provide a straight-to-the-source education. Check out my FintechTweeps list for a curation of the best of Fintwit’s best & follow me @fintech_ryan for more on Twitter.

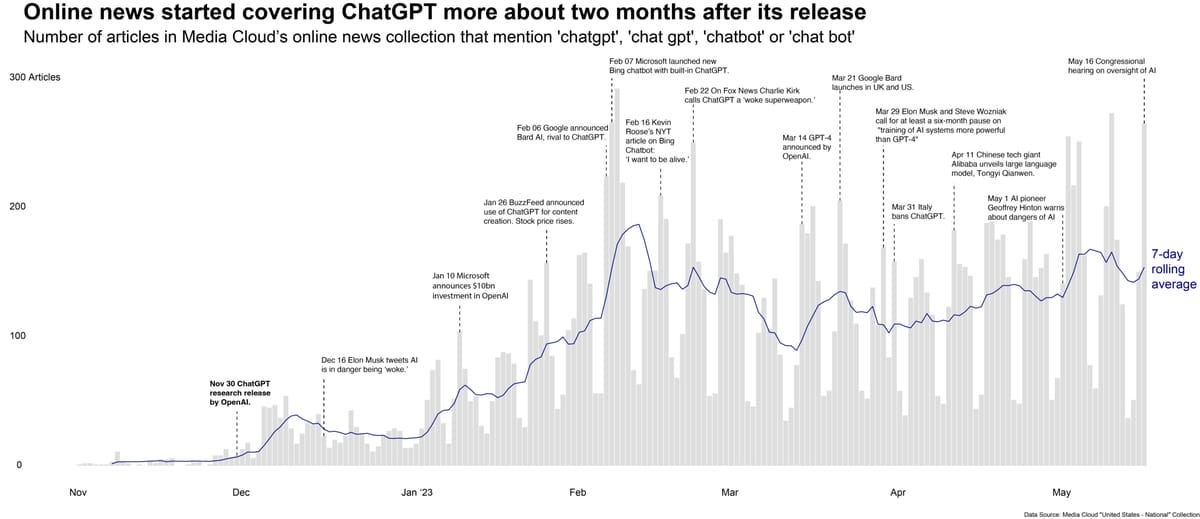

Hype-cycles around new technologies tend to get a bad wrap but are critical to ensuring the new technologies develop. People don’t tend to buy, let alone leave their current jobs to go build the next new thing unless there is interest. It is also critical to ensure the investment dollars flow (insert web3 to Gen AI VC joke). The chart below shows how the coverage of ChatGPT and related technologies or products has taken off since December.

Nicole Casperson writes Fintech is Femme, a fintech newsletter seeking insight from diverse voices and hosts the podcast Humans of Fintech. In this episode, she interviews New York Times bestselling author and Chief Behavioral Officer to Orion, Daniel Crosby. I am fascinated by behavioral finance, as no matter how “rational” we think we are, when it comes to money, we tend to make poor decisions based on emotion. Nicole and Daniel discuss how we can use behavioral decisions to spend money in ways that will incite joy instead of judgment and to destigmatize the financial struggles around money. If you are interested in the intersection of psychology and money, this is a good one.

Stripe Issues Charge Cards to Help Small Business Cash Flow.

Venmo targets teens and parents with new teen accounts and debit card.

Monzo, a British digital bank, hit monthly profitability for the first time after spike in lending.

Zoe Financial Selects BridgeFT’s WealthTech API to Power Its Data Connectivity and Infrastructure.

FIS Is Buying BaaS Platform Bond, As Fintech Consolidation Accelerates.

DLocal Faces Alleged Investigation for Illegal FX Movements in Argentina.

JPMorgan is developing a ChatGPT-like A.I. service for investment advice.

Argentine fintech Ualá Scores Mexico Bank License With Deal Approval.

Okay, which analyzes engineers’ productivity, sells to Stripe.

Franklin Templeton to buy Putnam Investments for $925 million.

Delays with cash withdrawals causing some Apple savings account users to flee.

SEC sues Binance and CEO Changpeng Zhao for U.S. securities violations.

Worldcoin, a Sam Altman backed crypto project, raises $115 million.

PayPal Ventures leads $52M funding round in web3 onboarding startup Magic.

Crypto Lender Celsius’ $800M Ether Staking Shake-Up Stretches Ethereum Validator Queue to 44 Days.

Chainalysis acquired Transpose, a blockchain data and infrastructure company that enables applications using web3 data.

Ripple acquires crypto custody startup Metaco for $250 million.

‘Confident’ Ripple CEO Helps The XRP Price Suddenly Outperform Bitcoin.

USDC Issuer Circle Has Ditched All U.S. Treasuries From $24B Reserve Fund Amid Debt Ceiling Showdown.

‘A New Tarantino or Kubrick’ Could Come From Web3 Film World.

BitFlyer adopts crypto deposit limits to comply with Travel Rule.

This week’s long read comes from Andreessen Horowitz’s Fintech Newsletter (Joe Schmidt, Sumeet Singh, and Seema Amble), and looks at how Generative AI is being used to automate the processes of underwriting, selling, and servicing insurance - promising the potential to reduce underwriting time and cost, help consumers answer questions about what policies to buy, and manage conversations in customer support and claims.

Alas all good things must come to an end. If you enjoyed this content, please hit “like” button. Ideas for an area you’d like to learn more on, leave a comment!

Psst: I’d love to hear from you. The best place to find me is on Twitter or LinkedIn!

Until next week, fare thee well friends.

If you enjoyed this newsletter please share it with a friend (or two!)- remember, sharing is caring!

Disclaimers: All content and views expressed here are the authors’ personal opinions and do not reflect the views of any of their employers or employees. The author does not guarantee the accuracy or completeness of the information provided on this page. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this Site constitutes a solicitation, recommendation, endorsement, or offer by TFL or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.