🌊 Ripple Effect: XRP notches a "W" for itself, & Crypto

TFL # 25: Celsius' former CEO Arrested; Blackrock's CEO on PR Circuit for Bitcoin

Morning Fintech Illuminati 🧐 and welcome back to The Fintech Ledger! 🔥

This week Ripple won a landmark decision against the SEC, Celsius’s former CEO Alex Mashinsky is arrested on fraud changes (finally!), Blackrock’s CEO goes on the PR circuit for Bitcoin, SVB sues the FDIC and Bank of America entered into two consent orders with the CFPB for opening credit card accounts without their clients consent and “double dipping” on NSF fees.

Yikes!

It was an eventful week.

Let’s jump in.

Psst: Was this newsletter forwarded to you? Sign up today for free to get the latest insight right to your inbox.

My Fintech Ledger motivation this week.

If you can’t read and write, you can’t think. Your thoughts are dispersed if you don’t know how to read and write. You’ve got to be able to look at your thoughts on paper and discover what a fool you were.

~ Ray Bradbury

👩⚖️ Ripple Victorious: Ruling Hampers SEC’s Crypto Regulatory Efforts (Maybe)

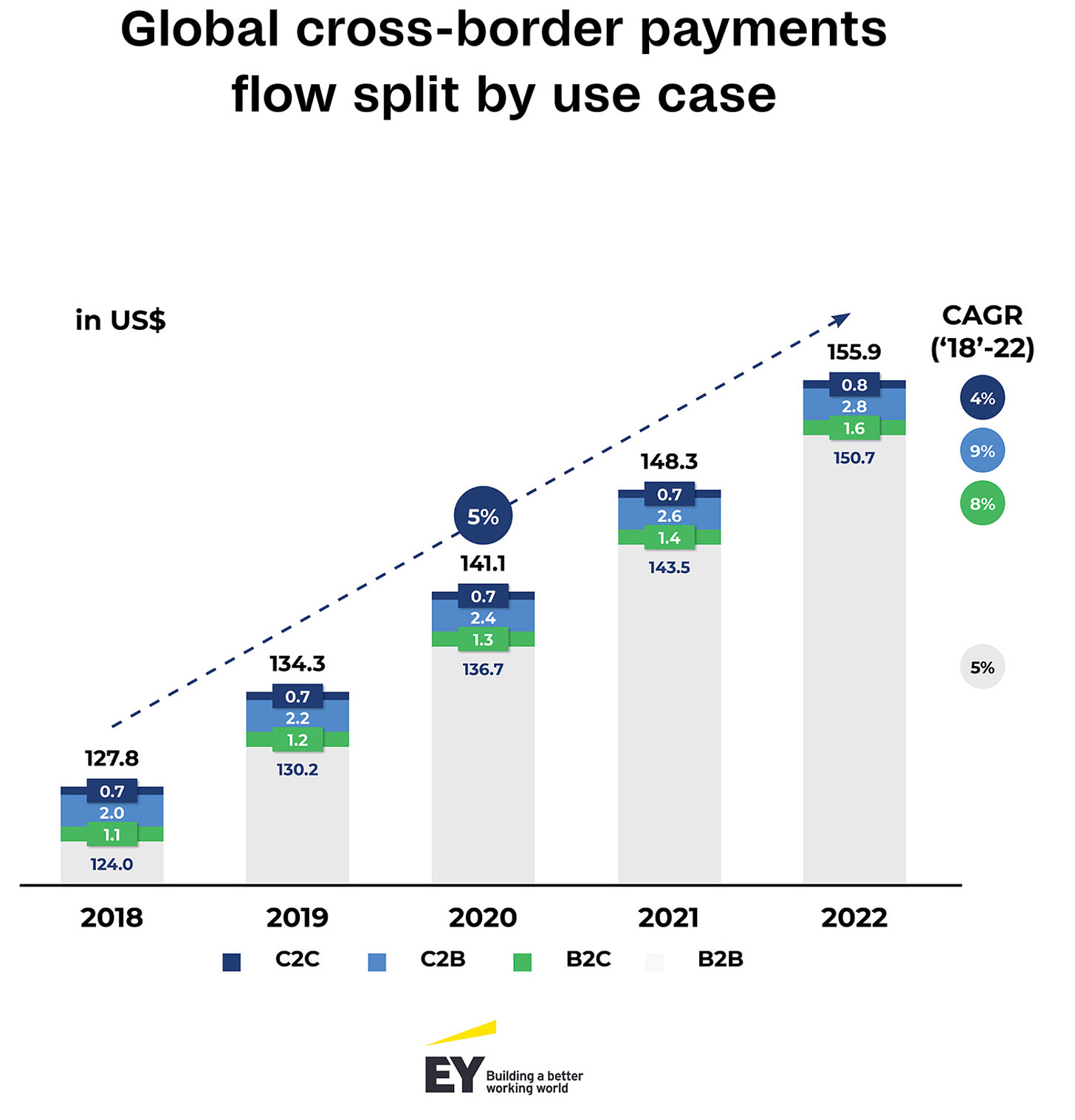

Ripple won a significant victory this week in its enforcement case with the SEC stemming from its sale of more than $1.4 billion XRP tokens. U.S. District Judge Analisa Torres found that Ripple Labs’ didn’t violate investor protection laws and that XRP, a token developed to facilitate cross-border payments, isn’t a security.

Kind of. More on that below.

The broader crypto industry celebrated the victory, seeing it as strengthening the broader industries case vs. the perceived hostile regulator.

If other courts follow this reasoning, that is a major problem for the SEC.

Marc Fagel, a former director of the SEC’s San Francisco office.

It is one of the longest running and most important cases in crypto. In 2020, the SEC sued Ripple and two of its executives, Brad Garlinghouse and Christian Larsen, a move that prompted most leading U.S. crypto exchanges to delist XRP, the native Ripple token. Though this is an early ruling in a larger case, it’s still important.

Judge: XRP isn’t a Security, Unless it Is

The details are actually a little more nuanced than most headlines portrayed. Judge Torres said XRP wasn’t an unregistered security. She also said it was.

Confused?!

Let’s unpack.

Thanks for reading The Fintech Ledger! 📚 Subscribe for free to get weekly insight into what’s going on in fintech, crypto & the economy at large, including:

2 to 3 deep takes on the biggest stories 📝

Fintech & Crypto News: Insight, fundings 🚨

Podcast I’m digging 🎧

Beyond the Ledge: Long Reads & Recs 📚

Tweet of the Week 🐤

Chat of the Week 📈

...and more…free!

Remember, the crux of the SECs argument is that XRP is a security. The basis for determining whether or not an asset is a security is the longstanding Howey Test (which I’ve covered in depth prior).

The SEC frowns on “unregistered securities” and prevents the general public from investing in them, as they are viewed as high risk.

To be deemed a security, an asset must satisfy the 4 stipulations of the Howey Test.

Those are:

Is it an investment of money?

Is it an investment in a common enterprise?

Is there an expectation of profit?

Can the money be used by the enterprise?

The judge was more concerned with how XRP was sold to institutional investors, not to retail investors. To sum it up…

Institutional Sales ❌

Retail Sales ✅

Institutional Sales

The judge ruled that Ripple Labs $728.9 million of institutional sales to sophisticated investors like VCs and hedge funds did in fact constitute “written contracts.” Institutional investors invested in these contracts by purchasing XRP with the expectation of profit through the efforts of Ripple Labs.

Those investors could infer that Ripple would boost the value of XRP and they relied on the company to make their tokens appreciate, Torres wrote, leading her to find Ripple Labs did sell “unregistered securities.”

Clearly, the Institutional Buyers would have understood that Ripple was pitching a speculative value proposition for XRP with potential profits to be derived from Ripple's entrepreneurial and managerial efforts.

Judge Torres

Considering this judgement, it was a little shocking that she saw it a little differently for retail investors. I’ll explain.

Retail Investors

The judge ruled that the sale of XRP to retail investors on cryptocurrency exchanges did not constitute the sale of a security as it did not satisfy the Howey Test. Specifically, the third stipulation of the Howey Test.

The judge said that as people who bought XRP on digital-asset exchanges didn’t know they were buying from Ripple (since the seller isn’t disclosed), those investors didn’t depend on Ripple’s efforts to drive the value of XRP—like the institutional investors, and thus weren’t securities offerings. She also dismissed the SEC’s claims related to $600 million in XRP that Garlinghouse and Larsen sold on exchanges.

Ripple did not make any promises or offers because Ripple did not know who was buying the XRP, and the purchasers did not know who was selling it…In fact, many Programmatic Buyers were entirely unaware of Ripple's existence.

Judge Torres

Ripple & Crypto Win…For Now

The concern for the cryptocurrency industry was never on the institutional side of this case. The retail ruling is more critical and gives them breathing room. For now. More importantly, it creates a legal precedent for future proceedings, where the SEC has at writing labeled 15 other cryptocurrencies as “unregistered securities.”

A number of cryptocurrency exchanges in the US have already re-listed XRP for trading since the announcement, including Coinbase, Gemini, and Kraken. It has also given other high profile companies in similar crosshairs with the SEC a little swagger.

For exchanges, for tokens that are listed on exchanges, for regular investors, there’s no question that this ruling strikes a blow to the idea that somehow securities are being traded when people go onto exchanges and trade the assets. I think we will win. Now, I thought we would win before this decision. We think this decision has only further strengthened the case.

Paul Grewal, chief legal officer at Coinbase

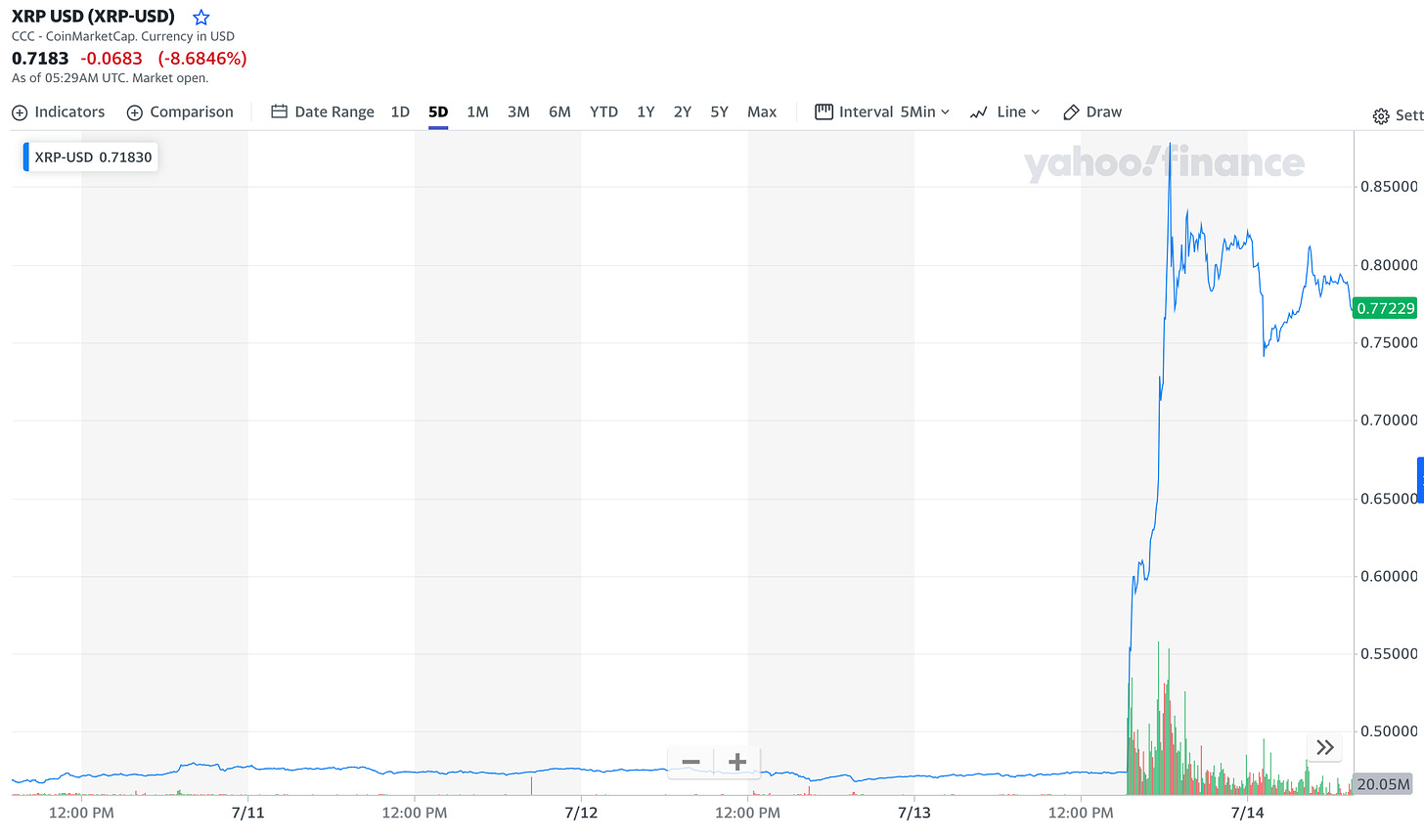

It is probable Ripple will face some financial penalties over those institutional sales, but the mood is undeniably up at the company. By Friday, XRP had jumped 60% in 24 hours, making it the fourth largest cryptocurrency in the world by market cap, worth $40 billion.

Source

Celsius CEO & Key Deputy Arrested 🚔

Bankrupt crypto exchange Celsius' former CEO and a key deputy were arrested on fraud charges (finally!) this past week. The SEC, CFTC and the FTC - a veritable alphabet soup of regulators - all filed lawsuits against the company this past Thursday. Alex Mashinsky, 57, was also charged with attempting to manipulate crypto currencies (more on that below). Celsius also agreed to pay a $4.7 billion settlement to the regulators, who as the last in line after bankruptcy creditors and investors are made whole (unlikely) make the agreement largely symbolic.

Mashinsky was famous for throwing the traditional financial industry and specifically banks under the bus, claiming they were “not your friends.” He did this while purporting to offer users high-yields on crypto assets that he claimed were more safe and equitable than traditional banks. That turned out not to be true.

Either the bank is lying or Celsius is lying.

~ Alex Mashinsky

It appears Celsius was lying, and were heavily engaged in two separate but related investment scams. The first was to get customers to deposit cryptocurrencies with Celsius by promising them 'safe’ yields as high as 17%, which they would then turn around and lend to crypto hedge funds. The second was its token CEL, a way for investors to ‘bet’ on the company.

TL;DR: Celsius couldn’t generate the 17% yields (shocker!), and the token appears to be a classic pump and dump scheme where false narratives about the company were consistently used to inflate the price.

All was good during the crypto rally of 2021, but when the market began to sour in mid 2022, customers began withdrawing funds. From there, in just a matter of weeks Celsius would halt withdrawals and shortly thereafter file for bankruptcy.

I’ll Take ‘Ponzi Scheme’ for $1k Alex…

Mashinsky and others at the company feared losing customers if they lowered interest rates they paid to participants in the Earn Interest Program. Thus rates were set to attract and retain investors rather than on business returns. On several occasions, Mashinsky and others at the company stated that 80% of revenue was paid to investors, and that Celsius consistently paid out more in interest than the company generated in revenue.

They in fact knew this to not be true. In 2021, Celsius paid 23% more in interest to investors in the Earn Interest Program than it generated in revenue. There’s a word for that: Ponzi.

It gets worse. Mashinsky was quoted in an April 2022 CNBC interview that Celsius had 1.7 million users, when in fact it had fewer than 500,000, according to the SEC. Or the famous May 11, 2022 Mashinsky tweet.

Celsius halted withdrawals on June 12. According to the SEC, there were some pretty damaging internal communications during the May preceding that refuted that rosy view.

May 9, 2022: a Celsius executive called the company a “sinking ship.” (Two days before the infamous tweet).

May 12 and 25, 2022: the same executive wrote in Slack exchanges that “there is no hope … there is no plan.”

May 21, 2022: An unnamed employee stated in an internal message “We don’t have any profitable services.”

It is important that we separate the fraudulent behavior of an individual (or more) from an industry. People love to hate on the sector but as I’ve argued prior, this is the result you get from “Regulation by Enforcement.”

It’s like treating a heart attack victim after the attack, rather than with diet and exercise to ward off the malady.

This pretty much sums up the SECs week: Regulation by Enforcement having a tough go.

Check out my FintechTweeps for a curated list of Fintwit’s best & follow me @fintech_ryan for more (Twitter).

The startup funding situation remains pretty bad as interest rates continue to rise, forcing investors to look for profits sooner than many startups can deliver. Which begs the question: How many venture capital funds does the world really need?

Last month FintechNexus announced a new partnership with Fintech Meetup - ceding their events business to focus on their media business. In this episode of Fintech One-on-One by FintechNexus, CEO and Co-Founder Bo Brustkern and Jon Lear, the President and Co-Founder of Fintech Meetup discuss the origins of Fintech Meetup, the partnership in more detail, Fintech Nexus’ digital media plans and more.

Every week I come across a few articles that are worth going down the rabbit hole. I really enjoyed this research article from QED Investors (Camila Key Saruhashi): Emerging opportunities in global trade: goods, money and data.

Global trade is experiencing significant growth, reaching a record level of $32 trillion in 2022. Small and medium-sized enterprises (SMEs) are seizing opportunities in global manufacturing and sales, looking to disrupt the traditionally fragmented freight forwarding industry.

U.S. broker Public launches in the UK in its first foray overseas. (BONUS: Fintech Ledger’s recent interview with Public co-CEO Jannick Malling.

Bank of America to pay $250 million for illegal fees, fake accounts.

Prehired, a student loan fintech, sued by State Partners U CFPB Sue for Illegal Student Lending Practices.

Monzo is reportedly eyeing merger with Nordic neobank Lunar.

Mastercard’s New AI Tool Helps Nine British Banks Tackle Scams

Google's Gradient Ventures invests in fintech Collective's $50M round.

Workforce Management Platform When I Work Acquires Fintech Startup Lean Financial.

EBANX and Nubank team up to leverage NuPay in Latin America’s cross-border digital commerce.

Former Celsius CEO arrested, company agrees to pay $4.7 billion settlement.

Coinbase’s stock flies toward an 11-month high, and has soared more than 25% this month.

XRP surges after judge delivers a huge win to Ripple in SEC case.

US Dollar Is Under Threat, Says Circle CEO in Warning to Congress.

Gemini Sues Digital Currency Group and Founder Barry Silbert Alleging 'Fraud'.

IMF repeats warning on Marshall Islands’ digital asset ecosystem plans.

Traditional asset managers’ plans are “moment of validation,” says Grayscale boss.

Stables launches APACs first stablecoin virtual card powered by Mastercard.

Sound.xyz, Raises $20m from Snoop Dog and a16z to Help Artists Make a Living from Their Music.

Updated Lummis-Gillibrand bill adds momentum for new crypto legislation.

Alas all good things must come to an end. If you enjoyed this content, please hit “like” button. Ideas for an area you’d like to learn more on, leave a comment!

Psst: I’d love to hear from you. The best place to find me is on Twitter or LinkedIn!

Until next week, fare thee well friends.

If you enjoyed this newsletter please share it with a friend (or two!)- remember, sharing is caring!

Disclaimers: All content and views expressed here are the authors’ personal opinions and do not reflect the views of any of their employers or employees. The author does not guarantee the accuracy or completeness of the information provided on this page. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this Site constitutes a solicitation, recommendation, endorsement, or offer by TFL or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.