👮🏼♀️ SEC Sues Binance & Coinbase, kicking off the "Crypto Wars"

TFL #21: Plaid enables IDV with it's network of 100M + connected accounts

Good morning fintech Illuminati 🧐 and welcome back to The Fintech Ledger #21!

Last week the SEC brought charges against both Binance and Coinbase. The ensuing legal battle will most likely take years and promises to set the stage for the future of the industry in the U.S.

In Fintech news, Amazon added BNPL platform Affirm to its retail checkout, Stripe added support for CashApp pay, and Plaid announced a powerful addition to their product lineup: an automated IDV (Identify and Verify) solution powered by their existing data aggregation footprint which supportz more than 100 million unique connected accounts.

There is a lot to cover.

Let’s jump in.

Psst: Was this newsletter forwarded to you? Sign up today for free to get the latest insight right to your inbox and join the most intelligent (and fun!) community of fintech and web3 operations and investors around.

SEC Goes After Binance & Coinbase

Well it finally happened.

Last week, the SEC, the biggest financial regulator in the United States, sued both Coinbase and Binance for among other things, operating unlicensed exchanges’ and thus offering “unregistered securities.” This should not come as a surprise. I have been writing extensively about the SECs seemingly insatiable thirst to break the back of the crypto industry in the U.S., an approach many deem as “regulation by enforcement.” (see Crypto Crackdown: Regulators turning up the heat). This roughshod approach has often been dubbed “Chokepoint 2.0,” in reference to the controversial Obama Era program “Operation Chokepoint” - a coordinated effort of the DOJ, the Comptroller of the Currency and the FDIC - which attempted to circumvent Congress and pressure banks to cut ties with otherwise legal businesses.

The program came to an ignominious end in 2017 after a Congressional investigation brought the overreach to light. The parallels are many.

While both company’s are facing serious charges, the allegations against them are not equal.

Let’s unpack.

Thanks for reading The Fintech Ledger! 📚 Subscribe for free to get weekly insight into what’s going on in fintech, crypto & the economy at large, including:

2 to 3 deep takes on the biggest stories 📝

Fintech & Crypto News: Insight, fundings 🚨

Podcast I’m digging 🎧

Beyond the Ledge: Long Reads & Recs 📚

Tweet of the Week 🐤

Chart of the Week 📈

...and more…free!

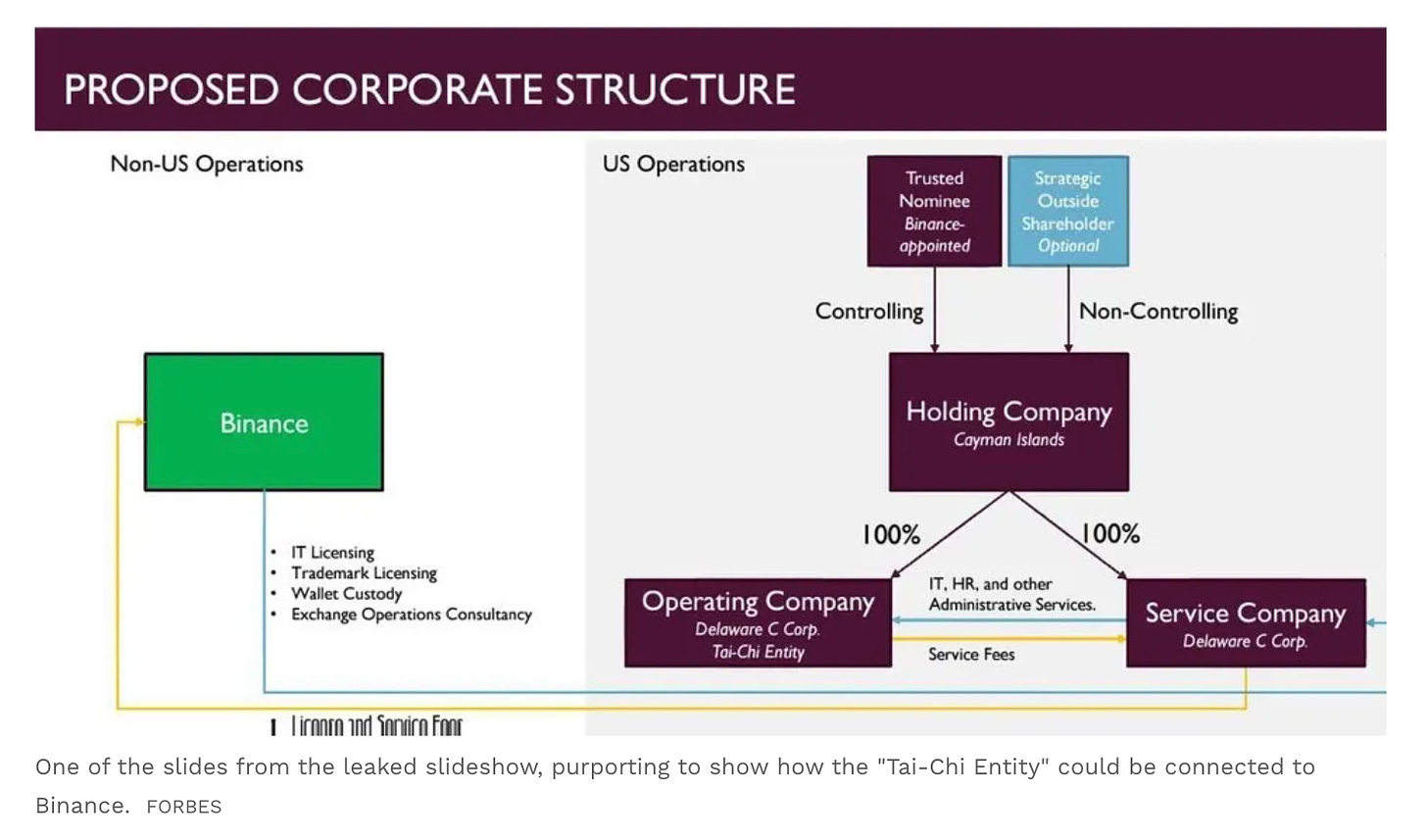

The Binance charges were announced on Monday, laying out thirteen separate allegations against both the company and their founder Changpeng Zhao (aka “CZ”). Among other things, the SEC alleges that while Zhao and Binance claimed publicly that U.S. customers were restricted from transacting on Binance.com, they were not in fact honoring that claim. According to the charges, Binance was secretly allowing U.S. high-value customers to trade on Binance.com. Additionally, the SEC also alleged that Zhao and Binance commingled customer assets or diverted customer assets as they pleased, including to an entity Zhao owned and controlled called Sigma Chain.

Through thirteen charges, we allege that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law.

SEC Chair Gary Gensler.

Source

Back in February, Binance’s Chief Strategy Officer Patrick Hillman finally admitted they had been in touch with the regulator. Up until that date, Binance had refuted reports the SEC was looking into the exchanges operations in the U.S. In an interview with the Wall Street Journal, he said they (Binance) were ‘unfamiliar with laws and rules surrounding bribery, corruption, and money laundering’ - but that they have been working to fill in compliance gaps and expect to be fined by regulators, adding:

The company is “working with regulators to figure out what are the remediations we have to go through now to make amends,” adding, “the outcome will be likely a fine, could be more.…We just don’t know. That is for regulators to decide.

~ Binance Chief Strategy Officer Patrick Hillman to WSJ in February

Well, it looks like they’ve decided.

The above statement is typical of the false bravado and arrogance Binance has exuded. Like an unrepentant teenager who just got caught sneaking out of the house vibes and is showing off for his/ her friends, it seemed this attitude was pretty widespread. In my favorite quote cited in the allegation, Binance’s Chief Compliance Officer had a consistent tone, if not meant for public consumption - while bringing “let’s put the bro back in broker dealer” type of energy.

Coinbase was charged a day later by the SEC, who alleged the largest crypto exchange in the U.S. violated rules that require it to register as an exchange and thus fall under the oversight of the federal agency. Notably, the SEC didn’t name Coinbase Chief Executive Brian Armstrong as a defendant or accuse the company of mishandling customer funds, like they did Binance.

Binance and its U.S. affiliate Binance.US said Monday that they would defend themselves and that all user assets were secure. Coinbase also pushed back, continuing their accusation of an “enforcement-only approach” with the crypto industry in the absence of clear rules. For its part, Coinbase met with SEC officials more than 40 times since January 2018, its last meeting coming in January of this year. At that forum, the agency’s enforcement division notified them it would be suing the firm.

The solution is legislation that allows fair rules for the road to be developed transparently and applied equally, not litigation. In the meantime, we’ll continue to operate our business as usual.

Paul Grewal, chief legal officer of Coinbase

The Charges

- Against Coinbase and Binance

the exchanges operate as an exchange, broker, and clearing agency without registering as such

failing to register its staking platform, and hence offering services for “unregistered securities.”

- Against Binance only

offering unregistered sales of – Binance’s native coin (BNB), Binance’s stablecoin issued with Paxos (BUSD)

operating unregistered crypto lending products

misleading customers on manipulative trading on Binance' US

engaging in – undisclosed market making, and wash trading

willfully evading US federal securities laws by claiming that Binance’s US subsidiary (BAM Trading) operated independently and did not serve US customers ***

*** This charge refers to the "Tai-Chi" document, effectively Binance's plan to serve U.S. customers through an entity called Binance.US. This independent entity would allow them to operate as an unlicensed centralized exchange.

Source

10 Tokens Labeled as “Securities”

As part of the allegations, the SEC called out over 10 tokens it labeled as “securities.”

CHZ – native token of Chillz

SOL – native token of Solana

DASH – native token of Dash

NEXO – native token of Nexo

FIL – native token of Filecoin

VGX – native token of Voyager

ADA – native token of Cardano

ATM – native token of Cosmos

ALGO – native token of Algorand

MATIC – native token of Polygon

AXS – native token of Axie Infinity

SAND – native token of The Sandbox

MANA – native token of Decentraland

NEAR – native token of NEAR Protocol

ICP – native token of Internet Computer

FLOW – native token of Flow Blockchain

Repercussions for the Industry

The charges have hit the industry pretty hard. Robinhood Markets (HOOD.O), the popular online brokerage announced on Friday it would remove three of the tokens announced in the allegations - Solana, Cardano or Polygon - effective June 27, with the industry seeing broad declines across the board, with losses up to 25%.

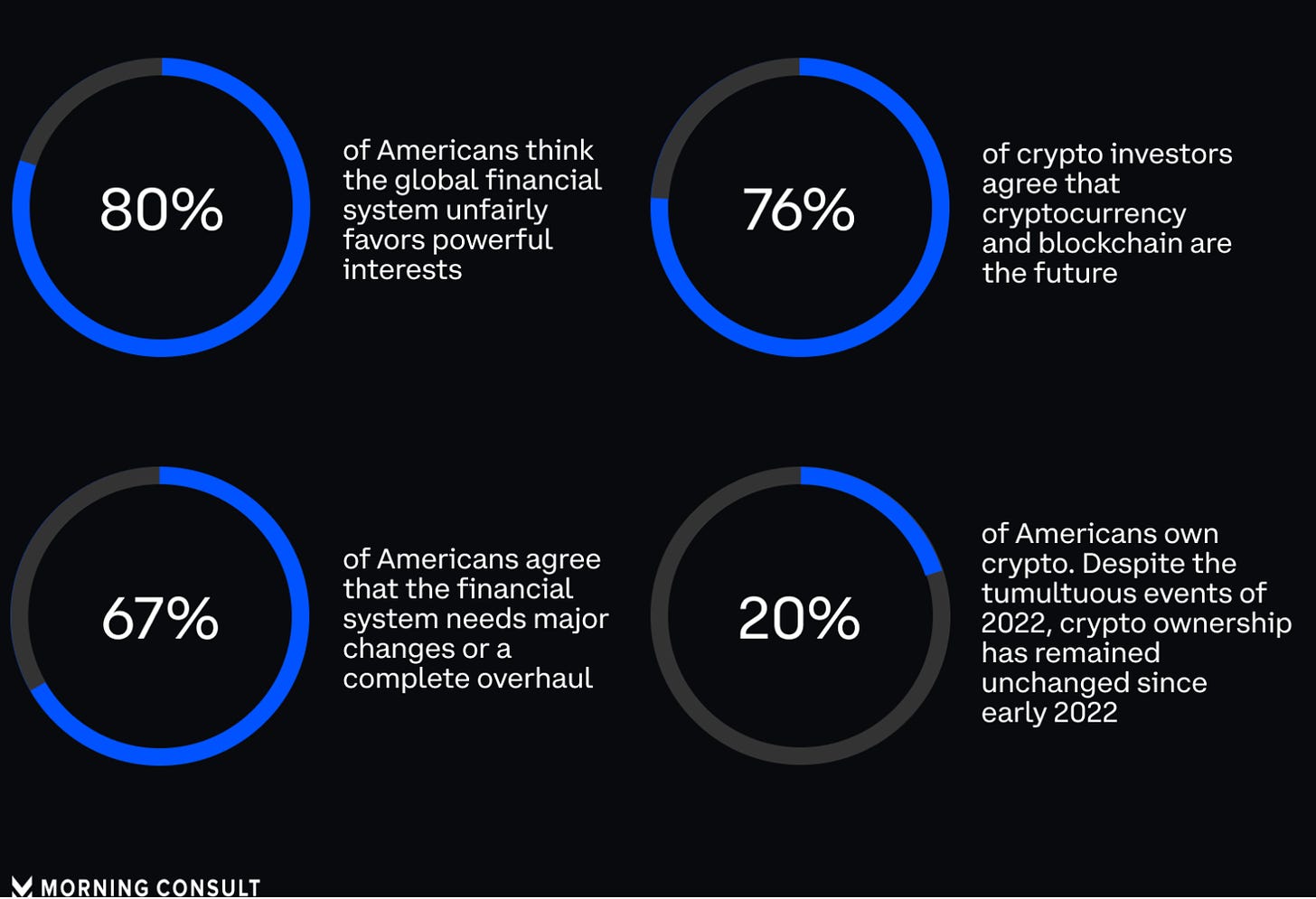

This is the most meaningful salvo in the war against crypto to date. The ensuing battle, which could take years to play out in the courts, will be interesting to watch and will prove critical for the future direction of crypto in the U.S. If Gensler’s all out attack strategy wins, it would most likely be the death knell to the future of digital money in the U.S., consistent with his unveiled comments suggesting he wants to crush the industry. Other branches of the US government, like the House and the executive branch, see potentially different paths, as do international jurisdictions who are moving to pass common sense legislation to both protect consumers and seek to bolster the still nascent technology. Considering over 20% of American’s own crypto, according to a recent study conducted by Coinbase, we should view Gensler’s attack on the industry an affront to personal sovereignty.

Source

I’ve been around finance for four decades. I’ve never seen so much just noncompliance and hype masquerading as reality as I’ve seen in this field.

SEC Head Gary Gensler in an interview last Tuesday

The SEC under Gensler wants the public to lump the FTX and Celsius debacles with their recent allegations against Coinbase and Binance. They are not analogous.

The industry has long been asking, nearly begging regulators to finally bring some clarity to this space, making the point that the existing regulations were not fit for purpose. When the automobile was invented, new speed thresholds needed to be introduced. The SEC is effectively still living in a horse and buggy world.

This weeks actions by the SEC are a reminder to be careful what you wish for. “Regulation” does not necessarily promise the regulation you had hoped for.

Shots fired.

Here we go.

Plaid Announces “Verify Once, Verify Everywhere” ID Verification

This week Plaid announced a new identity verification experience that allows consumers to fast track verifications across Plaid-powered apps and services. In recent years, commerce providers have worked to deliver “one-click” checkout experiences (ApplePay, Amazon). Similarly, Plaid has unveiled a solution that seeks to take the same frictionless experience to KYC verification that is not only a legal prerequisite in financial services but a big part of deterring fraudulent behavior. This builds on the launch of Plaid Identity Verification last year after the acquisition of Cognito.

Source

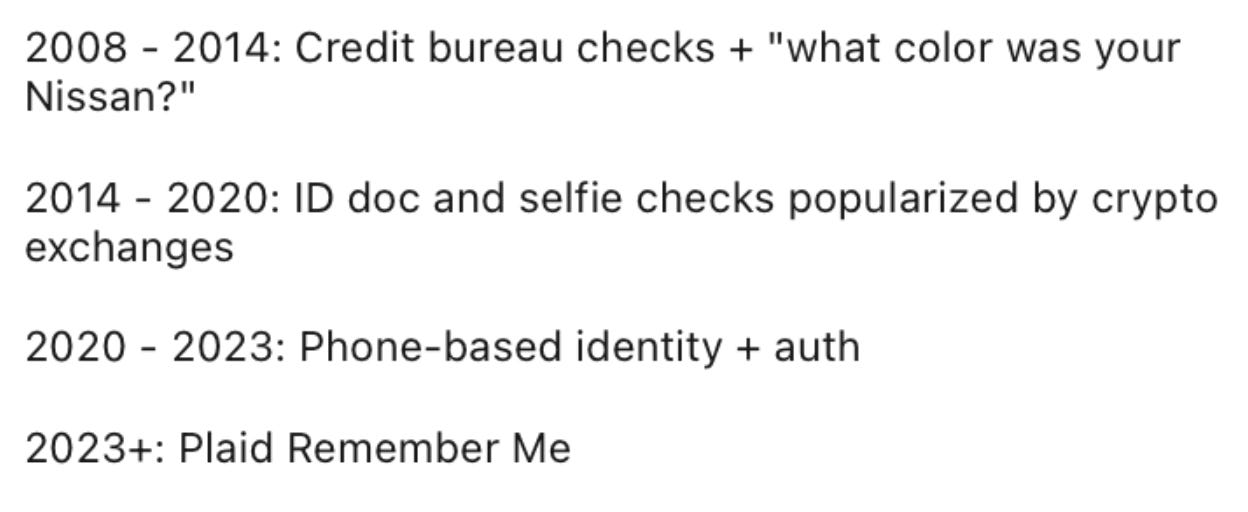

Previously, signing up for digital finance apps required repeating the entire identity verification experience every time. This is both time consuming and leads to friction, which in turn leads to abandoned onboarding sessions. With this new offering, Plaid is attempting to create a new standard for a “verify once, verify everywhere” experience - what I have previously referred to as the “holy grail” of fintech for its powerful network effects. To get a sense of where this this technology has evolved over the last ten to fifteen years, see the recent history of IDV below.

Identity verification is a necessary step for anyone using digital financial apps and services - whether it is opening an account, applying for a loan, buying a car or renting an apartment.

With this new service from Plaid, utilizing the more than 100M connections already linked via Plaid, the industry is moving to a sign up once, good forever type of frictionless experience.

That represents a huge step forward.

Marc Andreessen is a cofounder and general partner at Andreessen Horowitz (a16z). He is an investor and software pioneer (co-creator the highly influential Mosaic internet browser and co-founder of Netscape, which later sold to AOL for $4.2 billion). He is also a noted writer on technology, penning such notable pieces as Why Software Is Eating the World and It’s Time to Build.

This tweet storm and associated full essay Why AI Will Save the World, Marc outlines the potential of Artificial Intelligence (AI) to improve the world, dispelling the myths that AI will lead to the destruction of humanity. He argues AI will augment human intelligence and make life outcomes better, that it is NOT a killer software or robots that will spring to life and decide to murder the human race.

Life the aforementioned works, I believe this will become a seminal essay and is worth reading to understand the technology that promises to change the world. I highly recommend it.

Full tweet.

A well-curated timeline can provide a straight-to-the-source education. Check out my FintechTweeps list for a curation of the best of fintwit’s best & follow me @fintech_ryan for more on Twitter.

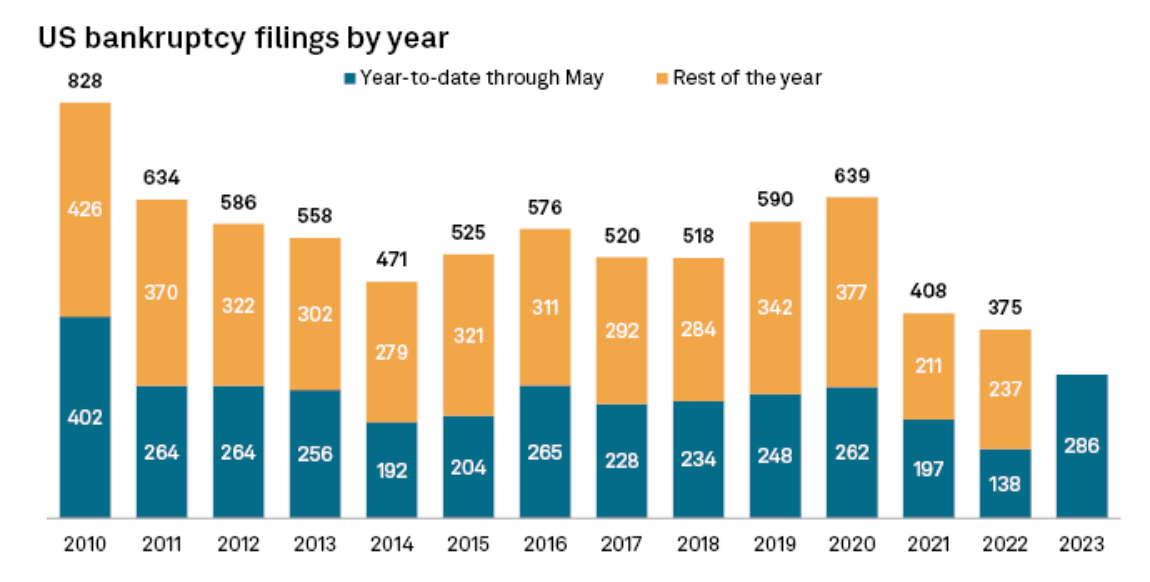

Corporate bankruptcy filings in the US are being made at the fastest pace in over a decade. Over the first 5 months of the year, there have been 286 corporate bankruptcies, the highest total since 2010.

Logan Bartlett is a Software Investor at Redpoint Ventures - a SV based VC with $6B AUM and investments in Snowflake, DraftKings, Twilio, and Netflix. In this episode he interviews Immad Akhund, serial entrepreneur and current CEO of Mercury, a startup focused neobank that was in the headlines recently for taking in over $2B in new deposits from companies leaving SVB. They recently raised their FDIC insurance from $1M to $3M to $5M in a week via a “sweeping” network, which I wrote about previously in “Meet the Aggregators Supercharging FDIC Insurance.”

This new product is what led to the conversation, as Logan recently posted on Twitter (paraphrased) that raising the FDIC insurance seems like a weird marketing tactic and regulatory arbitrage from neobanks that he thinks will get cracked down upon.

Definitely worth the listen.

Landlords face a $1.5 trn bill for commercial mortgages over the next 3 years.

CFPB Finds that Billions of Dollars Stored on Popular Payment Apps May Lack Federal Insurance.

SoFi at Work Launches Student Loan Verification Service To Help Employees Pay Off Student Debt While Also Saving for Retirement.

Finch, a unified API for employment systems, announces new funding.

Andreessen Horowitz Merges Fintech and Consumer Teams After Some Bets Fizzle.

Mexico Fintech Battle Heats Up as Ualá Rolls Out New Account.

SEC sues Coinbase over exchange and staking programs, stock drops 12%.

Gensler accused of being in ‘complete contempt of Congress’ with crackdown on Coinbase.

Binance lawyers allege SEC Chair Gensler offered to serve as advisor to crypto company in 2019.

Three Arrows Capital, a cryptocurrency hedge fund, collapsed, devastating the industry. Its two founders spent the next year surfing, meditating and traveling the world.

Judge rules FTX customer names can remain permanently shielded: AP

Cathie Wood's Ark Invest buys Coinbase shares worth $21 million, despite SEC lawsuit.

Millions in Polygon’s MATIC Tokens Were Sent to Binance and Coinbase Ahead of 30% Slide, Data Shows

On June 6th, 2023 The Board of Governors of the Federal Reserve System (Board), the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC) released a 68 page joint “guidance” report designed to help banking organizations manage risks associated with third-party relationships, including relationships with financial technology companies.

You may be thinking wow that sounds long. It is. Luckily, the inimitable Alex Johnson of Fintech Takes also read it and wrote his usual informed, insightful roundup below.

Enjoy.

The OCC Knows What BaaS Is (Alex Johnson, Fintech Takes).

Fintech x AI: The Lightspeed View. (Lightspeed Venture Partners)

Alas all good things must come to an end. If you enjoyed this content, please hit “like” button. Ideas for an area you’d like to learn more on, leave a comment!

Psst: I’d love to hear from you. The best place to find me is on Twitter or LinkedIn!

Until next week, fare thee well friends.

If you enjoyed this newsletter please share it with a friend (or two!)- remember, sharing is caring!

Disclaimers: All content and views expressed here are the authors’ personal opinions and do not reflect the views of any of their employers or employees. The author does not guarantee the accuracy or completeness of the information provided on this page. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this Site constitutes a solicitation, recommendation, endorsement, or offer by TFL or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.