Robinhood Acquires Credit Card Startup X1

TFL #23: Shopify steps out on Stripe, partners with Adyen

This week Robinhood announced the acquisition of X1, a credit card startup based in San Francisco. Stripe sees one of its oldest and most notable “exclusive” partners announce it wants to see other people (Adyen).

Plus, the bad haircut billionaire social media club (sounds like a Mission SF restaurant) looks to set up a cage match.

We’re entering the dog days of M&A summer.

Let’s jump in.

Psst: Was this newsletter forwarded to you? Sign up today for free to get the latest insight right to your inbox and join the most intelligent (and fun!) community of fintech and web3 operations and investors around.

Source

Robinhood Acquires X1, a no-fee Credit Card Startup

It’s M&A season in fintech, where more mature companies with plenty of cash are on the hunt for deals. This week Robinhood announced it would acquire no-fee credit card startup X1 for $95M in cash (they were founded in 2020 and had raised $62M through a Series B).

With this purchase, we will be one step closer to meeting all of our clients’ critical financial needs. As a consequence of our collaboration with X1, Robinhood will be able to provide credit to our users.

Vlad Tenev, CEO & co-founder of Robinhood

This acquisition makes sense to me. It seems to have the classic “synergies” you look for in M&A. Yes I hate that word too and will probably owe Simon Taylor some sort of restitution but it works here.

Why?

Diversifying revenue streams

Design & (I can only assume) culture fit.

Bay area company

A large user base to sell to

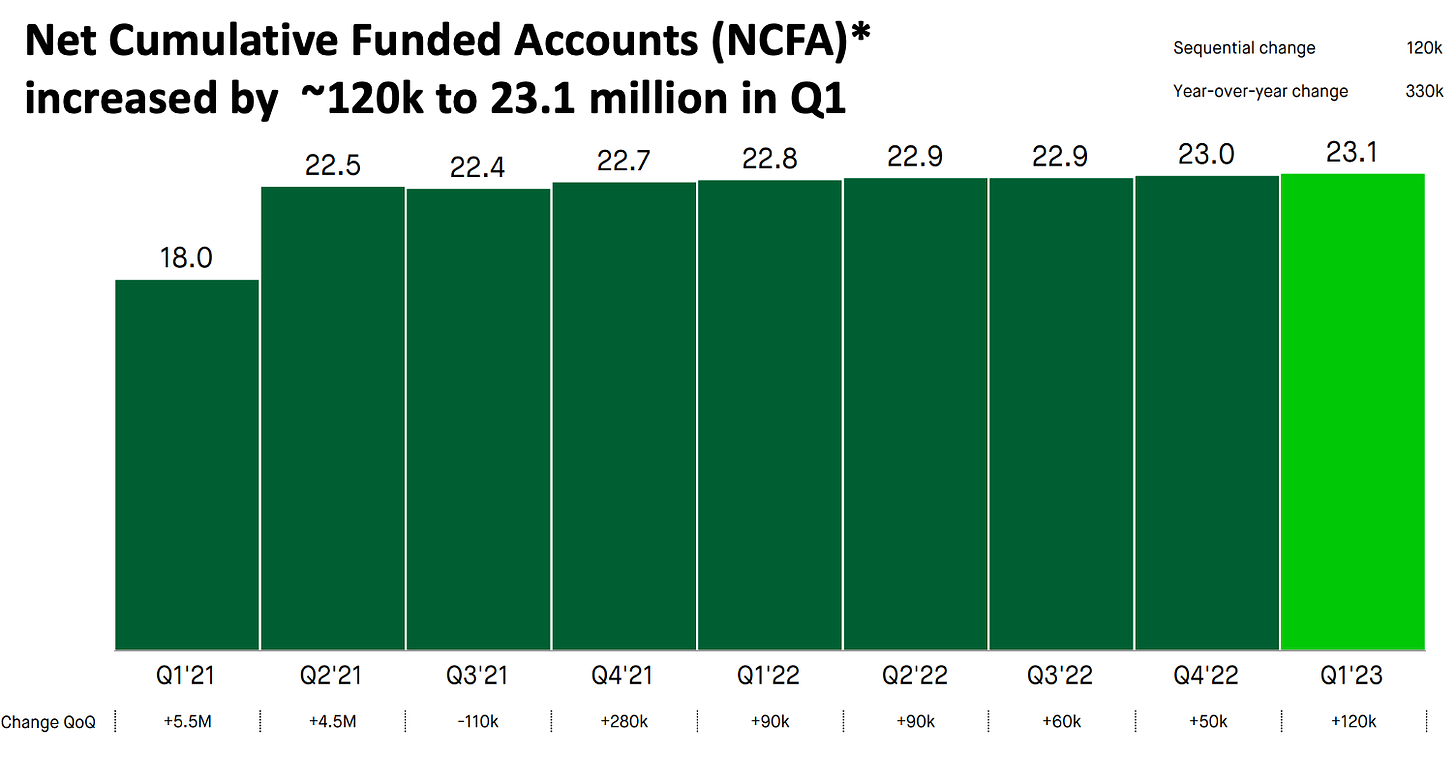

Flat growth in the core business

Source

Absent a new memestock rally (funded largely by the seemingly unending government spigot we experienced during the pandemic), it’s time to look for a new thing.

Could this be it?

Thanks for reading The Fintech Ledger! 📚 Subscribe for free to get weekly insight into what’s going on in fintech, crypto & the economy at large, including:

2 to 3 deep takes on the biggest stories 📝

Fintech & Crypto News: Insight, fundings 🚨

Podcast I’m digging 🎧

Beyond the Ledge: Long Reads & Recs 📚

Tweet of the Week 🐤

Chart of the Week 📈

...and more…free!

BTW for those looking to blast back to the recent past, the trailer for Dumb Money looks goooood!

Unbundling ——> Rebundling

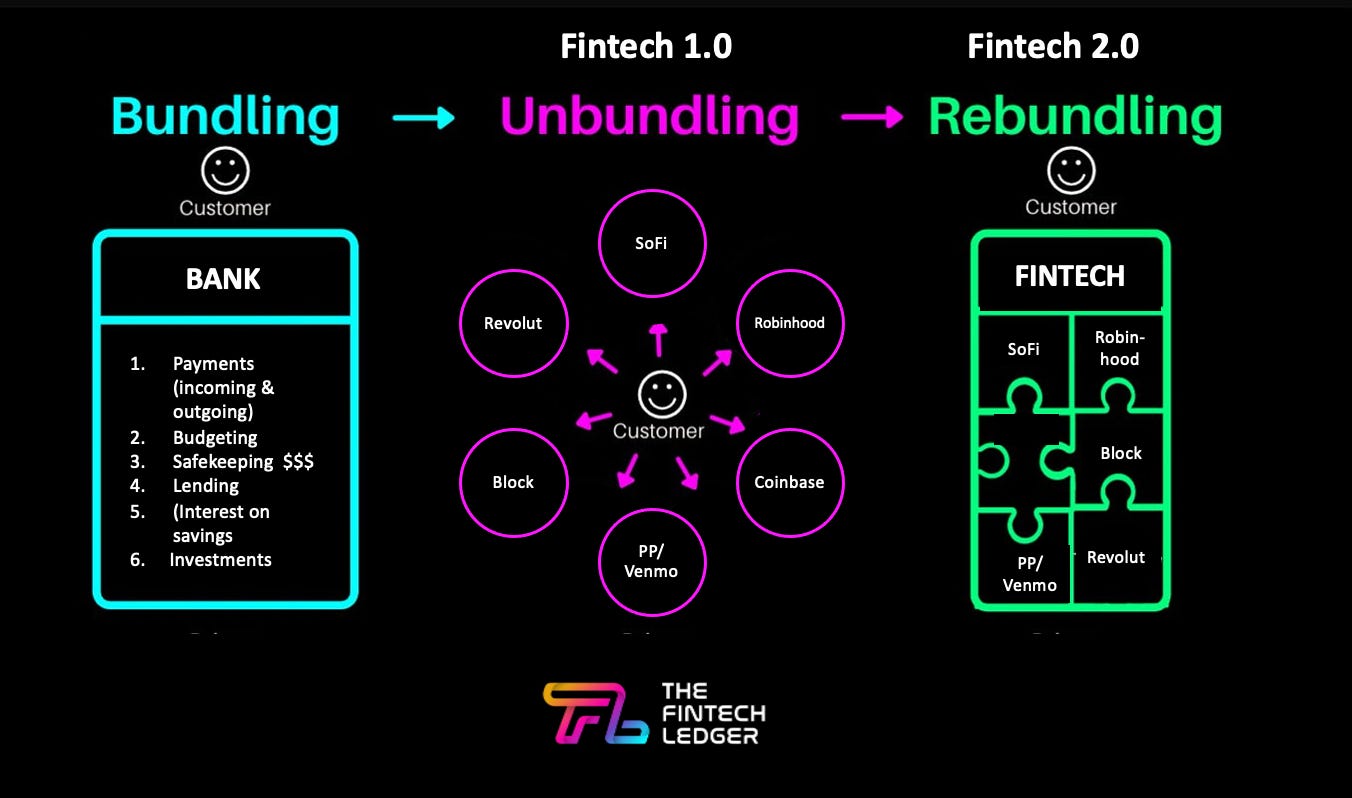

The first era of fintech (Fintech 1.0) saw many new players take a single slice of the banking stack. They were successful largely because of this focus which allowed them to really execute and dominate their swim lanes. Many examples come to mind - PayPal (person to person payments), Square (simple, low cost POS), Robinhood (no-fee stock trading), Stripe (easy online payments) etc. This of course is a short term tactic. If successful, fintechs quickly look to add adjacent financial services or even loosly related business lines that are not financial in nature (aka “Superapp”).

Enter the rebundling era. Fintech 2.0.

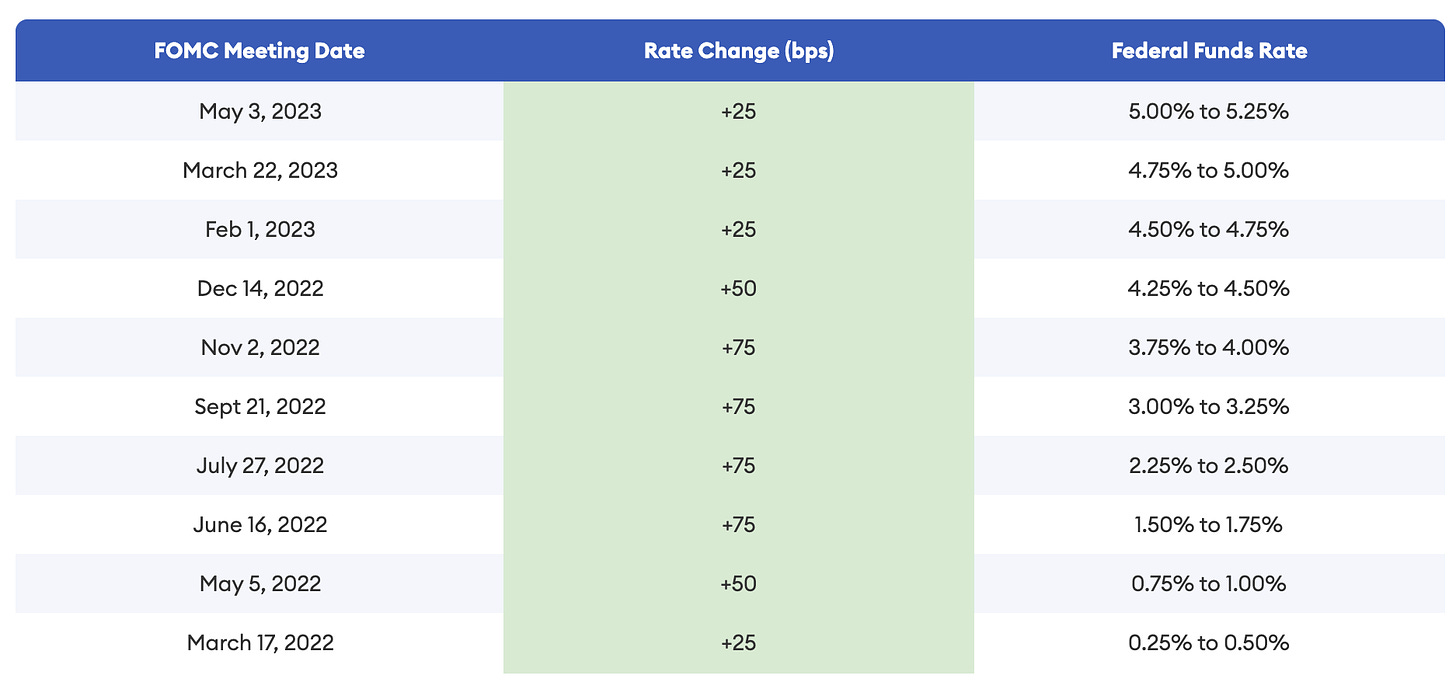

This need to diversify has only increased in importance in an interest rate environment that has seen rates increase faster than a cheetah on a double espresso binge. This new reality has led to a 180 degree pivot in strategy for fintechs and other venture backed startups from growth at all costs to a hyper focus on unit economics and a legitimate path to profitability. Naysayers like to point out that these companies were reckless (indeed many were) and of course a business needs to be profitable. The question is when? When the Fed kept rates so low for so long it signaled to businesses that capital would be easy to come by… seemingly forever. And in a world where the winner often takes all, you go for it. But as the saying goes “Show me the incentive and I will show you the outcome.”

I digress.

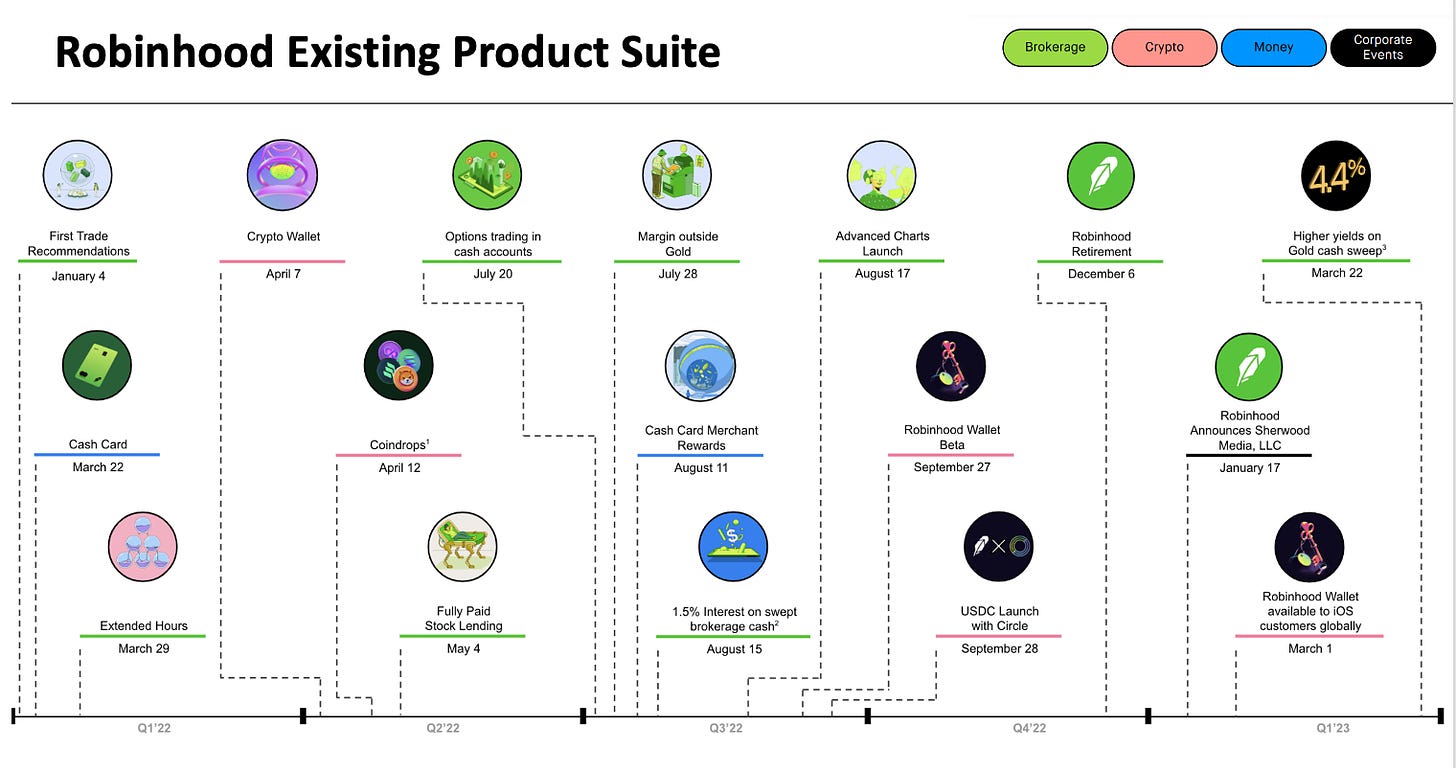

As you can see, Robinhood has been busy diversifying it’s business from the core no fee stock trading it pioneered to include crypto offerings, a cash card (debit), retirement and now it’s first credit product. This is rebundling in the 21st century.

Source

Banks provide essentially six primary services, including:

Payments (incoming and outgoing)

Budgeting for finances

Safekeeping money

Lending (overdrafts, loans, mortgages)

Interest on savings

Other products (investments/ insurance)

The problem is, it’s hard to build all of these products on your own. Fintechs don’t start out with the regulatory licenses needed to provide the above services at parity with existing FIs. This is usually because the capital (and regulatory burden) to do so is too large. Thus, they rely on partner institutions, a quicker yet often not quick enough strategy.

Thus an acquisition target at the right price that provides complementary products and new revenue streams quickly is almost too good to pass up.

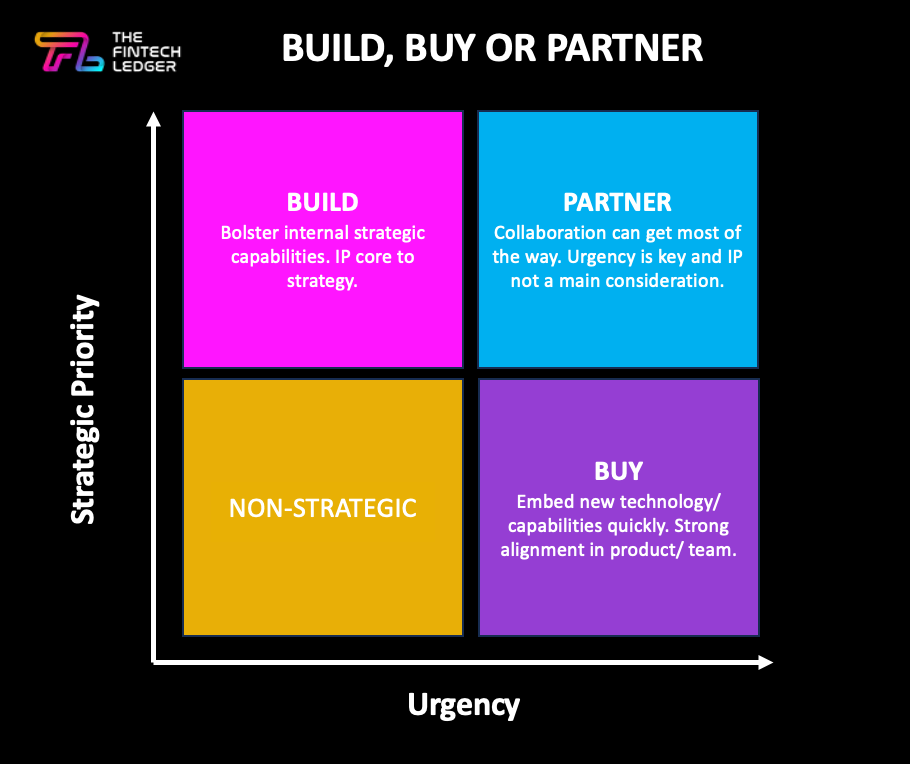

There are tradeoffs - known as build, buy, or partner - to consider but in this case, speed was paramount, the price seemed reasonable and the need to protect IP was not a factor.

X1 Provides a Strong Value Prop

X1 has a strong feature set including a 17g heavy metal card (I don’t know why but people love this), strong rewards and no annual fee (assume this will go).

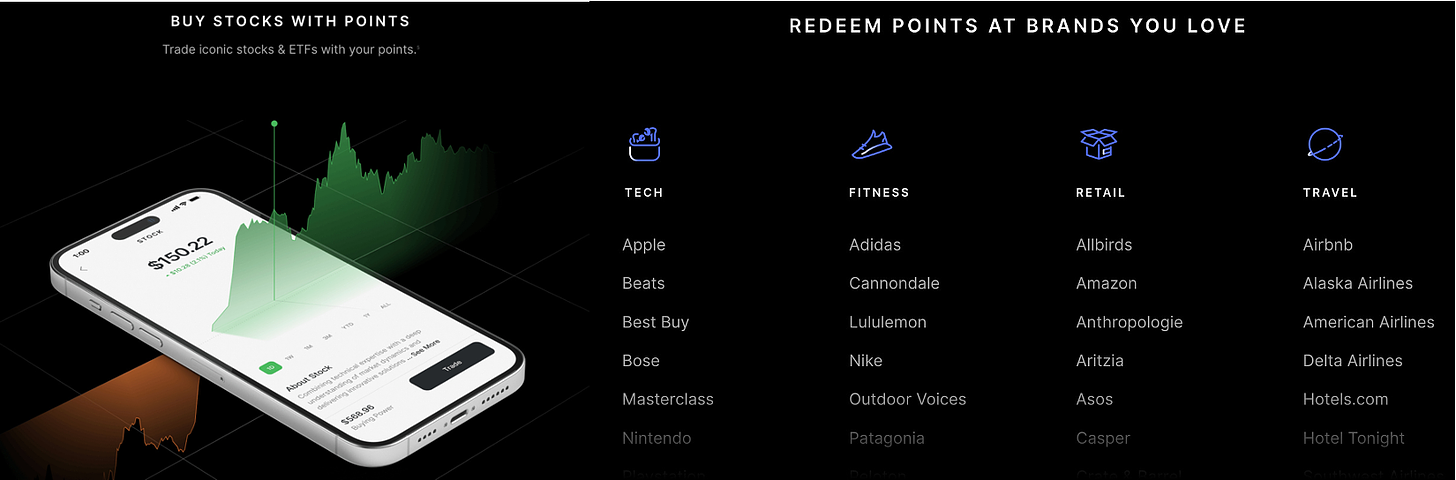

The benefits are points based, with 2x points on every purchase (10k points equals “up to” $100. I assume that means you are getting one of the point kickers like 3x points for $1k/ mo. in spend or 4x-10x for friend invites. The points themselves are redeemable for cash, to buy stocks, or can be used to purchase e-commerce goods and services from the app at selected merchants spanning technology, fitness, retail and travel.

The look, the feel, the price - there’s a lot about this deal to like. It gives Robinhood an important new product (lending) to cross sell to its millions of customers.

The Chase Sapphire and Amex Platinum cards print $$$ for their respective companies. Newer entrants like Revolut Ultra, Apple Card and now X1 are looking to get a slice of that pie. With a strong active user base and a slick new product to sell, they may just do that. They have a captive audience ripe for distribution.

And distribution is the name of the game.

Battle of the Billionaire Bad Haircut Social Club?

Elon Musk responded this week to tweets about a potential competing service by Meta, saying, “I’m up for a cage match if he (Mark Zuckerberg) is.”

Zuck took to his own social network Instagram to reply “Send Me Location.”

One can hope.

A well-curated timeline can provide a straight-to-the-source education. Check out my FintechTweeps list for a curation of the best of fintwit’s best & follow me @fintech_ryan for more on Twitter.

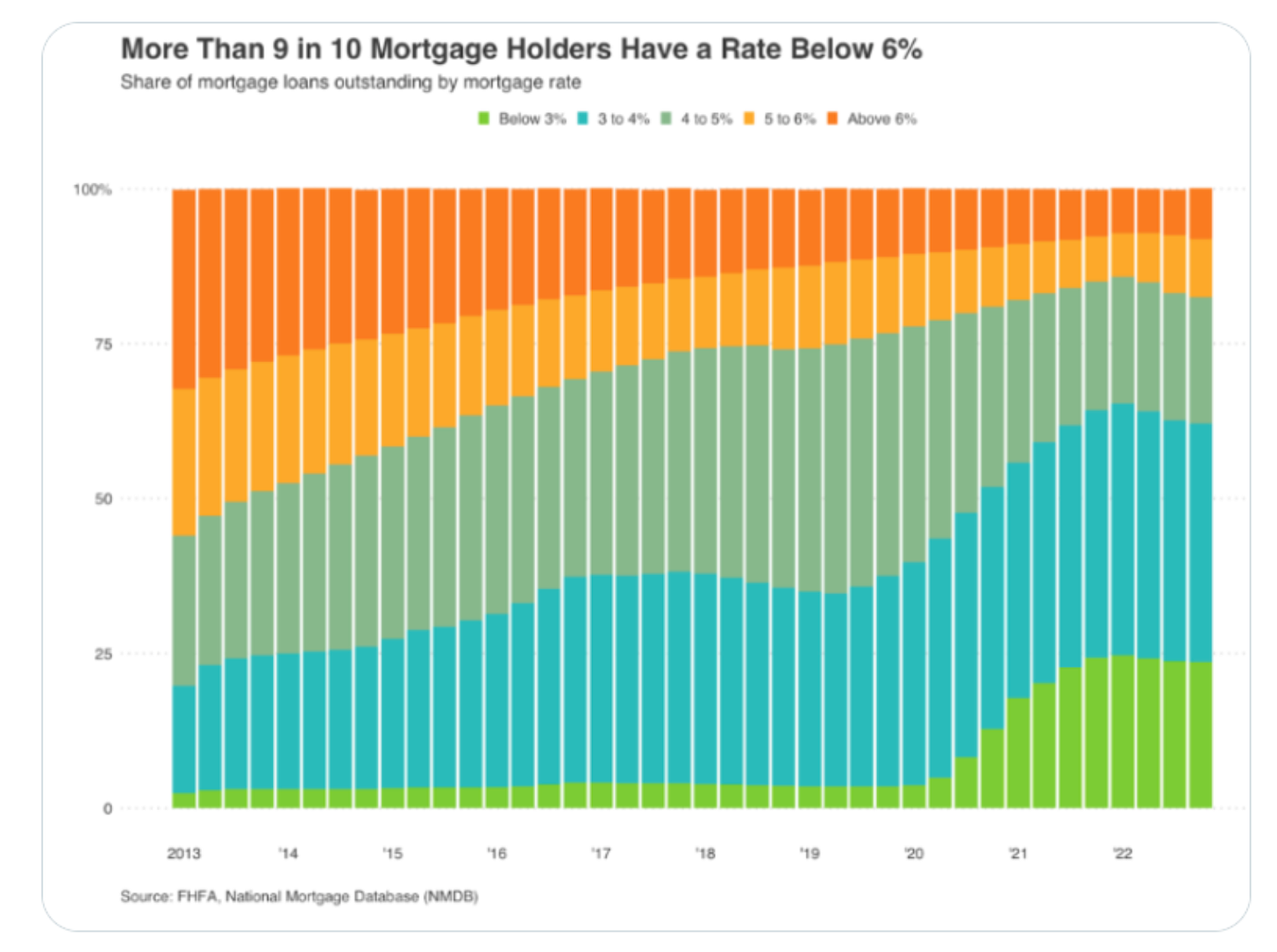

U.S. housing supply continues to be restricted, largely due to the fact that people can’t afford to move. Some are predicting a 2023 housing correction not seen since WWII.

It will be interesting to see where this leads.

Miguel Armaza hosts the Fintech Leaders Podcast and Newsletter and is Co-Founder & Managing General Partner of Gilgamesh Ventures, a seed-stage investment fund focused on fintech in the Americas.

In this episode, he interviews Tommy Nicholas, CEO and Co-Founder of Alloy, a company helping banks and fintech control fraud and manage compliance and risk. Tommy talks about going from 100 no’s to raising over $200M in venture funding…and more.

Below are a few of my favorite longer form reads and research I found this week.

Envisioning The Future of Money Movement. Produced by This Week in Fintech (Jenny Johnston & Nik Milanović.) in association with Visa.

BlackRock creates Bitcoin vehicle: half good, half terrible (Jesse Meyers)

Volt, an open banking fintech for payments & more, raises $60M.

JP Morgan Euro Payment Settlement With JPM Coin: settled $300M to date.

TrueCar Is Restructuring and Changing Management as Losses Continue.

Businesses will be able to accept IDs in Apple Wallet with iOS 17.

Cathie Wood’s Ark Invest picked up more than half a million shares of Robinhood.

Andreessen Horowitz to open first office outside the U.S. in London.

Gaming, Loyalty and Entertainment Are Adapting to the Rise of NFTs and Web3.

US Supreme Court halts Coinbase cases in its first crypto ruling.

Binance Ordered to Halt Offering Crypto Services in Belgium by Markets Regulator.

Celsius creditors allege Wintermute facilitated 'wash trading'.

'The Great Accumulation' of Bitcoin has begun, says Gemini's Winklevoss.

Crypto Exchange Backed by Citadel Securities, Fidelity Goes Live.

Prime Trust Has 'Shortfall of Customer Funds,' Nevada Regulator Says.

OPNX Files Defamation Lawsuit Against Mike Dudas, Issues “Justice Tokens”.

Wall Street-Backed Bitcoin ETFs Pile Up After BlackRock’s Filing.

Republic Acquires 9.5% Share in INX, Eyes Full Acquisition to Expand Digital Asset Services.

The Buck Stops Here: Circle CEO Warns U.S. Losing Dominance (6/18 #22).

Founders & Funders (Interview) 🚀: Jannick Malling co-founder and co-CEO of Public.

Fiction or Reality? The Rise of AI in Fintech (5/21 #19).

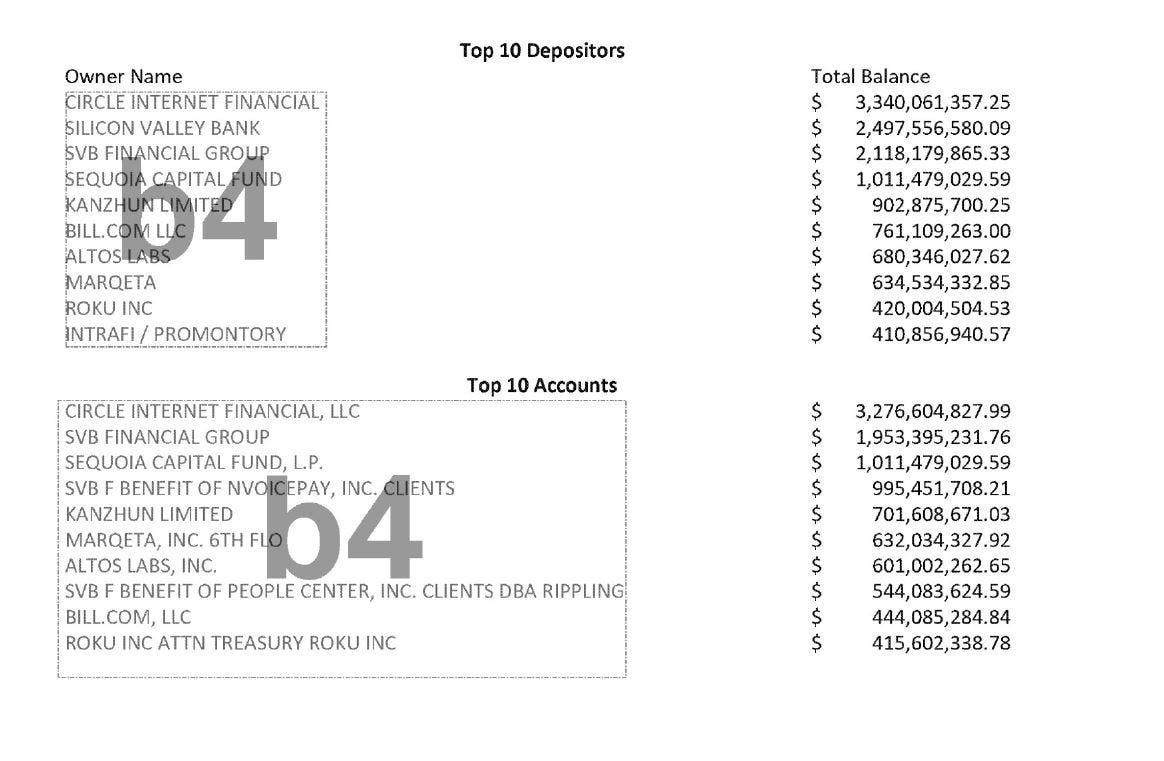

Oops! It looks like the FDIC accidentally released the list of the largest depositors at SVB. Not surprisingly, fintechs held a prominent role on the list.

Alas all good things must come to an end. If you enjoyed this content, please hit the “like” button (it means a lot!).

Have an idea for an area you’d like to learn more on or are just a salty dog, leave a comment!

I’d love to hear from you. The best place to connect with me is on Twitter or LinkedIn!

Until next week, fare thee well friends.

If you enjoyed this newsletter please share it with a friend (or two!)- remember, sharing is caring!

Disclaimers: All content and views expressed here are the authors’ personal opinions and do not reflect the views of any of their employers or employees. The author does not guarantee the accuracy or completeness of the information provided on this page. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this Site constitutes a solicitation, recommendation, endorsement, or offer by TFL or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.