💵 The Buck Stops Here: Circle CEO Warns U.S. Losing Dominance

TFL #22: BlackRock, the worlds largest asset manager, seeks to launch the first U.S. bitcoin ETF amid broader crypto crackdown

Good morning fintech Illuminati 🧐 and welcome back to The Fintech Ledger #22!

This week BlackRock, the world’s largest asset manager, announced it would seek approval for a Bitcoin ETF (they currently manage 404 ETFs with $2.38 trillion in assets). The timing is curious as it comes amid a broader crackdown in crypto, one with their proposed partner, Coinbase, squarely in the sights of the SEC. If successful, it would be the first of its kind. Blackrock may have set the stage for the ETF filing last August when it announced its first partnership with Coinbase to launch its first spot bitcoin private trust, available to U.S. institutional clients. Meanwhile, spot bitcoin ETFs have been made available in Europe and Canada and have proven to have significant demand.

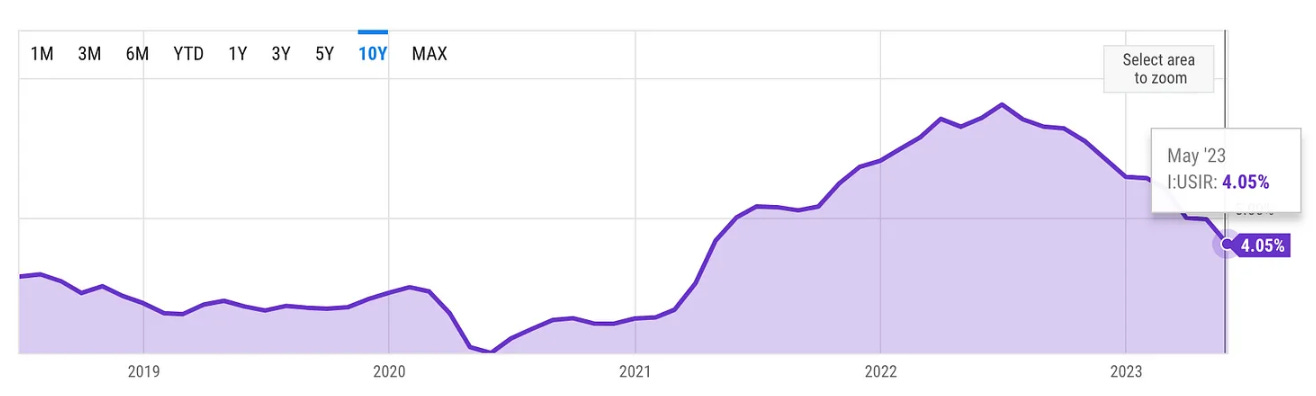

In macro news, the Fed continued its pause on interest rate increases but left the door open to future hikes. Goldman followed with a warning that markets are too optimistic inflation will continue to drop.

US Inflation Rate (I:USIR)

4.05% for May 2023

Source

Meanwhile, Circle CEO Jeremy Allaire went to Washington to press for urgently needed regulatory clarity in digital assets, including payment stablecoins, as a vehicle for strengthening the U.S. dollar’s competitiveness (Circle issues the #2 Stablecoin by market cap, USDC). The testimony occurred on Tues, the same day the Secretary of the Treasury Janet Yellen said we should expect a gradual decrease in the dollar’s share as a global reserve asset over time.

Janet appears to be a Worryen.

There is a lot to cover, but before we do I’d like to wish all the Dads out there a Happy Father’s Day! 😎

I’ll be spending the day with my favorite girls, my wife and daughter #girldad (IYKYK).

Let’s jump in.

Psst: Was this newsletter forwarded to you? Sign up today for free to get the latest insight right to your inbox and join the most intelligent (and fun!) community of fintech and web3 operations and investors around.

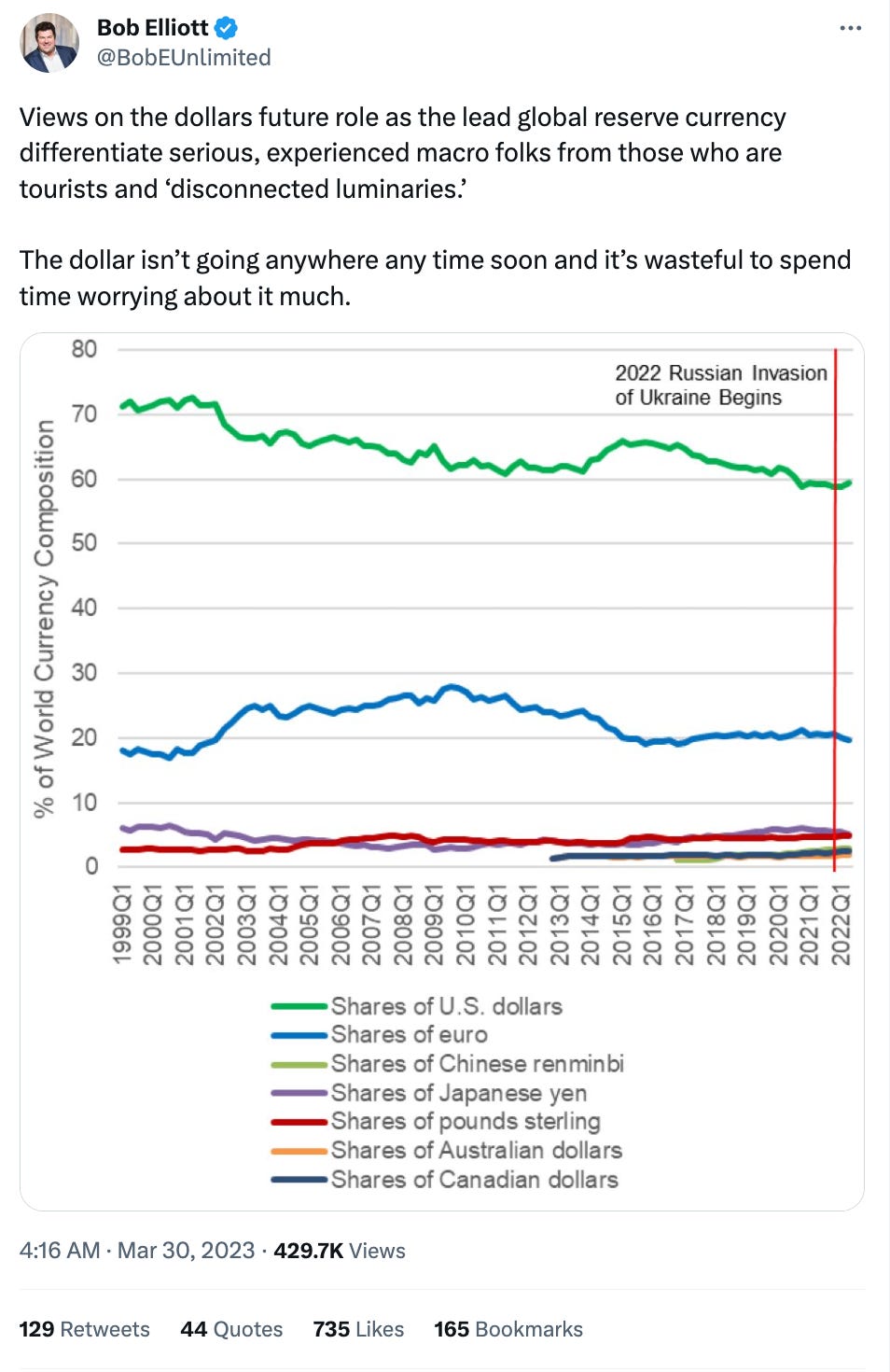

💵 The US dollar's share of global reserves is in decline. This was the sentiment delivered by Treasury Secretary Janet Yellen on Tuesday during comments at a Housing Financial Services Committee in response to questions about the risk of de-dollarization. While she added that she felt no alternatives exist that could completely displace the greenback, it was a shocking statement nonetheless.

We should expect over time a gradually increased share of other assets in reserve holdings of countries — a natural desire to diversify. But the dollar is far and away the dominant reserve asset. It will not be easy for any country to devise a way to get around the dollar.

U.S. Treasury Secretary Janet Yellen

Is the King of Currencies in danger of losing its crown? 👑

Probably not.

But there is significant talk on the heels of last year’s U.S dollar rally, combined with competing currency efforts from China and others to dethrone the buck that have reopened the debate.

Let’s unpack it.

Thanks for reading The Fintech Ledger! 📚 Subscribe for free to get weekly insight into what’s going on in fintech, crypto & the economy at large, including:

2 to 3 deep takes on the biggest stories 📝

Fintech & Crypto News: Insight, fundings 🚨

Podcast I’m digging 🎧

Beyond the Ledge: Long Reads & Recs 📚

Tweet of the Week 🐤

Chart of the Week 📈

...and more…free!

Now of course there are many who rightly point out that the U.S. dollar has maintained a fairly stable dominance for the last 60 or so years.

I agree with the premise this will not happen overnight and there is currently no suitable equivalent. However, to suggest we should rule out the possibility is shortsighted in my view. As they say, “never say never.” As one of my favorite business school professors used to say about big incumbents ripe for disruption, they are sitting there “fat, dumb and happy.”

So who stands to win and lose in a de-dollarized world?

Who Stands to Lose

United States: This is as much about geopolitical sway and dominance as it is about finance. It’s also the most obvious one on this list. As the issuer of the US dollar and the country with significant global economic and political influence that entails, the United States could face challenges if the dollar were to decline in importance. It could lead to reduced demand for US Treasuries, higher borrowing costs, and a potential loss of the privilege of the dollar being the world's primary reserve currency.

Dollar Holders: Countries and entities holding substantial amounts of US dollar-denominated assets, such as foreign central banks and international investors, might experience a decline in the value of their reserves if the dollar loses its status. This could have negative consequences for their economies and financial stability.

International Trade: A decline or replacement of the US dollar could disrupt international trade and global financial markets. The dollar's widespread acceptance and liquidity have made it a preferred medium of exchange and a pricing currency for commodities. Any shift away from the dollar could introduce uncertainties and challenges in trade settlement and cross-border transactions.

Who Stands to Win

Other Countries Reserve Currencies: If the US dollar were to decline or be replaced as the dominant reserve currency, other major currencies like the euro, Japanese yen, British pound, or Chinese yuan could gain prominence. Central banks and investors may diversify their reserves into these currencies, which could strengthen their respective economies, financial systems and international importance (e.g. muscle).

Emerging Economies: A decline in the US dollar's status could benefit emerging economies that have historically been dependent on dollar-denominated debt. These countries might experience reduced borrowing costs and increased economic stability as they rely less on the US dollar for trade and financing.

Cryptocurrencies: If traditional fiat currencies face a decline, cryptocurrencies like Bitcoin or Ethereum - or “Stablecoins” like USDC - might gain greater acceptance and recognition. Some believe that decentralized digital currencies can provide an alternative to traditional currencies, but their adoption and regulatory framework would need significant development for this to occur.

Circle, USDC Stablecoin Issuer, Heads to Washington, Warns of U.S. Losing Dominance

Circle CEO Jeremy Allaire published a June 12 blog Payment Stablecoins Support the Dollar and U.S. Economic Competitiveness featuring prepared testimony he presented to Congress the following day in support of draft Stablecoin legislation. The landmark hearing had him portraying an “urgent need” for increased regulatory clarity in digital assets, including payment stablecoins, as a vehicle for strengthening the U.S. dollar’s competitiveness in the 21st century.

In the blog post and testimony, Allaire used an analogy of the current situation in relation to the US government and industry's response to the internet technology disruption of 1999-2001, which he argued led to the US establishing itself as the leader of internet-based technology and businesses. His main points are:

The US government and industry responded to the internet technology disruption of 1999-2001 in a proactive way.

This response established the US as the leader of internet-based technology and businesses.

Other nations, most notably China, have closed the technology capability gap with the US.

The crux of his argument is that the U.S. dollar is declining in dominance in global foreign reserves, while China with the digital yuan and others are creating alternative digital payment technologies that could soon rival the dollar dominance. Thus, the U.S. must act to keep the dollar competitive.

He added that other jurisdictions including the EU, Japan, and Hong Kong are creating laws for stablecoins issued in the U.S. and urged U.S. lawmakers to lead stablecoin regulation instead of allowing foreign countries to do so.

Full testimony recording here.

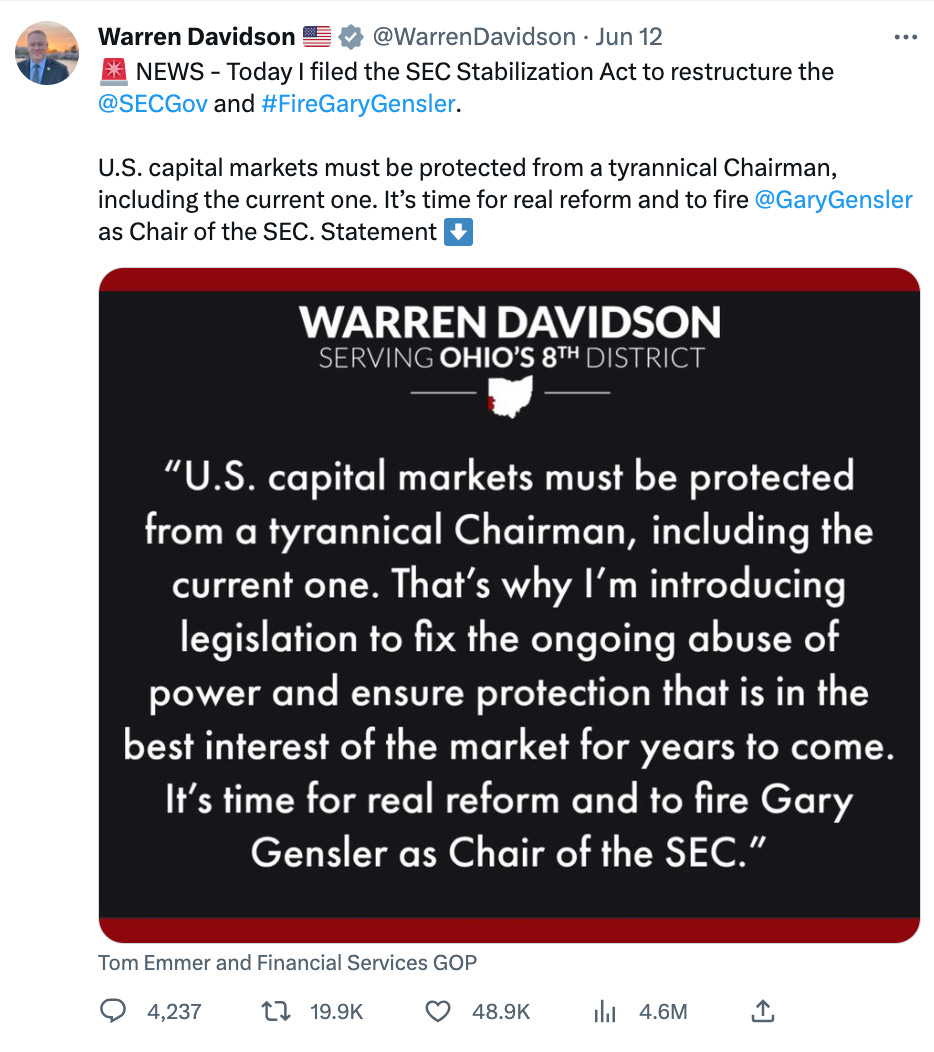

Move to Replace Gensler at SEC

Allaire’s testimony comes on the heels of aggressive action by the SEC against Coinbase and Binance the week prior, which led some in Congress to call for the firing of SEC Chair Gary Gensler and restructure the agency.

Following the announcement, #firegarygensler was trending on Twitter.

Davidson (R-OH) was joined by Rep. Tom Emmer (R-MN), the crypto-supportive House Majority Whip in the filing. In a press release related to the legislation on Emmer’s website, the Representative cited a “long list of abuses” Gensler has committed while in office, including a “hotel California rule” for crypto providing “no resolution and no clarity for the captives in the market.”

The recent SEC actions against Coinbase and Binance, and the CFTC’s victory against Ooki DAO confirming that decentralized entities can be held legally accountable, represents bold moves by the current regulatory apparatus to bring the cryptosphere in line with existing US regulation, much of which dates back over 75 years (almost as old as the two current presidential frontrunners).

Sigh.

With so much on the line, this feels like a watershed moment.

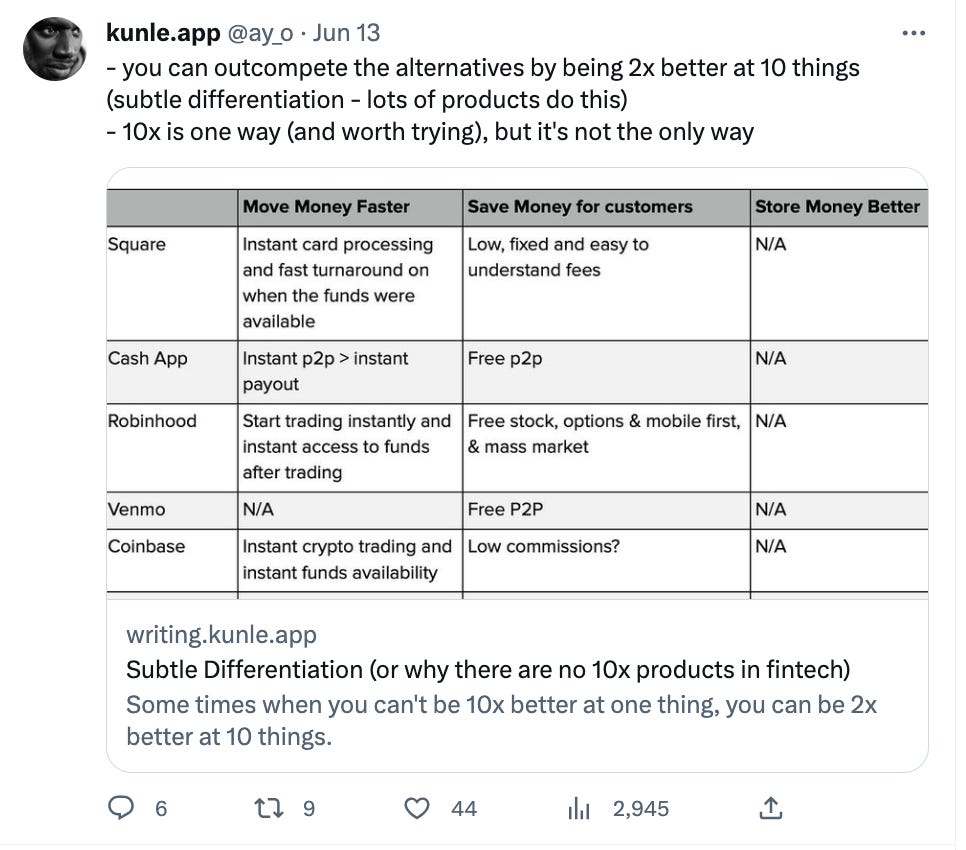

Link to the full blog post: Subtle Differentiation (or why there are no 10x products in fintech)

A well-curated timeline can provide a straight-to-the-source education. Check out my FintechTweeps list for a curation of the best of fintwit’s best & follow me @fintech_ryan for more on Twitter.

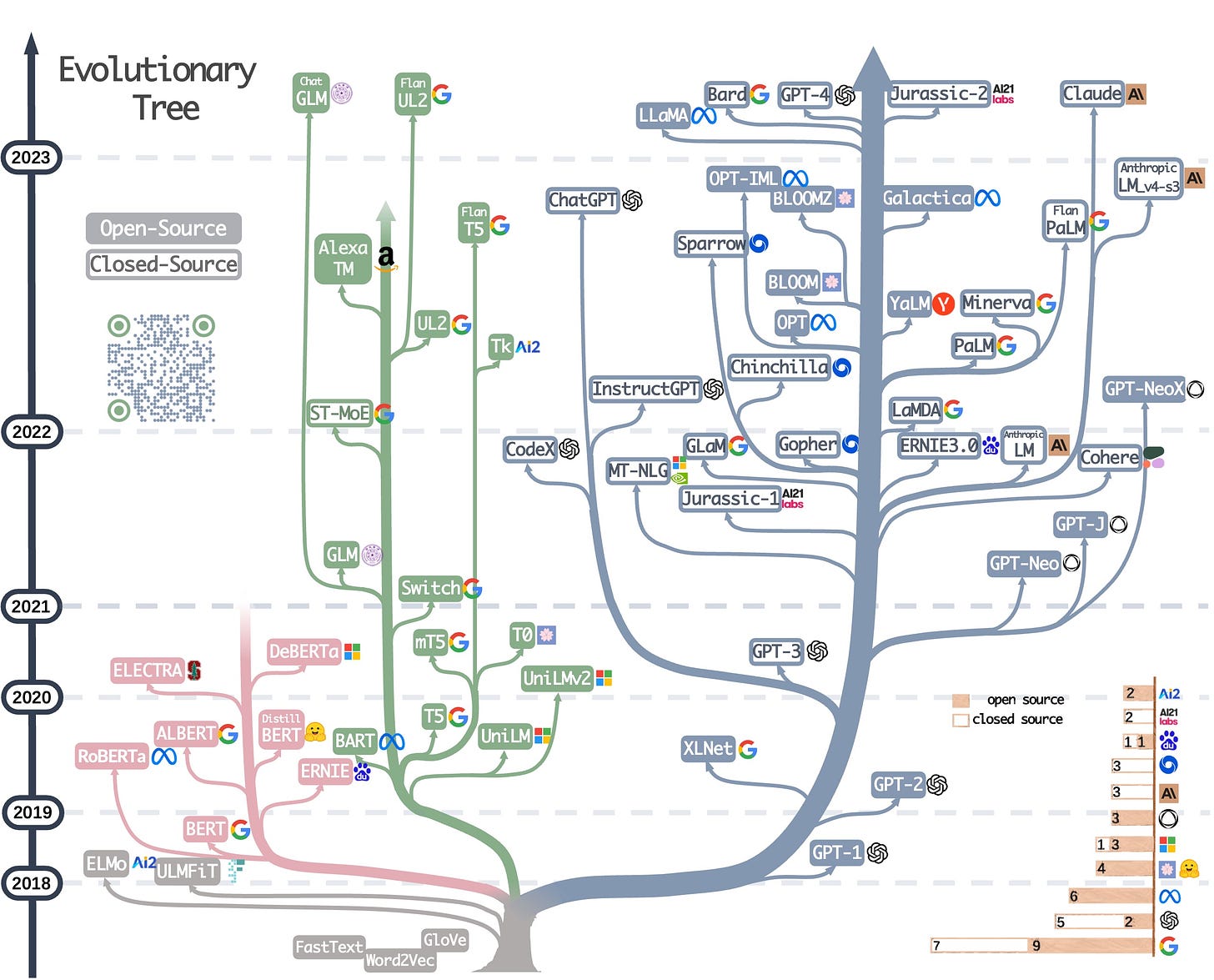

A recent survey paper: Harnessing the Power of LLMs in Practice: A Survey on ChatGPT and Beyond presents a comprehensive and practical guide for end-users working with Large Language Models (LLMs). And for visualists, they created this cool evolutionary tree of modern Large Language Models (LLMs) to trace advances over the years and highlight some of the most well-known models.

Last month Fintech Nexus announced it had acquired one of my favorite fintech newsletters Fintech Blueprint, led by Lex Sokolin, one of the deep thinkers in the space. In this episode of Fintech One-on-One, host Peter Renton sits down with Lex to discuss the acquisition of Fintech Blueprint and topics of fintech interest, including:

Platform shifts he is tracking today in fintech.

Lex’s view defi in the context of today’s risk-off environment.

Two strategies bringing traditional finance and crypto together.

The US crackdown on crypto, compared to the UK and Europe.

His vision for self-driving money and the role AI will play.

The technologies Lex is looking at most closely over the next two to three years.

Lex is the type of contrarian thinker that makes you go hmmm.

Give it a listen.

SEC to Weigh New Artificial Intelligence Rules For Wealth Management.

Public Hires Prashant Yerramalli as its VP of Operations and Regulatory Affairs.

New tax rule on apps like Venmo, PayPal could spell confusion for SMBs.

Gen Z Is Eschewing Traditional Investment in Pursuit of a Virtual and Fractional Path (General Catalyst).

Revolut sees its valuation reconsidered as public markets stir the fintech pot.

Cross River Bank Surpasses 1 Million RTP Transactions, Totaling Over $500mm in the Month of May Alone.

Discover Launches $36 million Fund Aimed to Improve Financial Health.

Mastercard’s Start Path program for SMBs added five new startups to its inaugural cohort.

Ualá, the Argentinean neo-bank - expanded its product offerings in Mexico with a high-yield savings account.

BlackRock Bitcoin ETF Is the ‘Real Deal’—Is This Finally the One?

Blockchain-Based, AI Compute Protocol Gensyn Closes $43M Series A Funding Round Led by a16z.

Block to open public beta of self-custody wallet and integrate with Coinbase and Cash App.

SEC comments on Hinman speech released in Ripple Labs filing.

U.S. Judge Rebuffs SEC Request for Binance.US Asset Freeze for Now.

Regulators say crypto lender Abra is insolvent and lied about FTX exposure.

JPMorgan says Ethereum could be put into ‘other category’ by US Congress.

The Crypto Market of the Future Needs a Flexible Legal Framework.

CFTC wins Ooki DAO case, setting precedent that DAOs can be held liable.

Swift explores blockchain interoperability, partners with Chainlink, FIs.

Miami Mayor and Crypto advocate Francis Suarez officially launches 2024 presidential bid.

Below are a few of my favorite longer form reads and research I found this week.

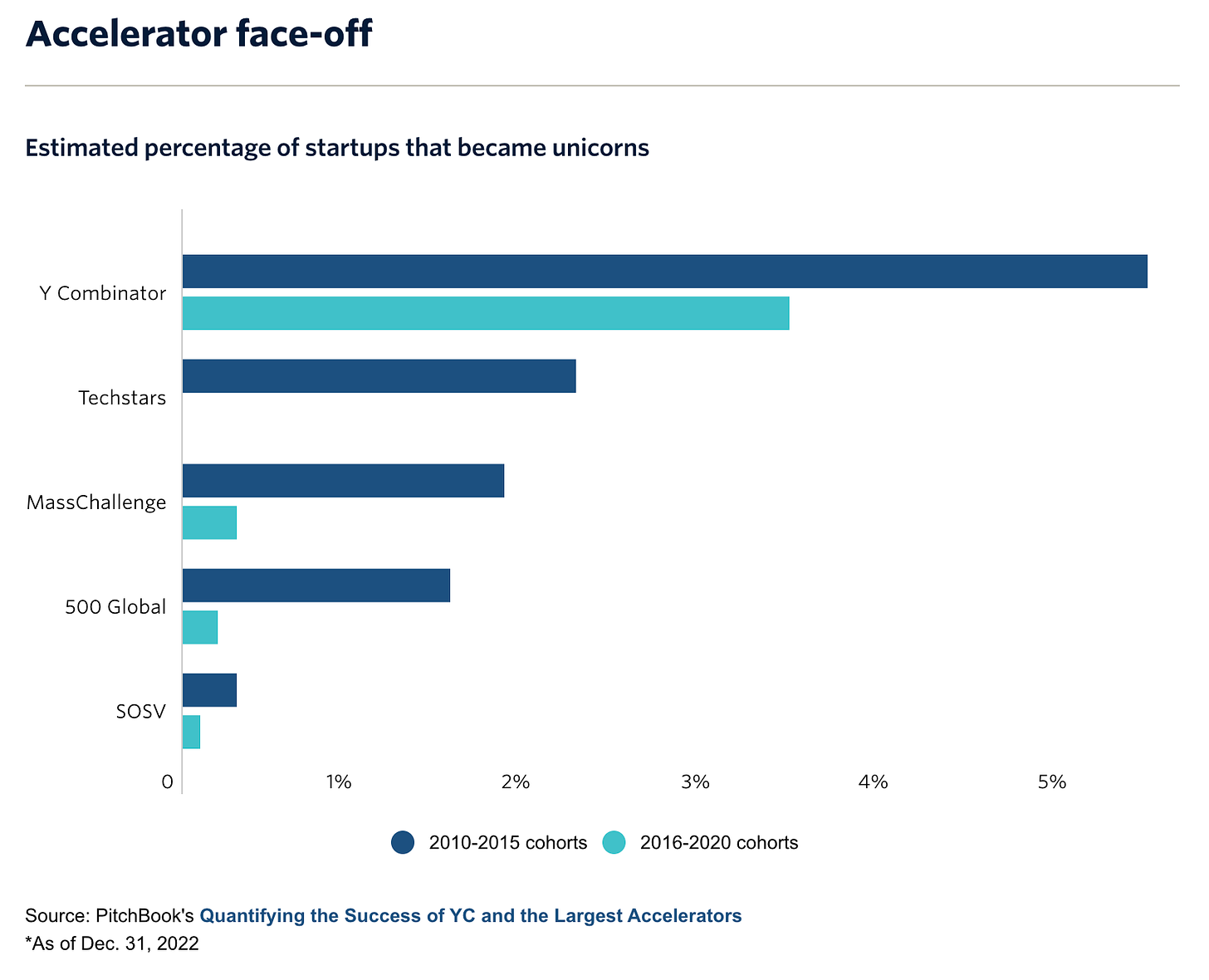

The Shadow Price of Venture Capital (Nnamdi Iregbulem, Lightspeed Venture Partners).

Founders & Funders (Interview) 🚀: Jannick Malling co-founder and co-CEO of Public.

Breakfast Club vs. Gossip Girl: 👦 👧 Teen Banking & the fight for GenZ

Alas all good things must come to an end. If you enjoyed this content, please hit the “like” button (it means a lot!).

Have an idea for an area you’d like to learn more on or are just a salty dog, leave a comment!

I’d love to hear from you. The best place to find me is on Twitter or LinkedIn!

Until next week, fare thee well friends.

If you enjoyed this newsletter please share it with a friend (or two!)- remember, sharing is caring!

Disclaimers: All content and views expressed here are the authors’ personal opinions and do not reflect the views of any of their employers or employees. The author does not guarantee the accuracy or completeness of the information provided on this page. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this Site constitutes a solicitation, recommendation, endorsement, or offer by TFL or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.