SVB DOA: The Undoing of Silicon Valley Bank

TFL # 10: The longtime startup lender enters receivership. Crypto bank Silvergate to wind down operations.

Hey friends,

I thought for sure the biggest news this week would be Silvergate shutting down operations and liquidating. I was wrong. Silicon Valley Bank (SVB), a vital part of the startup and venture capital ecosystem since 1983, entered into FDIC receivership on Friday. It’s been a whirlwind 48 hours. There’s a lot to unpack, so let’s dive in.

The week started off normally enough. On Tuesday, the bank held their Q1 mid-quarter investor update, which was mostly uneventful. The event ended with a classic softball question to the CEO.

“Cycling is my advice. Living in Northern California and being on the peninsula. That’s just—I think it’s the best bike-riding cycling in the world, period.”

Greg Becker, CEO of SVB, on how he likes to “de-stress” at their Q1 investor update on Tuesday

Two days later, they would be experiencing their Lehman moment. In another twenty- four hours, the FDIC would take over; SVB would become the second-largest bank failure in U.S. history. What happened?!

Confidence.

Or lack thereof.

Confidence can be fickle. When applied to fractional banking, a lack of confidence can be deadly. And contagious. In bank terms, it’s called a bank run. Which is what happened on Thursday. We’ll come back to that in a minute. But first, let’s back up a little.

During the pandemic, SVB took in record volumes of new deposits. They had approximately $62 billion in deposits at the end of 2019, growing to almost $190 billion by the end of 2021. All is good, right? On paper, yes. SVB was collecting more deposits, usually an unenviable position. However, as banks are in the business of making money, they need to do something with those deposits. That “something” is either lending, buying assets, or keeping cash to generate a yield.

Generating borrower demand for $130 billion in two years is difficult, even with a near zero interest rate policy (ZIRP). With loan demand not sufficient, and cash not a viable option, Silicon Valley Bank chose to invest in securities. When banks purchase securities, they choose up-front whether they intend to hold them to maturity, which dictates whether they are classified as “held-to-maturity” (HTM) assets or as “available-for-sale” (AFS) assets.

So what did SBV do?

They purchased mortgage-backed securities (MBS) to the tune of $80 billion dollars! 97% of which were 10-year maturity that they intended to hold. So they took the quick influx of capital, turned around and bought a bunch of long-duration assets. At the time it made sense; US Treasuries were yielding 0-0.25% while SVBs mortgage backed securites were yielding 1.5%. A nice little spread. That all works fine when interest rates remain stable. Of course, they did not.

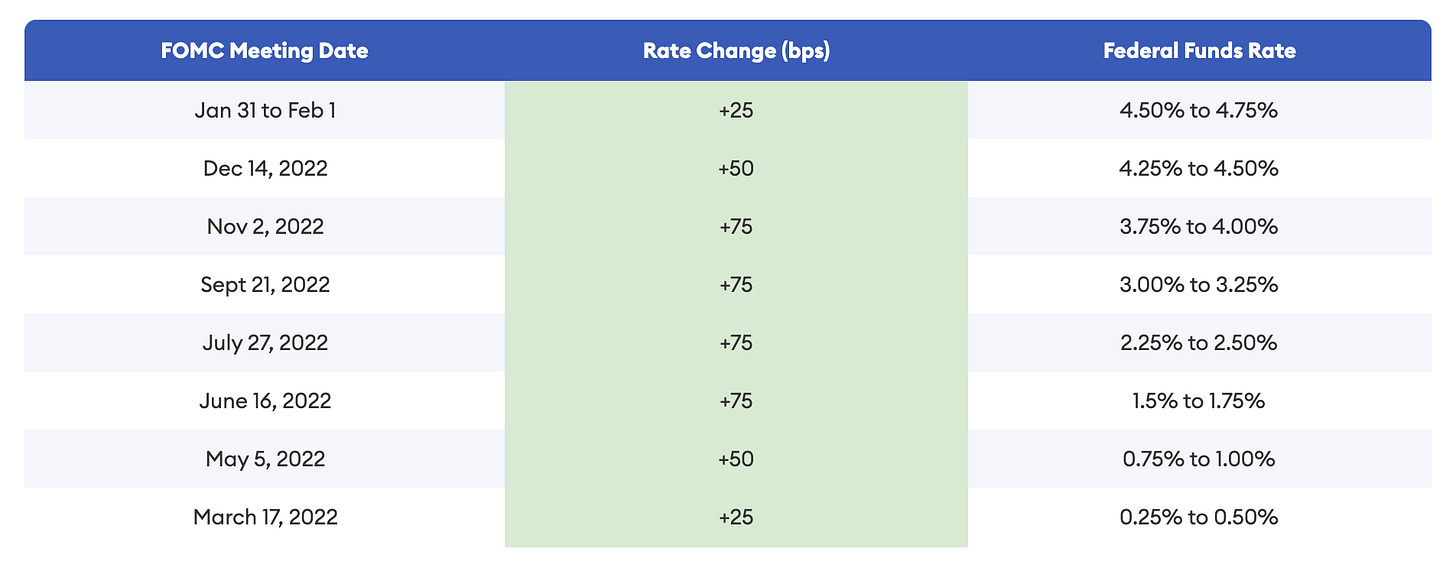

Enter the Fed

As I’ve written prior, the constant intervention in the markets by the Fed has a big hand in what’s going on here. They artificially held interest rates at near zero for years, forcing banks (and others) to search for yield in longer-duration assets. Meanwhile, ZIRP coupled with the extensive Covid-19 global financial support (surpassing $9 trillion by the latest IMF estimate - circa 10.5% of the global GDP in 2020), elevated asset prices. Add in global supply chain shocks and the Russian invasion of Ukraine, and you’ve got a recipe for full-blown inflation. While there

Source

was arguably little that could have been done to counter the last two, the Fed could have acted sooner. They didn’t. Instead, when they finally realized in Q1 of 2022 what was happening was not “transitory,” they were forced to turn on a dime. In March of that year, they began increasing rates at historically fast levels to tame inflation. The economy was its rag doll.

It is said if you want to understand a situation, look at the incentive structure. The central bank has effectively pushed financial institutions and investors into high-risk positions. The distortion of free markets forces companies to make bad decisions. A whiplash like this from a low interest rate environment to a high interest rate

Source

environment tends to break things. No one predicted it would break a US regulated bank, however.

SVBs Unforced Error: A PR Lesson

SVBs position had gotten out of hand. A full 55.4% of their assets were held in securities - the highest in their peer group. Among rising rates, they were forced to take some losses in order to reduce their risk and put the bank in a better financial position. Normally, this would not have caused much of a stir. But we are not in normal times.

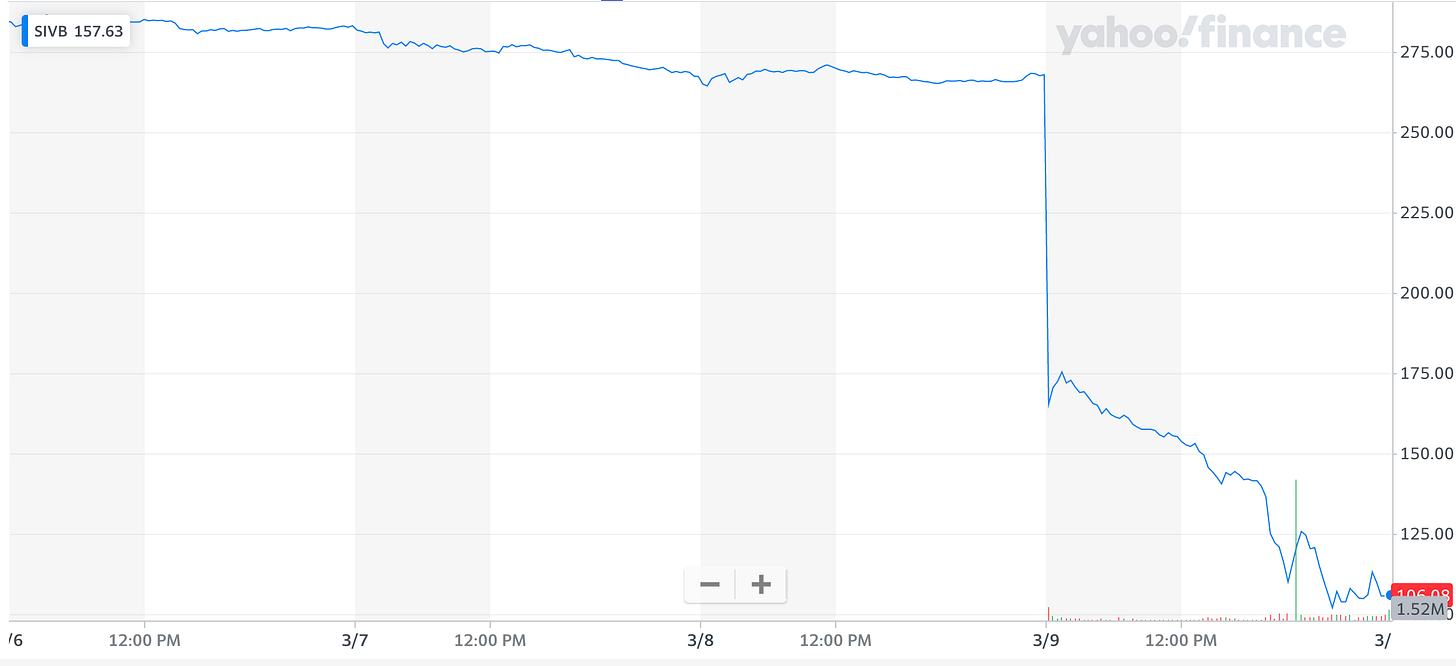

Timing, they say, is everything. It certainly is in public relations. So it is somewhat of a head scratcher that SVB decided to announce it was selling assets at a $1.8 billion loss and raising $1.25 billion from General Atlantic just as crypto bank Silvergate announced it was shutting down operations - a fallout of FTX, BlockFi and the broader crypto contageon. This understandably spooked markets, sending the stock tumbling 60% in a day — more after the bell.

SVB Financial Group (SIVB)

NasdaqGS - NasdaqGS Real Time Price. Currency in USD

So SVB was getting hit hard, but they’d secured the funding and they still had those deposits, right? Wrong. Deposits don’t belong to the bank. They belong to their customers. And customers can ask for their money back at any time, which is usually not a big deal. But a confluence of events such as what transpired on Thursday meant a lot of customers started asking for their money back at the same time.

Enter VC Twitter: “How Can We Help?”

To start, by not exacerbating the problem. That appeared to be too tall an ask. Technically, you don’t need any real reason for a bank run to start. You just need enough people to start the domino effect that creates a critical mass of people to want to pull their money out. Once that happens, it’s like a runaway locomotive.

It appears the SVB run started when Peter Thiel’s VC firm, Founders’ Fund, as reported by Bloomberg, first advised its portfolio companies to pull their money out of SVB. That started the wheels in motion for the self-styled contrarians to join the herd in the stampede.

“There is another reason that it is maybe not great to be the Bank of Startups, which is nobody on Earth is more of a herd animal than Silicon Valley venture capitalists.”

Matt Levine, Bloomberg Opinion columnist covering finance

Shortly after, The Information reported that Union Square Ventures had warned founders to limit their exposure to Silicon Valley Bank. They also detailed a call between the SVB CEO and prominent VCs that did the exact opposite of allaying concerns.

“Calls started coming and started panic. The bank has ample liquidity to support our clients with one exception: If everyone is telling each other SVB is in trouble, that would be a challenge. I would ask everyone to stay calm and to support us just like we supported you during the challenging times.”

SVB CEO Greg Becker on a call Thursday with top venture capitalists

At this point, VC Twitter went into overdrive, effectively yelling “FIRE!” into the bullhorn of the social media platform. In less than 24 hours after the ignominious call with VCs, SVB would enter receivership.

What will be the broader effect on the startup and financial ecosystems?

The simple answer is we don’t yet know. And we probably won’t know more until Monday at the earliest. On the one hand, while SVB was the most egregious in their reliance on long term securities as a percentage of assets, they were not alone. Between the end of 2019 and the first quarter of 2022, US bank deposits increased by $5.40 trillion. And only 15% of that volume was turned into loans; the rest was invested in securities portfolios or kept as cash (securities portfolios ballooned to $6.26 trillion, up from $3.98 trillion at the end of 2019).

The good news is, unlike 2008, there doesn’t appear to be multiple big banks collapsing at once — at least not so far. That could always change, as bank runs are unpredictable. It’s perhaps more probable that another big bank, like Goldman Sachs or JP Morgan Chase could come in and buy the assets, ending this sad saga. A quick sale would vastly reduce the chance of panic and contagion. I am sure that is the MO of the FDIC right now.

This whole thing has been painful to watch. Silicon Valley Bank has been an incredible partner to the technology community for decades. The tech industry is better off because of them. It is ironic that the very institution that supported and helped the startup community for so many years appears to have been felled by its own. I get it. Loyalty only lasts as long as your ability to make payroll. But still. This whole situation is giving me "The Empire Strikes Back" vibes.

Tweet thread(s) of the week 🧵

Even though we saw, in many cases, the worst of Twitter this week, it is not all memes, shitposts, and scorched earth. A well-curated timeline can provide a straight-to-the-source education (my FintechTweeps list). This week I’m proud of those who stood up and tried to stop the mob. While not ultimately successful, IMO they were on the right side of history here.

Fintech & Crypto Update 📝

Brex got billions of dollars in Silicon Valley Bank deposits Thursday.

Stripe Is raising $6 Billion to Resolve Taxes & Expiring Employee Shares, Delaying Public Listing.

Coinbase announces Wallet as a Service: expands its web3 business solutions, so any company can build fully customizable onchain wallets for their customers.

Amazon is entering the NFT game, will Launch NFT Marketplace Next Month.

Fidelity is preparing to launch its first mutual fund in China.

Visa and Mastercard will pause work on code to track gun purchases.

CFTC says stablecoins are commodities, not securities.

Blur continues to capture NFT market share. The platform hosted 84% of Ethereum-based NFT transactions over the first week of March, overtaking rival OpenSea.

Beyond the Ledge Deep Reads: Down the Rabbit Hole 🐰🕳

What's your plan for 5 years of 5% interest rates? (new!)

After Multibillion Fintech Binge, Wall Street Has a Writedown Hangover (new!).

Who will be PayPal’s next CEO? Here are the 7 leading contenders. (new!)

The Infrastructure and App Cycle: Strategic Thinking for Emerging Infrastructure Providers. (new!)

Varo Raising $50m In Significant Downround, Term Sheet Reveals (new!)

US Housing Market Posts $2.3 Trillion Drop, Biggest Since 2008 (new!)

BaaS Is No Silver Bullet for Community Banks, De Novos, Analysis Shows.

The Fintech Formula: A Data-Driven Blueprint for Creating Enduring Value

Healthtech x Fintech’s Biggest Prize: The Financial Operating System for Healthcare

Jobs & Co-Founder Matching 💼 🔊

Fintech is incredibly competitive. It is also a remarkable community. Let’s help our peers looking for the next thing and help connect incredible talent with amazing companies where they can build great things!

Looking for a co-founder? Cambrian's bi-annual fintech co-founder matching tool is now live! (including 75+ technical co-founders).

Looking for a job? For those not ready for the entrepreneur’s journey, here is a link to thousands of VC portfolio company jobs. H/T to Michaela Keady

That’s a Wrap 🎬

Thanks for reading. If you enjoyed this content, please tell all your fintech and crypto friends to check it out and make sure to hit the subscribe button.

If you have any feedback or thoughts, I’d love to hear from you. The best place to find me is on Twitter!

Until next week, fare thee well friends.